Federal Reserve Chairman Jerome Powell's speech at the Jackson Hole symposium on Friday was the focus of market attention this week.

Powell's unexpectedly dovish remarks reinforced market hopes for a September rate cut. As a result, the US Dollar Index fell sharply on Friday, reversing the upward trend of the first four trading days of the week. Moreover, Friday's strong gains also pushed gold prices to a nearly $36 surge for the week.

On Friday (August 22), the US Dollar fell sharply and gold prices soared due to dovish comments from Federal Reserve Chairman Powell

Federal Reserve Chairman Jerome Powell hinted at future rate cuts in his highly anticipated speech at the Jackson Hole central bank's annual symposium, saying a rate cut "may be necessary" if conditions warrant. While he did not promise a rate cut, Powell said changes in the risk landscape could require adjustments to the Fed's policy guidance.

“The stability of the unemployment rate and other labor market indicators allows us to be cautious as we consider changes to the stance of policy,” Powell said Friday. “However, changes in the baseline outlook and the balance of risks may make it appropriate to adjust the stance of policy while policy remains within its narrow range.”

The remarks attempted to strike a delicate balance, acknowledging rising risks to the job market while warning that inflation pressures remain. Powell also stressed on Friday that policymakers must guard against persistent inflation risks from President Donald Trump’s tariffs. He said the impact of tariffs on consumer prices was “now evident,” but there was reason to expect the effects would be relatively short-lived.

Following Powell’s speech, the US dollar fell sharply, gold prices jumped and the yield on the 2-year US Treasury note fell 10 basis points to 3.69%.

Powell’s comments also highlighted the importance of jobs and inflation data ahead of the Federal Reserve’s policy meeting on September 16-17.

The CME FedWatch tool shows that traders are now pricing in a 75% chance of a September rate cut.

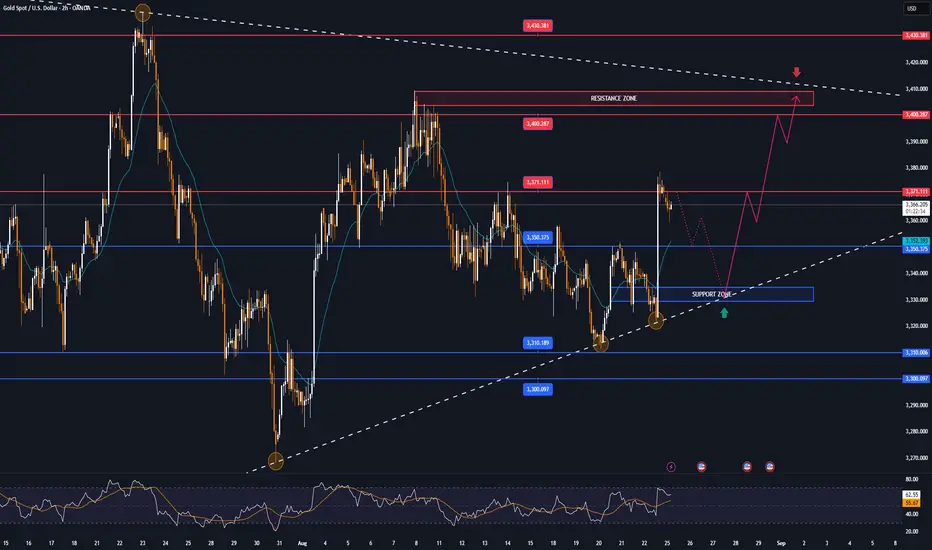

Technical Outlook Analysis XAUUSD

XAUUSD

On the daily chart, gold has recovered from $3,310, which is the first support point in the $3,310 – $3,292 area noted by readers in last week’s weekly edition. However, the temporary recovery is still limited by the 0.236% Fibonacci retracement level, which if gold breaks above this level with price action above $3,371, it will be eligible for further upside with the next target around $3,400 in the short term, more so than $3,430 – $3,450.

Overall, gold is still in a sideways technical state as depicted inside the green rectangle. In case of a sell-off below the 0.382% Fibonacci retracement level, the downside momentum could also be limited by the $3,246 level followed by the $3,228 level at the 0.50% Fibonacci retracement price point. The relative strength index hovering around 50 also shows the market's indecision, it does not give any reliable signal whether the trend is bullish or bearish in terms of momentum.

Looking ahead, gold is primed for a short-term rally, with a break above $3,371 a necessary condition for a new short-term rally, with the following key points to watch.

