________________________________________

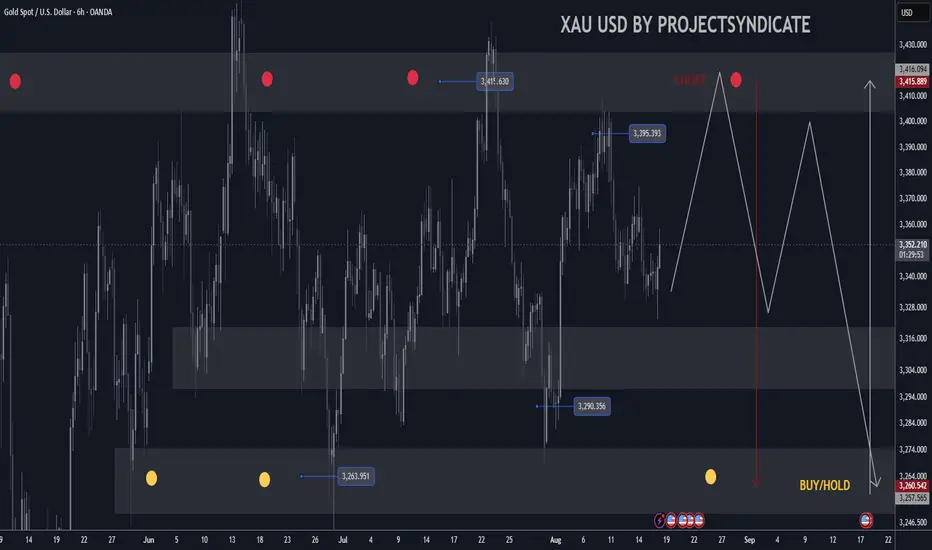

📊 Gold Technical Outlook Update – H4 & 2H Chart

📰 Latest Summary Headlines

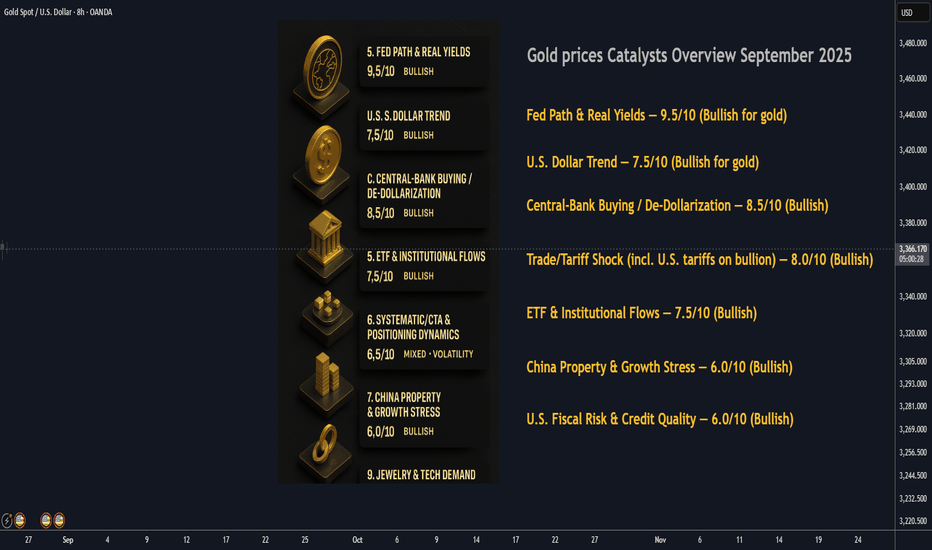

• 🟡 Gold edges firmer as weaker USD provides short-term lift.

• 📉 Technical compression on charts signals potential sharp move.

• ⚠️ Rising wedge formation hints at possible breakdown risk.

• 🎯 Traders eye a slide toward $3,225 if bearish pattern confirms.

________________________________________

🏆 Market Overview

• 💰 Current gold price hovers near $3,345–3,348 per ounce, consolidating in a tight range.

• 🔄 Price action remains choppy, with no breakout beyond key levels in recent sessions.

