During the week,  XAUUSD fluctuated in the range of 3,245 - 3,331 USD/oz and closed the week at 3,289 USD/oz. The reason for the sideways gold price was due to the lack of strong information. The US Court of International Trade's ruling on blocking the Trump administration's tariff policy was postponed, while the US PCE index in April increased by only 2.5%, down from the previous month, not enough to influence the FED's policy in the context of prolonged trade instability.

XAUUSD fluctuated in the range of 3,245 - 3,331 USD/oz and closed the week at 3,289 USD/oz. The reason for the sideways gold price was due to the lack of strong information. The US Court of International Trade's ruling on blocking the Trump administration's tariff policy was postponed, while the US PCE index in April increased by only 2.5%, down from the previous month, not enough to influence the FED's policy in the context of prolonged trade instability.

If the Court continues to block the tariffs, President Trump can still use several laws to maintain the tariffs:

🔹Section 122 - Trade Act of 1974: Allows for a 15% across-the-board tariff for 150 days; then requires congressional approval to extend.

🔹Section 338 - Trade Act of 1930: Allows for tariffs of up to 50% on goods from countries deemed to discriminate against the United States.

🔹Section 232 - Trade Expansion Act of 1962: Allows for the expansion of tariffs from items such as aluminum, steel, and automobiles to other industries on national security grounds.

US Treasury Secretary Scott Bessent said that US-China trade negotiations are still at a standstill due to many complicated issues, requiring direct intervention from the leaders of the two countries. Although the tariff war is still complicated, the most tense phase has passed. Therefore, in the short term, gold prices are unlikely to exceed the $3,500/oz mark and will likely continue to adjust and accumulate in the $3,100-$3,400/oz range.

Although gold prices are currently stuck in a range, the US economic data released next week, especially the May non-farm payrolls (NFP) report on Friday, could cause a sharp move. The NFP is forecast to come in at 130,000 jobs, down from 177,000 in April. If true, this could reinforce expectations that the Fed will cut interest rates to support the labor market, thereby supporting gold prices. Conversely, if the NFP is stronger than expected, especially higher than last month, the Fed could keep interest rates unchanged, putting downward pressure on gold prices.

