💎MJTrading:

The Federal Open Market Committee (FOMC) guides U.S. interest rates. Their decisions ripple through all major markets, not just the dollar.

🔑 How It Works (Simple View):

- When the Fed signals higher rates, the USD demand rises (investors seek higher returns), while gold, stocks, and crypto often fall because money becomes “more expensive.”

- When the Fed signals lower rates or slows tightening, the USD loses demand, and money flows into assets like gold, stocks, and crypto.

🔍 Why a Rate Cut Weakens the Dollar:

* Cutting rates means borrowing money becomes cheaper.

* Investors earn less return by holding USD in banks or bonds.

* This lowers demand for the dollar, making it cheaper in global markets.

📊 What the Current Charts Show:

DXY (Dollar Index): Sharp drop → less demand for USD.

DXY (Dollar Index): Sharp drop → less demand for USD.

XAUUSD (Gold): Demand rises as an alternative store of value.

XAUUSD (Gold): Demand rises as an alternative store of value.

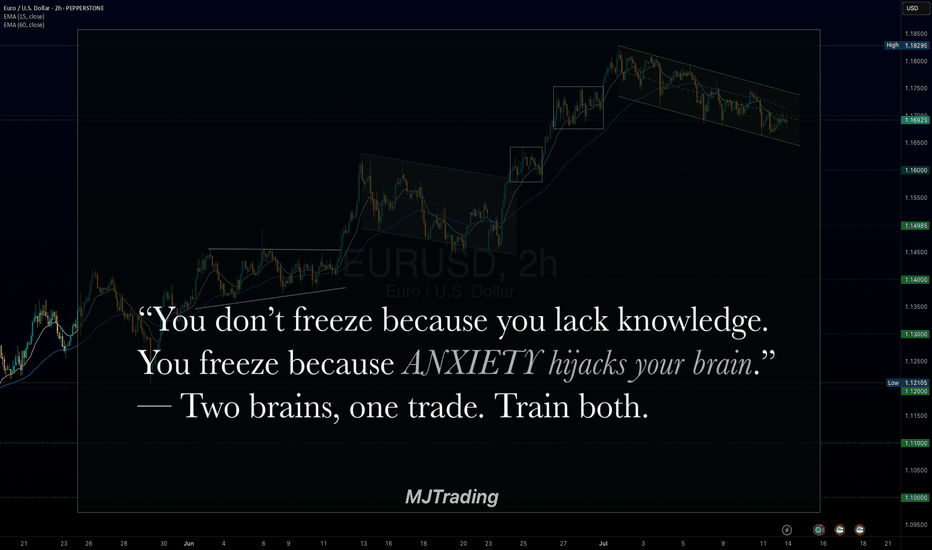

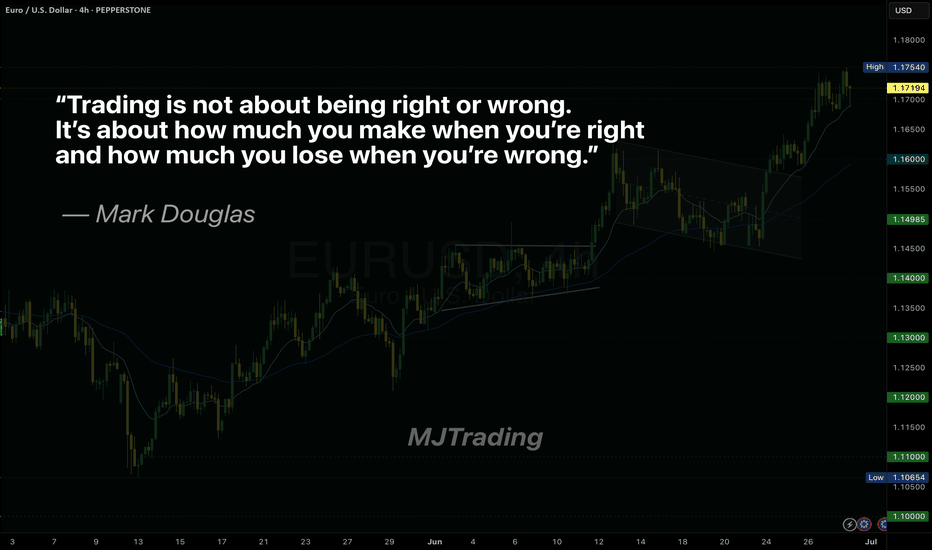

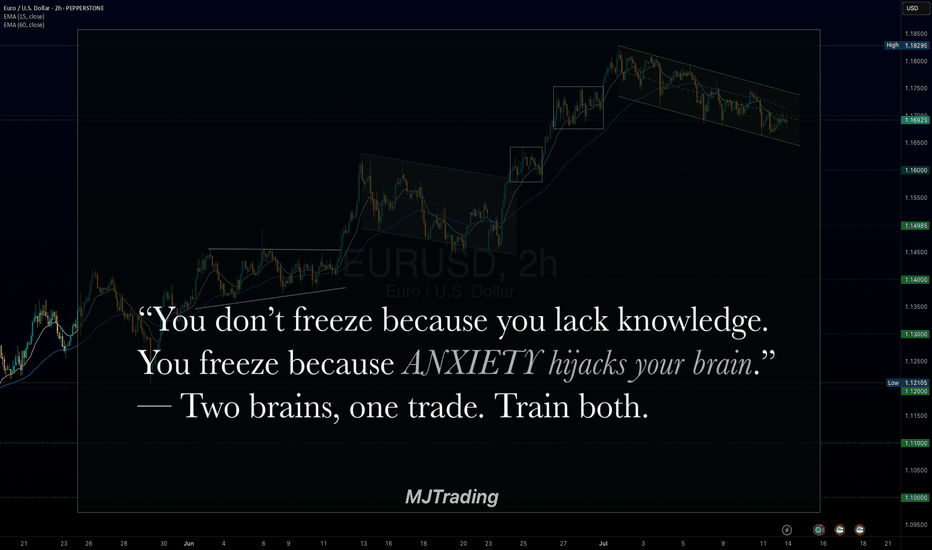

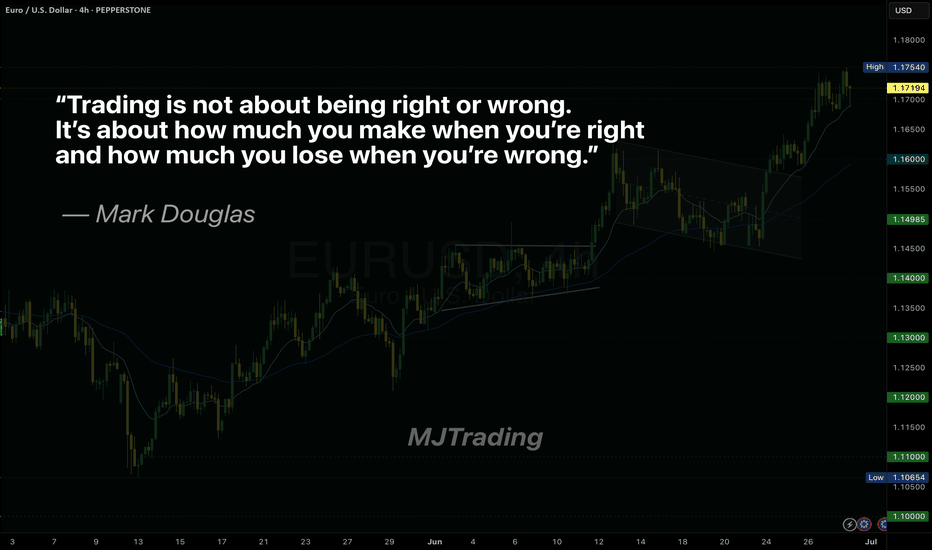

EURUSD : Euro strengthens against weaker dollar.

EURUSD : Euro strengthens against weaker dollar.

BTCUSD : Risk appetite returns, lifting crypto.

BTCUSD : Risk appetite returns, lifting crypto.

US30 (Dow Jones): Stocks benefit as liquidity shifts from USD into equities.

US30 (Dow Jones): Stocks benefit as liquidity shifts from USD into equities.

⚡ The Core Reason – Demand & Supply

Weaker dollar = reduced demand for USD, so supply flows into gold, stocks, euro, and crypto.

🔮 Looking Ahead – Will the Rally Continue?

The rally may extend if the dollar remains under pressure and the Fed stays dovish.

But caution: after the first strong impulse, markets often retrace to test demand zones before continuing.

Next week’s momentum will depend on whether buyers can sustain demand beyond the initial FOMC reaction.

👉 Takeaway for Traders:

FOMC moves aren’t random. They’re driven by where capital finds the best return. Understanding this demand–supply flow helps explain why all charts move together in these moments.

#MJTrading