Support: $3,350 – $3,310 – $3,300

Resistance: $3,371 – $3,400 – $3,430

SELL XAUUSD PRICE 3405 - 3403⚡️

↠↠ Stop Loss 3409

→Take Profit 1 3397

↨

→Take Profit 2 3391

BUY XAUUSD PRICE 3329 - 3331⚡️

↠↠ Stop Loss 3325

→Take Profit 1 3327

↨

→Take Profit 2 3333

Powell's unexpectedly dovish remarks reinforced market hopes for a September rate cut. As a result, the US Dollar Index fell sharply on Friday, reversing the upward trend of the first four trading days of the week. Moreover, Friday's strong gains also pushed gold prices to a nearly $36 surge for the week.

On Friday (August 22), the US Dollar fell sharply and gold prices soared due to dovish comments from Federal Reserve Chairman Powell

Federal Reserve Chairman Jerome Powell hinted at future rate cuts in his highly anticipated speech at the Jackson Hole central bank's annual symposium, saying a rate cut "may be necessary" if conditions warrant. While he did not promise a rate cut, Powell said changes in the risk landscape could require adjustments to the Fed's policy guidance.

“The stability of the unemployment rate and other labor market indicators allows us to be cautious as we consider changes to the stance of policy,” Powell said Friday. “However, changes in the baseline outlook and the balance of risks may make it appropriate to adjust the stance of policy while policy remains within its narrow range.”

The remarks attempted to strike a delicate balance, acknowledging rising risks to the job market while warning that inflation pressures remain. Powell also stressed on Friday that policymakers must guard against persistent inflation risks from President Donald Trump’s tariffs. He said the impact of tariffs on consumer prices was “now evident,” but there was reason to expect the effects would be relatively short-lived.

Following Powell’s speech, the US dollar fell sharply, gold prices jumped and the yield on the 2-year US Treasury note fell 10 basis points to 3.69%.

Powell’s comments also highlighted the importance of jobs and inflation data ahead of the Federal Reserve’s policy meeting on September 16-17.

The CME FedWatch tool shows that traders are now pricing in a 75% chance of a September rate cut.

