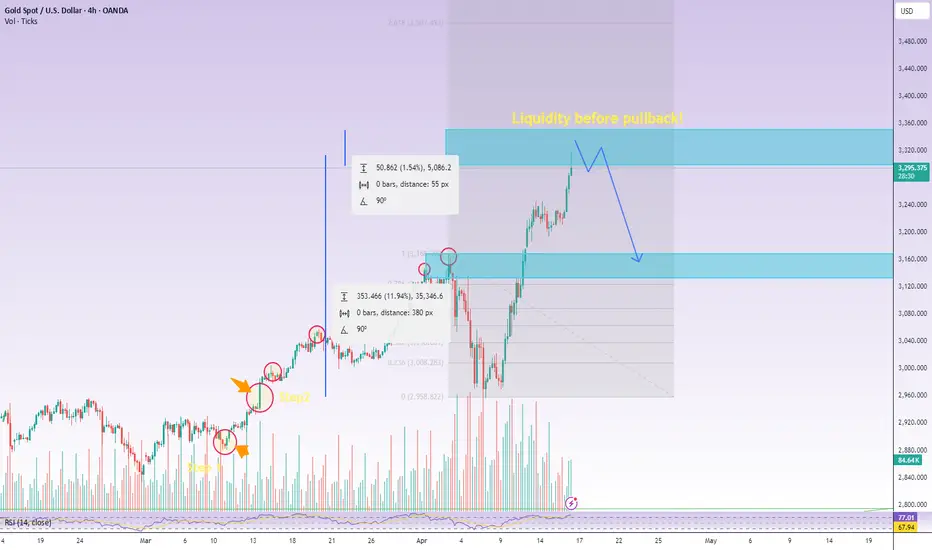

Gold (XAU/USD) is approaching a critical liquidity zone around the $3,330 level, which aligns with a strong Fibonacci extension area and previous structural highs. Price has shown an impressive recovery after hitting support below $3,000, triggering a bullish rally that reached our TP at $3,270 following a successful SL re-entry.

The price is currently tapping into a liquidity zone, with expectations of short-term rejection signals forming on the 1H time frame.

If we start to see 1H candle rejections or bearish divergence, we can anticipate a possible pullback towards the $3,140-$3,180 zone, which is a confluence of previous resistance turned support and a Fibonacci retracement level.

📌 Patience is key—wait for proper price action confirmation before entering shorts.

The price is currently tapping into a liquidity zone, with expectations of short-term rejection signals forming on the 1H time frame.

If we start to see 1H candle rejections or bearish divergence, we can anticipate a possible pullback towards the $3,140-$3,180 zone, which is a confluence of previous resistance turned support and a Fibonacci retracement level.

📌 Patience is key—wait for proper price action confirmation before entering shorts.

Note

Perfectly swiping out our liquidation area! Let’s wait for 1H rejections and a new LL! :)Trade active

Entry: $3340Trade closed: stop reached

My previous analysis played out very well, except I was concerned that we didn't reach the $3,180 area. With the ongoing trade wars and recent comments from Powell, the USD is weakening significantly, and we’re seeing a gold move unlike any I’ve experienced before—possibly the most bullish pattern yet.Based on my analysis from the edge of the market, we can identify key breakout levels that must hold to continue pushing toward $3,700.

Watch the 1H and 4H wick and body formations:

If the 1H candle body can break above $3,500, we’ll likely continue making higher highs and higher lows toward $3,700.

If the 1H candle body fails to hold the $3,400 level, we might see the pullback I’ve been anticipating—possibly down to the $3,200 level.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.