#FOMC #DXY #XAUUSD #EURUSD #BTCUSD #US30 #Forex #Gold #TradingEducation #Rally

Psychology Always Matters:

The Federal Open Market Committee (FOMC) guides U.S. interest rates. Their decisions ripple through all major markets, not just the dollar.

🔑 How It Works (Simple View):

- When the Fed signals higher rates, the USD demand rises (investors seek higher returns), while gold, stocks, and crypto often fall because money becomes “more expensive.”

- When the Fed signals lower rates or slows tightening, the USD loses demand, and money flows into assets like gold, stocks, and crypto.

🔍 Why a Rate Cut Weakens the Dollar:

* Cutting rates means borrowing money becomes cheaper.

* Investors earn less return by holding USD in banks or bonds.

* This lowers demand for the dollar, making it cheaper in global markets.

📊 What the Current Charts Show:

⚡ The Core Reason – Demand & Supply

Weaker dollar = reduced demand for USD, so supply flows into gold, stocks, euro, and crypto.

🔮 Looking Ahead – Will the Rally Continue?

The rally may extend if the dollar remains under pressure and the Fed stays dovish.

But caution: after the first strong impulse, markets often retrace to test demand zones before continuing.

Next week’s momentum will depend on whether buyers can sustain demand beyond the initial FOMC reaction.

👉 Takeaway for Traders:

FOMC moves aren’t random. They’re driven by where capital finds the best return. Understanding this demand–supply flow helps explain why all charts move together in these moments.

#MJTrading

#FOMC #DXY #XAUUSD #EURUSD #BTCUSD #US30 #Forex #Gold #TradingEducation #Rally

Psychology Always Matters:

🌟MJTrading | Private account manager and forex trader;

🌱 Join me to grow together👇:

▶️🔴 Youtube: youtube.com/@MJTradingYT

✈️🔵 Telegram: t.me/MJTradingTG

🌱 Join me to grow together👇:

▶️🔴 Youtube: youtube.com/@MJTradingYT

✈️🔵 Telegram: t.me/MJTradingTG

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🌟MJTrading | Private account manager and forex trader;

🌱 Join me to grow together👇:

▶️🔴 Youtube: youtube.com/@MJTradingYT

✈️🔵 Telegram: t.me/MJTradingTG

🌱 Join me to grow together👇:

▶️🔴 Youtube: youtube.com/@MJTradingYT

✈️🔵 Telegram: t.me/MJTradingTG

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.