Gold is recovering after falling to $3,283 thanks to a weaker dollar and lower bond yields amid concerns over Trump's new tariff threats. The announced tariffs against seven countries, including Brazil and the Philippines, have heightened tensions, partially offsetting the Fed's hawkish signals. Markets are now awaiting new data from the US and speeches by Fed officials, which could influence the further dynamics of gold.

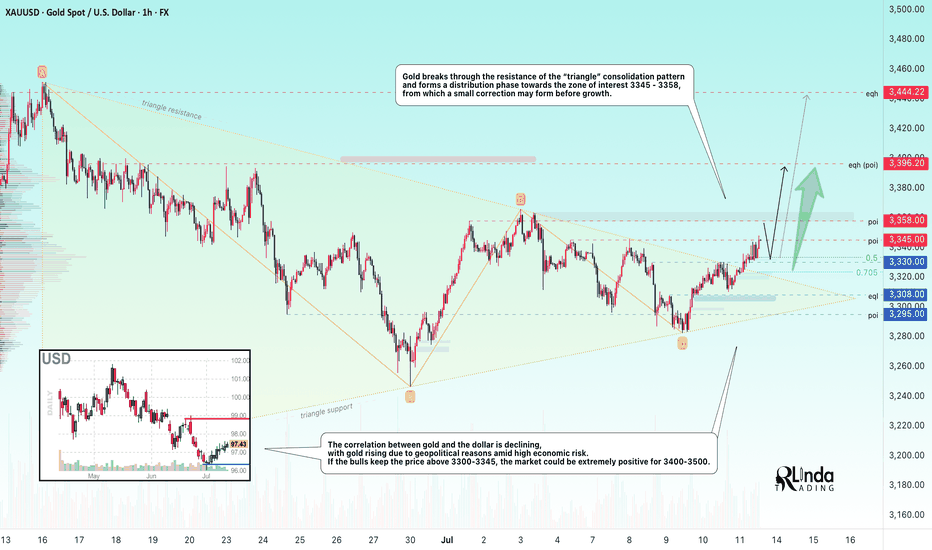

Technically, gold is squeezed between the resistance and support of a symmetrical triangle. The price is being aggressively pushed away from support within a bullish trend, but at the same time, gold is testing resistance for the fifth time, which only increases the chances of a breakout.

Resistance levels: 3330, 3345, 3358

Support levels: 3308, 3295

If gold continues to storm the local resistance at 3330 and the triangle resistance during consolidation, we will have a good chance of catching the breakout and growth. An additional scenario could be growth after a shake-up of the triangle support and the global trend.

Best regards, R. Linda!

🌹TRADING is a CASINO💔!?

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🌹TRADING is a CASINO💔!?

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.