In early Asian trading on Thursday, the U.S. dollar index continued to rise, hitting a more than one-month high of 103.59 at one point. In the early morning, after the minutes of the Federal Reserve meeting showed that most policymakers continued to put the fight against inflation first, spot gold extended its intraday decline, falling below the previous low of 1893, the lowest since March this year, and finally closed down 0.49% at 1892.33

This trading day focuses on the number of initial jobless claims in the United States for the week ending August 12, and the number of continuing jobless claims in the United States for the week ending August 5. Gold fluctuated at a low level yesterday. Although it rebounded, it still failed to break through 5 The daily line pressure, the tone of the Federal Reserve meeting minutes in the early morning was relatively hawkish, causing gold to fall below 1900 again, and the low fell to around 1890, and the daily line closed again.

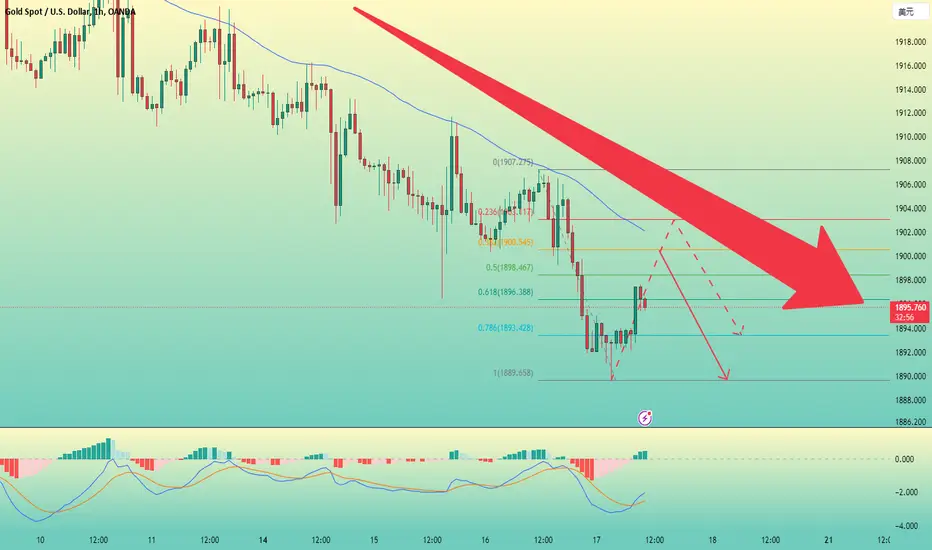

The 4-hour chart relies on the middle rail as the resistance point for a unilateral weak decline. This week, it basically sorts out the pressure at the middle rail and then falls to the lower rail. At present, a bardo line is close to 1893 but has not bottomed out Afterwards, it rebounded, but closed at a low level. Today is expected to continue the downward trend. At that time, it will close below 1893 and the form will effectively fall below. The 4-hour chart is still bearish; the 1-hour chart is running in a downward channel with shocks, and the daily gold short-term operation idea is on. Jiesse suggested that the rebound should be short-selling, supplemented by stepping back to the low position and doing long.

Gold operation strategy:

SELL:1899-1902

TP1:1895

TP2:1890

BUY: 1883-1885

TP1:1889

TP2:1893

This trading day focuses on the number of initial jobless claims in the United States for the week ending August 12, and the number of continuing jobless claims in the United States for the week ending August 5. Gold fluctuated at a low level yesterday. Although it rebounded, it still failed to break through 5 The daily line pressure, the tone of the Federal Reserve meeting minutes in the early morning was relatively hawkish, causing gold to fall below 1900 again, and the low fell to around 1890, and the daily line closed again.

The 4-hour chart relies on the middle rail as the resistance point for a unilateral weak decline. This week, it basically sorts out the pressure at the middle rail and then falls to the lower rail. At present, a bardo line is close to 1893 but has not bottomed out Afterwards, it rebounded, but closed at a low level. Today is expected to continue the downward trend. At that time, it will close below 1893 and the form will effectively fall below. The 4-hour chart is still bearish; the 1-hour chart is running in a downward channel with shocks, and the daily gold short-term operation idea is on. Jiesse suggested that the rebound should be short-selling, supplemented by stepping back to the low position and doing long.

Gold operation strategy:

SELL:1899-1902

TP1:1895

TP2:1890

BUY: 1883-1885

TP1:1889

TP2:1893

Trade active

BUY1885 Hit TP1Trade active

Perfect Analysis and TP Points, Coming Soon to TP2Trade active

Trade active

Trade active

Trade active

Ready to start trading today💥Telegram Channel Free Updates 👉🏻

💥t.me/Actuary00group

✉️Signal and daily analysis channel

💥t.me/Actuary00group

✉️Signal and daily analysis channel

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💥Telegram Channel Free Updates 👉🏻

💥t.me/Actuary00group

✉️Signal and daily analysis channel

💥t.me/Actuary00group

✉️Signal and daily analysis channel

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.