⭐️GOLDEN INFORMATION:

Gold prices continued to retreat during Wednesday’s North American session, slipping below the $3,300 mark after reaching an intraday high of $3,325 earlier. The pullback, amounting to a 0.27% decline, came as traders absorbed the implications of the latest Federal Reserve (Fed) meeting minutes.

During the May 6–7 policy meeting, the Fed opted to leave interest rates unchanged, highlighting growing uncertainty surrounding the economic impact of proposed tariffs. Officials maintained a cautious stance, citing heightened risks of both inflation and unemployment—potential consequences of trade disruptions.

The minutes also reflected concerns over stagflation, with policymakers noting that “the Committee may face challenging trade-offs if inflation proves more persistent while growth and employment expectations deteriorate.”

⭐️Personal comments NOVA:

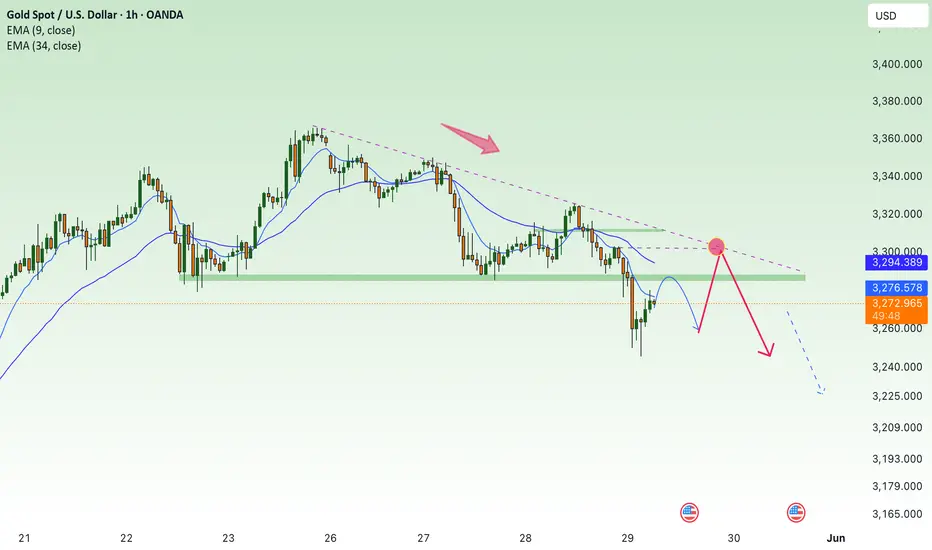

The downtrend line remains intact, gold prices are trading around below 3300. The tariff backdrop remains largely unchanged.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3311- 3313 SL 3318

TP1: $3300

TP2: $3290

TP3: $3280

🔥BUY GOLD zone: $3205- $3207 SL $3200

TP1: $3218

TP2: $3230

TP3: $3248

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold prices continued to retreat during Wednesday’s North American session, slipping below the $3,300 mark after reaching an intraday high of $3,325 earlier. The pullback, amounting to a 0.27% decline, came as traders absorbed the implications of the latest Federal Reserve (Fed) meeting minutes.

During the May 6–7 policy meeting, the Fed opted to leave interest rates unchanged, highlighting growing uncertainty surrounding the economic impact of proposed tariffs. Officials maintained a cautious stance, citing heightened risks of both inflation and unemployment—potential consequences of trade disruptions.

The minutes also reflected concerns over stagflation, with policymakers noting that “the Committee may face challenging trade-offs if inflation proves more persistent while growth and employment expectations deteriorate.”

⭐️Personal comments NOVA:

The downtrend line remains intact, gold prices are trading around below 3300. The tariff backdrop remains largely unchanged.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3311- 3313 SL 3318

TP1: $3300

TP2: $3290

TP3: $3280

🔥BUY GOLD zone: $3205- $3207 SL $3200

TP1: $3218

TP2: $3230

TP3: $3248

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Trade active

Gold price recovers when bad unemployment data for dollarsDear My Friends,

NOVA returns and updates new information

✅ Gold Scalping Signal: 4 - 6 signals.

✅ Forex Signal: 5 - 8 signals.

✅ Trading Idea / Setup / Technical.

✅ NEW UPDATE : Signals free in Telegram:

t.me/+1mFSljRaI5RlNjg1

NOVA returns and updates new information

✅ Gold Scalping Signal: 4 - 6 signals.

✅ Forex Signal: 5 - 8 signals.

✅ Trading Idea / Setup / Technical.

✅ NEW UPDATE : Signals free in Telegram:

t.me/+1mFSljRaI5RlNjg1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Dear My Friends,

NOVA returns and updates new information

✅ Gold Scalping Signal: 4 - 6 signals.

✅ Forex Signal: 5 - 8 signals.

✅ Trading Idea / Setup / Technical.

✅ NEW UPDATE : Signals free in Telegram:

t.me/+1mFSljRaI5RlNjg1

NOVA returns and updates new information

✅ Gold Scalping Signal: 4 - 6 signals.

✅ Forex Signal: 5 - 8 signals.

✅ Trading Idea / Setup / Technical.

✅ NEW UPDATE : Signals free in Telegram:

t.me/+1mFSljRaI5RlNjg1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.