Fundamental Analysis: What’s Driving Gold’s Rally? 🌟

Gold’s Big Win: Spot gold jumped 0.9% to $3,447.09/oz on August 29, with a stellar 4.8% gain for the month. Gold futures also rose 1.2% to $3,515.70/oz, signaling strong bullish momentum. 📈

USD Stays Steady but Weakens: The USD held stable but lost 2.2% in August, making gold more affordable for foreign buyers and boosting its appeal. 📉

PCE Data Supports Rate Cuts: US PCE inflation rose 0.2% month-on-month and 2.6% year-on-year in July 2025, aligning with forecasts. Strong consumer spending and tariff-driven price hikes signal persistent inflation, but analysts expect the Fed to cut rates—potentially twice this year—lifting commodities like gold. The market now sees an 89% chance of a 0.25% rate cut in September 2025, up from 85%, per CME FedWatch. 🏦

Fed Drama Intensifies: A federal judge is reviewing whether to block President Trump’s attempt to fire Fed Governor Lisa Cook, who’s suing to protect her position, arguing Trump lacks valid grounds. This uncertainty around the Fed’s independence is a major tailwind for gold’s safe-haven status. 🇺🇸⚖️

Why Gold Shines: As a non-yielding asset, gold thrives in low-interest-rate environments and during economic uncertainty—perfect conditions for its current rally!

Technical Analysis: Bullish Momentum Continues, But Watch Key Levels! 📉

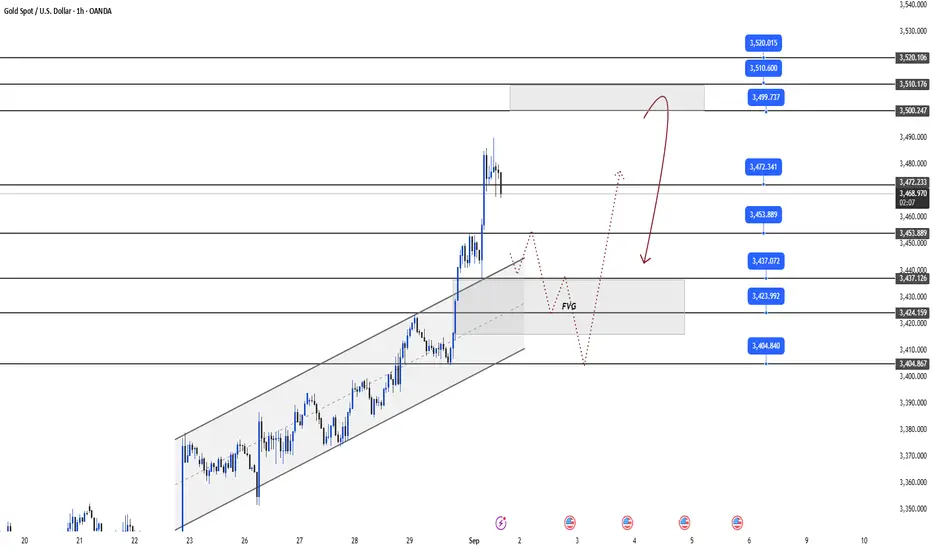

Gold kicked off the Asian session with a bang, breaking through the 3353 resistance and creating a significant FVG (Fair Value Gap) due to its strong upward push. As long as gold stays above the 343x zone, the bulls remain in control. However, with prices nearing multi-month highs, a pullback could be looming. Here’s the game plan:

Key Resistance: 3500 - 3510 - 3520

Key Support: 3472 - 3453 - 3437 - 3423 - 3404

Scalping Opportunities:

Sell Scalp: 3499 - 3501

SL: 3504

TP: 3496 - 3491 - 3486

Buy Scalp: 3453 - 3451

SL: 3448

TP: 3456 - 3461 - 3466

Swing Trading Opportunities:

Sell Zone: 3510 - 3512

SL: 3516

TP: 3506 - 3500 - 3490 - 3480

Buy Zone: 3436 - 3434

SL: 3430

TP: 3440 - 3450 - 3460

Gold’s Big Win: Spot gold jumped 0.9% to $3,447.09/oz on August 29, with a stellar 4.8% gain for the month. Gold futures also rose 1.2% to $3,515.70/oz, signaling strong bullish momentum. 📈

USD Stays Steady but Weakens: The USD held stable but lost 2.2% in August, making gold more affordable for foreign buyers and boosting its appeal. 📉

PCE Data Supports Rate Cuts: US PCE inflation rose 0.2% month-on-month and 2.6% year-on-year in July 2025, aligning with forecasts. Strong consumer spending and tariff-driven price hikes signal persistent inflation, but analysts expect the Fed to cut rates—potentially twice this year—lifting commodities like gold. The market now sees an 89% chance of a 0.25% rate cut in September 2025, up from 85%, per CME FedWatch. 🏦

Fed Drama Intensifies: A federal judge is reviewing whether to block President Trump’s attempt to fire Fed Governor Lisa Cook, who’s suing to protect her position, arguing Trump lacks valid grounds. This uncertainty around the Fed’s independence is a major tailwind for gold’s safe-haven status. 🇺🇸⚖️

Why Gold Shines: As a non-yielding asset, gold thrives in low-interest-rate environments and during economic uncertainty—perfect conditions for its current rally!

Technical Analysis: Bullish Momentum Continues, But Watch Key Levels! 📉

Gold kicked off the Asian session with a bang, breaking through the 3353 resistance and creating a significant FVG (Fair Value Gap) due to its strong upward push. As long as gold stays above the 343x zone, the bulls remain in control. However, with prices nearing multi-month highs, a pullback could be looming. Here’s the game plan:

Key Resistance: 3500 - 3510 - 3520

Key Support: 3472 - 3453 - 3437 - 3423 - 3404

Scalping Opportunities:

Sell Scalp: 3499 - 3501

SL: 3504

TP: 3496 - 3491 - 3486

Buy Scalp: 3453 - 3451

SL: 3448

TP: 3456 - 3461 - 3466

Swing Trading Opportunities:

Sell Zone: 3510 - 3512

SL: 3516

TP: 3506 - 3500 - 3490 - 3480

Buy Zone: 3436 - 3434

SL: 3430

TP: 3440 - 3450 - 3460

🔥 Ready to Elevate Your Trading Game?

t.me/+1aSqbdspbEdkYjU9

✅ Dive into in-depth technical & fundamental analysis

✅ Master risk management tips to safeguard your capital

📩 Join our TradingView community now!

t.me/+1aSqbdspbEdkYjU9

t.me/+1aSqbdspbEdkYjU9

✅ Dive into in-depth technical & fundamental analysis

✅ Master risk management tips to safeguard your capital

📩 Join our TradingView community now!

t.me/+1aSqbdspbEdkYjU9

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔥 Ready to Elevate Your Trading Game?

t.me/+1aSqbdspbEdkYjU9

✅ Dive into in-depth technical & fundamental analysis

✅ Master risk management tips to safeguard your capital

📩 Join our TradingView community now!

t.me/+1aSqbdspbEdkYjU9

t.me/+1aSqbdspbEdkYjU9

✅ Dive into in-depth technical & fundamental analysis

✅ Master risk management tips to safeguard your capital

📩 Join our TradingView community now!

t.me/+1aSqbdspbEdkYjU9

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.