• ⛔ Strong resistance sits at $3,410–3,420 USD, keeping rallies capped.

• ⚖️ Major support remains at $3,300–3,310 USD, forming the lower boundary of the range.

• 💱 Market sentiment is driven by softer USD and yields, with gold unable to gain decisive momentum.

• 🌪️ Volatility expected to persist as traders await stronger catalysts.

________________________________________

⭐️ Recommended Trade Strategy

• 🎯 Bearish Setup (2H/H4): Short gold near $3,410–3,420 resistance.

• 🛑 Stop-loss: Above $3,430 recent highs.

• ✅ Take profit: Initial target $3,310 USD, extension to $3,300 USD.

• 📊 Range trading remains the favored play—sell near resistance, buy near support.

• ⚡ Stay nimble for sharp moves if the wedge pattern resolves.

• 🛡️ Risk management is critical: use tight stops and scale positions accordingly.

________________________________________

💡 Gold Market Highlights

• 🛡️ Safe-haven demand underpins gold as investors hedge against uncertainty.

• 🏦 Institutional flows remain strong, though short-term pullbacks are likely.

• 💥 Compression on charts suggests an explosive move once direction is chosen.

• 📈 Current market levels: Gold spot ~$3,345–3,348, ETF (GLD) trades around $307.

________________________________________

📌 Summary

• 📏 Gold remains locked in a multi-week range between $3,300 support and $3,410 resistance.

• 📉 The wedge pattern on short-term charts favors a potential breakdown toward $3,225.

• 🐻 Short-sellers should wait for confirmation, while 🐂 bulls will defend key support zones.

• 🧭 Tactical range trading remains the best approach until a decisive breakout occurs.

________________________________________

📊 Gold Technical Outlook Update – H4 & 2H Chart

📰 Latest Summary Headlines

• 🟡 Gold edges firmer as weaker USD provides short-term lift.

• 📉 Technical compression on charts signals potential sharp move.

• ⚠️ Rising wedge formation hints at possible breakdown risk.

• 🎯 Traders eye a slide toward $3,225 if bearish pattern confirms.

________________________________________

🏆 Market Overview

• 💰 Current gold price hovers near $3,345–3,348 per ounce, consolidating in a tight range.

• 🔄 Price action remains choppy, with no breakout beyond key levels in recent sessions.

• ⛔ Strong resistance sits at $3,410–3,420 USD, keeping rallies capped.

• ⚖️ Major support remains at $3,300–3,310 USD, forming the lower boundary of the range.

• 💱 Market sentiment is driven by softer USD and yields, with gold unable to gain decisive momentum.

• 🌪️ Volatility expected to persist as traders await stronger catalysts.

________________________________________

⭐️ Recommended Trade Strategy

• 🎯 Bearish Setup (2H/H4): Short gold near $3,410–3,420 resistance.

• 🛑 Stop-loss: Above $3,430 recent highs.

• ✅ Take profit: Initial target $3,310 USD, extension to $3,300 USD.

• 📊 Range trading remains the favored play—sell near resistance, buy near support.

• ⚡ Stay nimble for sharp moves if the wedge pattern resolves.

• 🛡️ Risk management is critical: use tight stops and scale positions accordingly.

________________________________________

💡 Gold Market Highlights

• 🛡️ Safe-haven demand underpins gold as investors hedge against uncertainty.

• 🏦 Institutional flows remain strong, though short-term pullbacks are likely.

• 💥 Compression on charts suggests an explosive move once direction is chosen.

• 📈 Current market levels: Gold spot ~$3,345–3,348, ETF (GLD) trades around $307.

________________________________________

📌 Summary

• 📏 Gold remains locked in a multi-week range between $3,300 support and $3,410 resistance.

• 📉 The wedge pattern on short-term charts favors a potential breakdown toward $3,225.

• 🐻 Short-sellers should wait for confirmation, while 🐂 bulls will defend key support zones.

• 🧭 Tactical range trading remains the best approach until a decisive breakout occurs.

________________________________________

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.