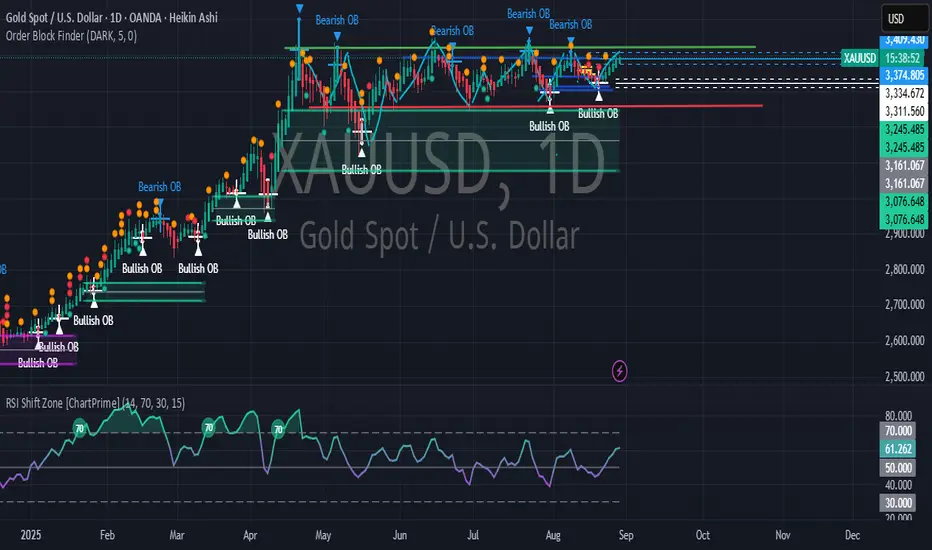

Gold (XAU/USD – Daily, Heikin Ashi) chart:

🔎 Key Observations

Price Zone:

Gold is trading between 3,378 (support) and 3,409 (resistance).

Strong Bullish OBs are stacked below (3,334 – 3,311).

Order Flow:

Multiple bearish OB rejections at 3,409 → sellers are defending that level.

However, price is not breaking down — showing accumulation.

RSI (around 61):

Still bullish, not overbought.

Suggests potential upside continuation if breakout happens.

Structure:

This looks like a tight consolidation before a breakout.

Market is “coiling” around resistance.

📈 Next Movement Expectation

If daily candle closes above 3,410 → Gold likely breaks upward toward 3,430 → 3,450 – 3,460.

If rejection happens at 3,409 again → Pullback to 3,334 – 3,323 zone is likely.

✅ Bias (next move):

Gold is building pressure for an upside breakout, but until we see a daily close above 3,410, the market will stay in range and may retest support.

⚖️ In short:

Watch 3,410 → Break = Bullish Move.

Watch 3,378 → Break = Bearish Pullback.

🔎 Key Observations

Price Zone:

Gold is trading between 3,378 (support) and 3,409 (resistance).

Strong Bullish OBs are stacked below (3,334 – 3,311).

Order Flow:

Multiple bearish OB rejections at 3,409 → sellers are defending that level.

However, price is not breaking down — showing accumulation.

RSI (around 61):

Still bullish, not overbought.

Suggests potential upside continuation if breakout happens.

Structure:

This looks like a tight consolidation before a breakout.

Market is “coiling” around resistance.

📈 Next Movement Expectation

If daily candle closes above 3,410 → Gold likely breaks upward toward 3,430 → 3,450 – 3,460.

If rejection happens at 3,409 again → Pullback to 3,334 – 3,323 zone is likely.

✅ Bias (next move):

Gold is building pressure for an upside breakout, but until we see a daily close above 3,410, the market will stay in range and may retest support.

⚖️ In short:

Watch 3,410 → Break = Bullish Move.

Watch 3,378 → Break = Bearish Pullback.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.