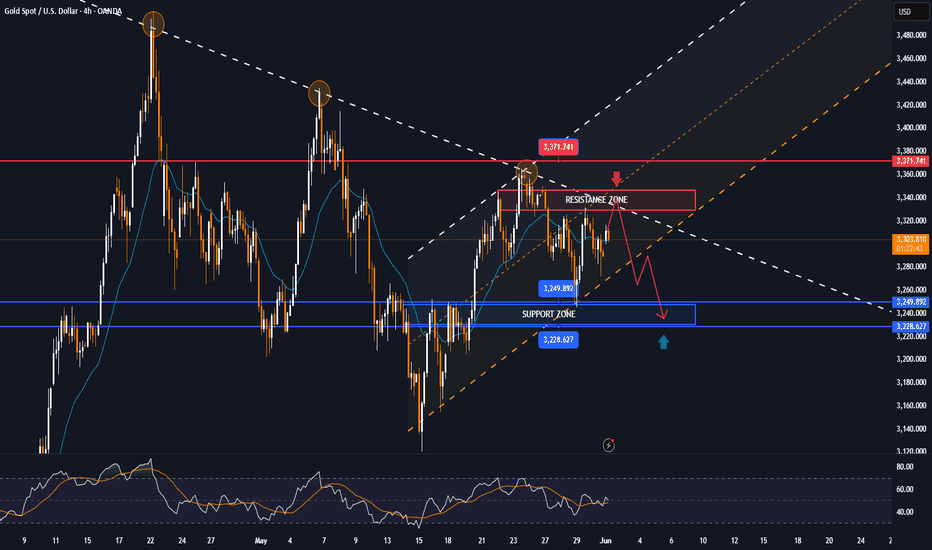

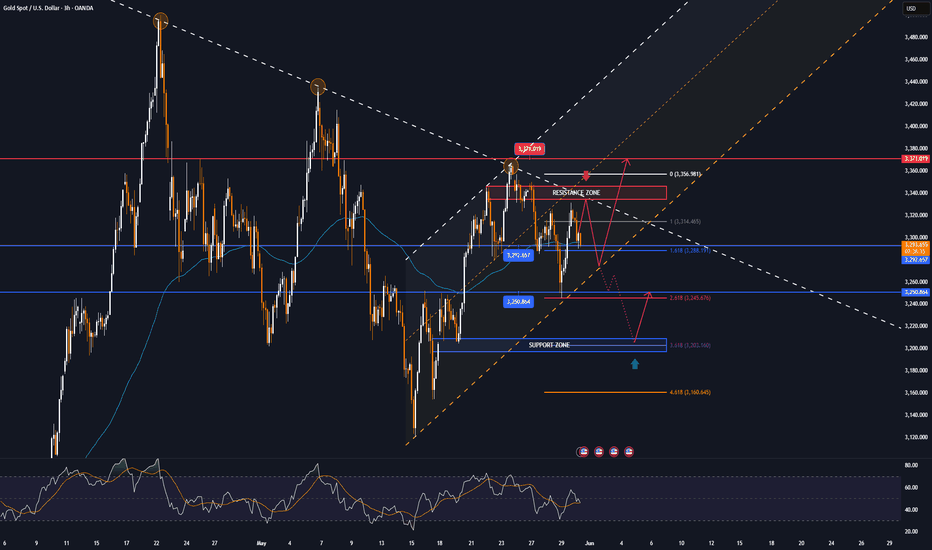

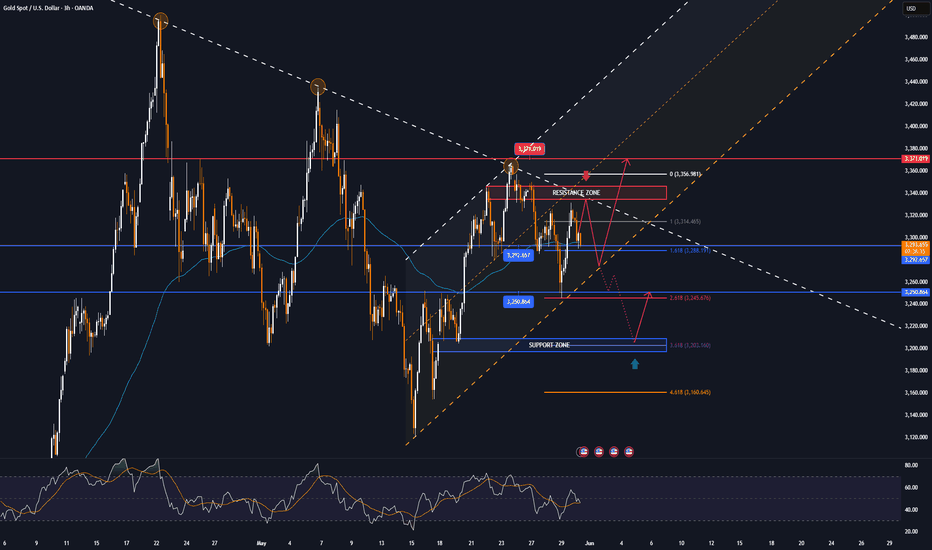

📌Technically, on the H4 chart, gold prices are almost moving sideways in a narrowing range, the resistance level is established around 3325 while the support level is around 3245. Next week, gold prices are likely to increase slightly if economic and geopolitical factors continue to support, corresponding to the H1 technical chart, gold prices will increase to 3365-3415 if the price breaks through the Downtrend line and breaks the resistance zone of 3325. In case the gold price falls below the support zone of 3245, the gold price will reverse and decrease.

Notable technical levels are listed below.

Support: 3,250 – 3,228USD

Resistance: 3,300 – 3,371USD

SELL XAUUSD PRICE 3327 - 3325⚡️

↠↠ Stop Loss 3431

BUY XAUUSD PRICE 3203 - 3205⚡️

↠↠ Stop Loss 3199

If the Court continues to block the tariffs, President Trump can still use several laws to maintain the tariffs:

🔹Section 122 - Trade Act of 1974: Allows for a 15% across-the-board tariff for 150 days; then requires congressional approval to extend.

🔹Section 338 - Trade Act of 1930: Allows for tariffs of up to 50% on goods from countries deemed to discriminate against the United States.

🔹Section 232 - Trade Expansion Act of 1962: Allows for the expansion of tariffs from items such as aluminum, steel, and automobiles to other industries on national security grounds.

US Treasury Secretary Scott Bessent said that US-China trade negotiations are still at a standstill due to many complicated issues, requiring direct intervention from the leaders of the two countries. Although the tariff war is still complicated, the most tense phase has passed. Therefore, in the short term, gold prices are unlikely to exceed the $3,500/oz mark and will likely continue to adjust and accumulate in the $3,100-$3,400/oz range.

Although gold prices are currently stuck in a range, the US economic data released next week, especially the May non-farm payrolls (NFP) report on Friday, could cause a sharp move. The NFP is forecast to come in at 130,000 jobs, down from 177,000 in April. If true, this could reinforce expectations that the Fed will cut interest rates to support the labor market, thereby supporting gold prices. Conversely, if the NFP is stronger than expected, especially higher than last month, the Fed could keep interest rates unchanged, putting downward pressure on gold prices.

📌Technically, on the H4 chart, gold prices are almost moving sideways in a narrowing range, the resistance level is established around 3325 while the support level is around 3245. Next week, gold prices are likely to increase slightly if economic and geopolitical factors continue to support, corresponding to the H1 technical chart, gold prices will increase to 3365-3415 if the price breaks through the Downtrend line and breaks the resistance zone of 3325. In case the gold price falls below the support zone of 3245, the gold price will reverse and decrease.

Notable technical levels are listed below.

Support: 3,250 – 3,228USD

Resistance: 3,300 – 3,371USD

SELL XAUUSD PRICE 3327 - 3325⚡️

↠↠ Stop Loss 3431

BUY XAUUSD PRICE 3203 - 3205⚡️

↠↠ Stop Loss 3199

Note

Spot gold prices fell below $3,360 an ounce, down 0.64% on the day.Note

Spot gold prices fell more than 1.00% on the day and are currently trading at $3,347.21 an ounce.Note

GOLD is reacting negatively to the situation after a positive phone call from TRUMP and XI JINPINGNote

Gold prices fell slightly on June 6 after hitting $3,403 an ounce as signs of cooling from the phone call between Trump and Xi Jinping reduced demand for safe havens.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.