1. Key Observations (Volume, Gann & CVD + ADX Focused)

a) Volume Profile Insights:

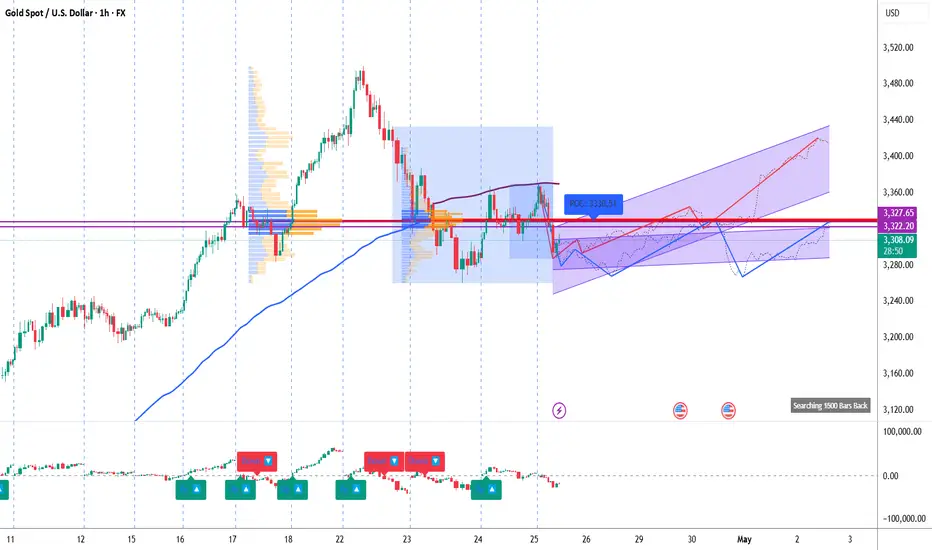

Value Area High (VAH): 3,327.65

Value Area Low (VAL): 3,287.37

Point of Control (POC): 3,325.89

High-Volume Nodes: 3,325–3,328 zone (significant consolidation & absorption).

Low-Volume Gaps: 3,280–3,290 zone (potential for fast price movement if re-tested).

b) Liquidity Zones:

Stop Clusters: Near 3,340 (previous highs), and below 3,280 (recent swing lows).

Order Absorption Zones: Strong absorption around POC (3,325), indicated by multiple rejections and volume stacking.

c) Volume-Based Swing Highs/Lows:

Swing High: 3,382 (volume spike + reversal).

Swing Low: 3,275 (volume increase on bullish reversal).

Current Range: Consolidation between 3,280–3,328.

d) CVD + ADX Indicator Analysis:

Trend Direction: Range-bound (CVD mixed; recent sharp upward CVD move neutralized by selling at resistance).

ADX Strength:

ADX < 20: Suggests weak trend, confirming range-bound environment.

DI+ ≈ DI-: No dominant directional strength.

CVD Confirmation:

Recent Rising CVD + No breakout above resistance = Hidden supply

Earlier bullish CVD divergence at 3,275 led to minor recovery

2. Support & Resistance Levels

a) Volume-Based Levels:

Support:

VAL: 3,287.37

Swing Low Support: 3,275

Resistance:

VAH: 3,327.65

POC: 3,325.89

Swing High: 3,382

b) Gann-Based Levels:

Recent Gann Swing High: 3,382

Recent Gann Swing Low: 3,275

Key Retracement Zones:

1/2 retracement: 3,328

1/3 retracement: ~3,311

2/3 retracement: ~3,345

3. Chart Patterns & Market Structure

a) Trend:

Range-bound (confirmed by low ADX & choppy CVD)

b) Notable Patterns:

Potential Bullish Flag within a Rising Channel (purple zone)

Channel Support: Near 3,280

Channel Resistance: 3,360–3,390

Retest of POC (3,325.89) with multiple failed attempts to close above = key resistance validation

4. Trade Setup & Risk Management

a) Bullish Entry (If CVD + ADX confirm uptrend):

Entry Zone: 3,287–3,292

Targets:

T1: 3,325

T2: 3,360

Stop-Loss (SL): 3,275 (below recent swing low)

RR: Minimum 1:2

b) Bearish Entry (If CVD + ADX confirm downtrend):

Entry Zone: 3,325–3,328

Target: T1: 3,287

Stop-Loss (SL): 3,340 (above recent rejection zone)

RR: Minimum 1:2

c) Position Sizing:

Risk only 1–2% of capital per trade.

a) Volume Profile Insights:

Value Area High (VAH): 3,327.65

Value Area Low (VAL): 3,287.37

Point of Control (POC): 3,325.89

High-Volume Nodes: 3,325–3,328 zone (significant consolidation & absorption).

Low-Volume Gaps: 3,280–3,290 zone (potential for fast price movement if re-tested).

b) Liquidity Zones:

Stop Clusters: Near 3,340 (previous highs), and below 3,280 (recent swing lows).

Order Absorption Zones: Strong absorption around POC (3,325), indicated by multiple rejections and volume stacking.

c) Volume-Based Swing Highs/Lows:

Swing High: 3,382 (volume spike + reversal).

Swing Low: 3,275 (volume increase on bullish reversal).

Current Range: Consolidation between 3,280–3,328.

d) CVD + ADX Indicator Analysis:

Trend Direction: Range-bound (CVD mixed; recent sharp upward CVD move neutralized by selling at resistance).

ADX Strength:

ADX < 20: Suggests weak trend, confirming range-bound environment.

DI+ ≈ DI-: No dominant directional strength.

CVD Confirmation:

Recent Rising CVD + No breakout above resistance = Hidden supply

Earlier bullish CVD divergence at 3,275 led to minor recovery

2. Support & Resistance Levels

a) Volume-Based Levels:

Support:

VAL: 3,287.37

Swing Low Support: 3,275

Resistance:

VAH: 3,327.65

POC: 3,325.89

Swing High: 3,382

b) Gann-Based Levels:

Recent Gann Swing High: 3,382

Recent Gann Swing Low: 3,275

Key Retracement Zones:

1/2 retracement: 3,328

1/3 retracement: ~3,311

2/3 retracement: ~3,345

3. Chart Patterns & Market Structure

a) Trend:

Range-bound (confirmed by low ADX & choppy CVD)

b) Notable Patterns:

Potential Bullish Flag within a Rising Channel (purple zone)

Channel Support: Near 3,280

Channel Resistance: 3,360–3,390

Retest of POC (3,325.89) with multiple failed attempts to close above = key resistance validation

4. Trade Setup & Risk Management

a) Bullish Entry (If CVD + ADX confirm uptrend):

Entry Zone: 3,287–3,292

Targets:

T1: 3,325

T2: 3,360

Stop-Loss (SL): 3,275 (below recent swing low)

RR: Minimum 1:2

b) Bearish Entry (If CVD + ADX confirm downtrend):

Entry Zone: 3,325–3,328

Target: T1: 3,287

Stop-Loss (SL): 3,340 (above recent rejection zone)

RR: Minimum 1:2

c) Position Sizing:

Risk only 1–2% of capital per trade.

Bharat Pandya @ProspireWealth

+91 9624044866

pandyabn76@gmail.com

+91 9624044866

pandyabn76@gmail.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Bharat Pandya @ProspireWealth

+91 9624044866

pandyabn76@gmail.com

+91 9624044866

pandyabn76@gmail.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.