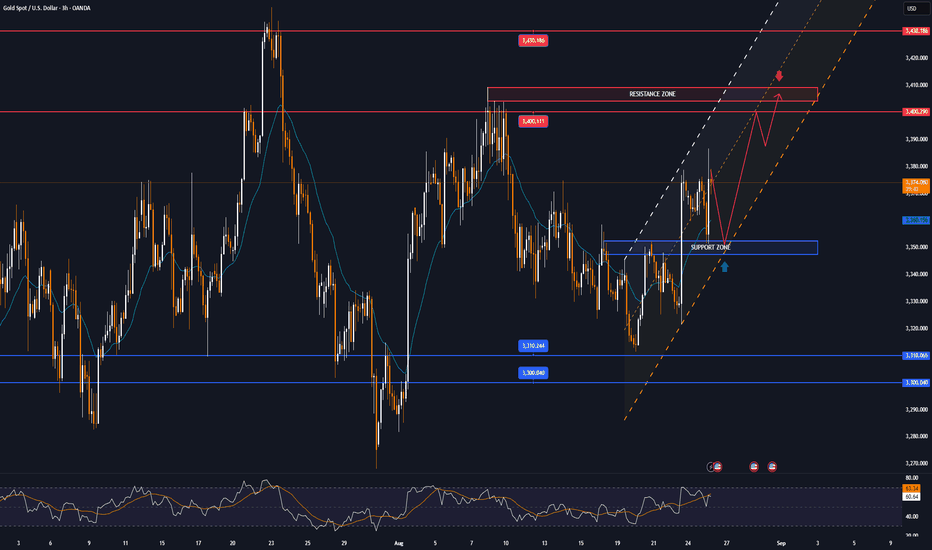

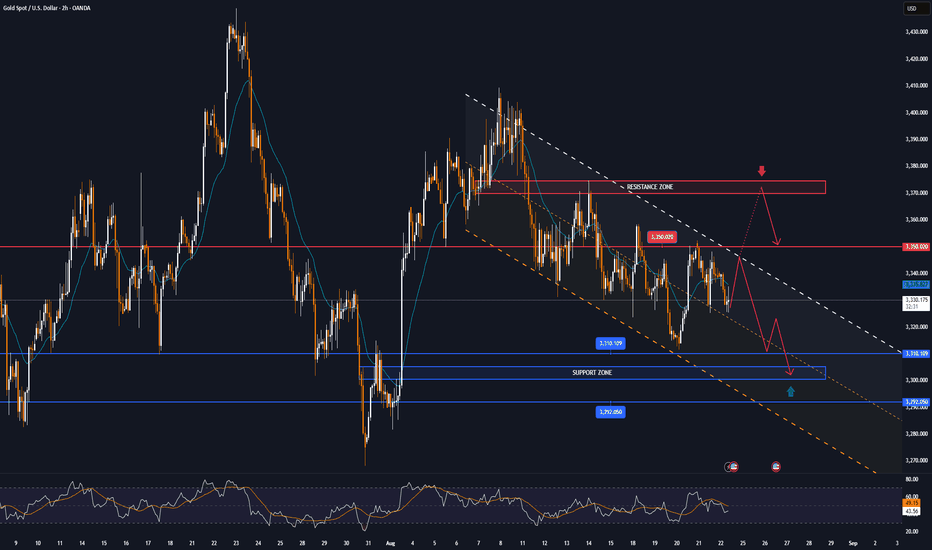

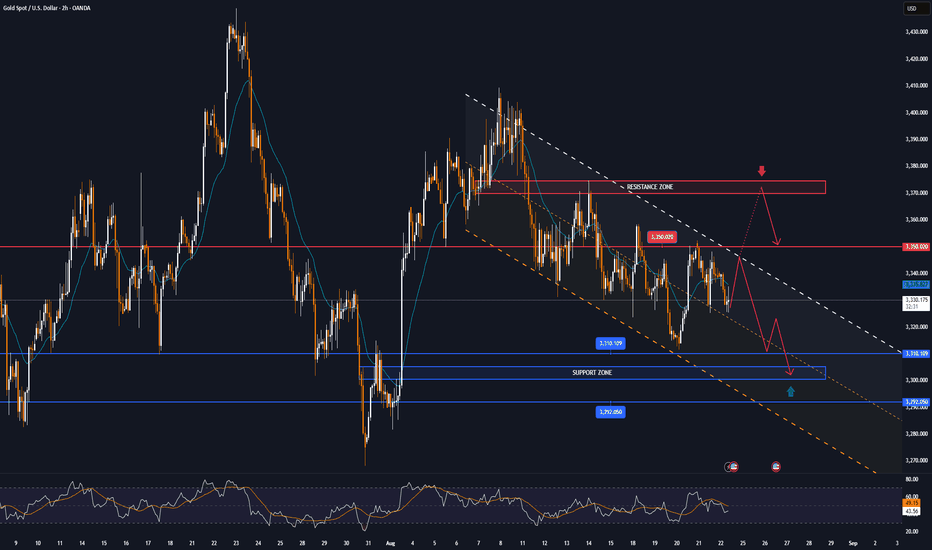

Technical Outlook Analysis

On the daily chart, gold has recovered from $3,310, which is the first support point in the $3,310 – $3,292 area noted by readers in last week’s weekly edition. However, the temporary recovery is still limited by the 0.236% Fibonacci retracement level, which if gold breaks above this level with price action above $3,371, it will be eligible for further upside with the next target around $3,400 in the short term, more so than $3,430 – $3,450.

Overall, gold is still in a sideways technical state as depicted inside the green rectangle. In case of a sell-off below the 0.382% Fibonacci retracement level, the downside momentum could also be limited by the $3,246 level followed by the $3,228 level at the 0.50% Fibonacci retracement price point. The relative strength index hovering around 50 also shows the market's indecision, it does not give any reliable signal whether the trend is bullish or bearish in terms of momentum.

Looking ahead, gold is primed for a short-term rally, with a break above $3,371 a necessary condition for a new short-term rally, with the following key points to watch.

Support: $3,350 – $3,310 – $3,300

Resistance: $3,371 – $3,400 – $3,430

SELL XAUUSD PRICE 3405 - 3403⚡️

↠↠ Stop Loss 3409

→Take Profit 1 3397

↨

→Take Profit 2 3391

BUY XAUUSD PRICE 3329 - 3331⚡️

↠↠ Stop Loss 3325

→Take Profit 1 3327

↨

→Take Profit 2 3333

Note

▫️Spot gold hit $3,370 an ounce, up 0.13% on the day.Note

Trump's surprise decision to fire Fed Governor Cook raised concerns about the Fed's independence, fueling demand for havens and pushing gold prices to a two-week high above $3,393 an ounce.Note

Gold prices remained below $3,400 an ounce as investors remained cautious ahead of PCE data – a key inflation measure that will determine expectations for a September Fed rate cut.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.