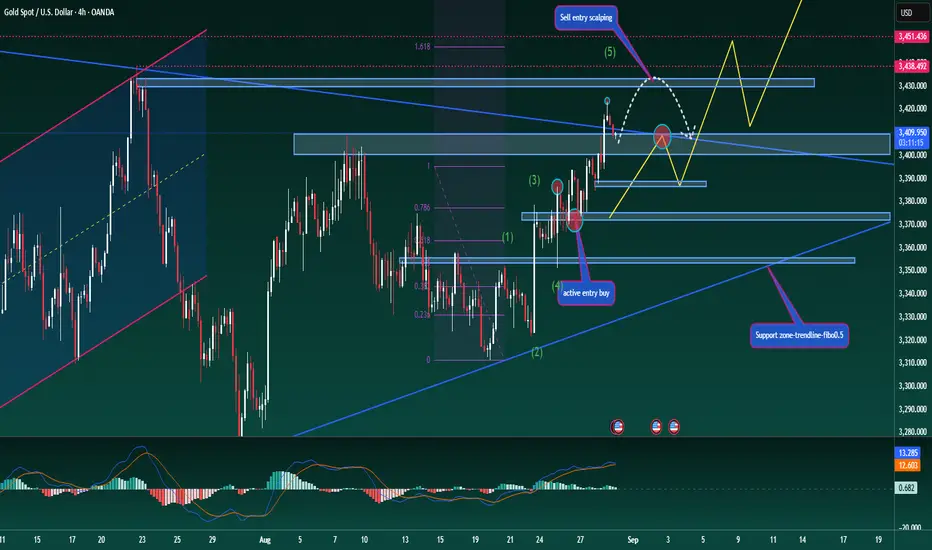

XAUUSD – Medium-Term Trading Scenario

Hello traders,

Gold is moving into the final stage of its flag formation. Medium-term traders are now waiting for a clear breakout confirmation, as that will determine the next medium- to long-term move. Once confirmed, the plan is to trade immediately in the breakout direction.

In the meantime, short-term and intraday traders continue to work inside the flag, taking scalping opportunities while price remains range-bound.

From my perspective, the probability of an upside breakout and continuation of the broader bullish trend is high after such a long period of consolidation. To optimise entries, buying near the lower boundary of the trendline makes sense, with stop-losses placed just below in case of a breakdown. A particularly important zone is the Fibonacci retracement 0.5 at 3354, which combines dynamic and static support with a key Fibonacci level. This is a strong area to build medium- to long-term long positions.

An earlier entry can also be considered around 3372, where the previous candle confirmed strong bullish momentum. In this case, stops should be kept tight, just under the nearest support.

The bullish case only fails if price breaks and closes firmly below the lower trendline, which would confirm a reversal.

That’s my view on gold for the coming sessions – stay patient, manage risk, and wait for the structure to confirm. What’s your outlook? Let’s discuss in the comments.

Hello traders,

Gold is moving into the final stage of its flag formation. Medium-term traders are now waiting for a clear breakout confirmation, as that will determine the next medium- to long-term move. Once confirmed, the plan is to trade immediately in the breakout direction.

In the meantime, short-term and intraday traders continue to work inside the flag, taking scalping opportunities while price remains range-bound.

From my perspective, the probability of an upside breakout and continuation of the broader bullish trend is high after such a long period of consolidation. To optimise entries, buying near the lower boundary of the trendline makes sense, with stop-losses placed just below in case of a breakdown. A particularly important zone is the Fibonacci retracement 0.5 at 3354, which combines dynamic and static support with a key Fibonacci level. This is a strong area to build medium- to long-term long positions.

An earlier entry can also be considered around 3372, where the previous candle confirmed strong bullish momentum. In this case, stops should be kept tight, just under the nearest support.

The bullish case only fails if price breaks and closes firmly below the lower trendline, which would confirm a reversal.

That’s my view on gold for the coming sessions – stay patient, manage risk, and wait for the structure to confirm. What’s your outlook? Let’s discuss in the comments.

💠Accurate signals 🥉 a standardised trading system.

🍑Free training and daily sharing of market experience.

t.me/+9B0zBuS1rboxZTY1

🍑Free training and daily sharing of market experience.

t.me/+9B0zBuS1rboxZTY1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💠Accurate signals 🥉 a standardised trading system.

🍑Free training and daily sharing of market experience.

t.me/+9B0zBuS1rboxZTY1

🍑Free training and daily sharing of market experience.

t.me/+9B0zBuS1rboxZTY1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.