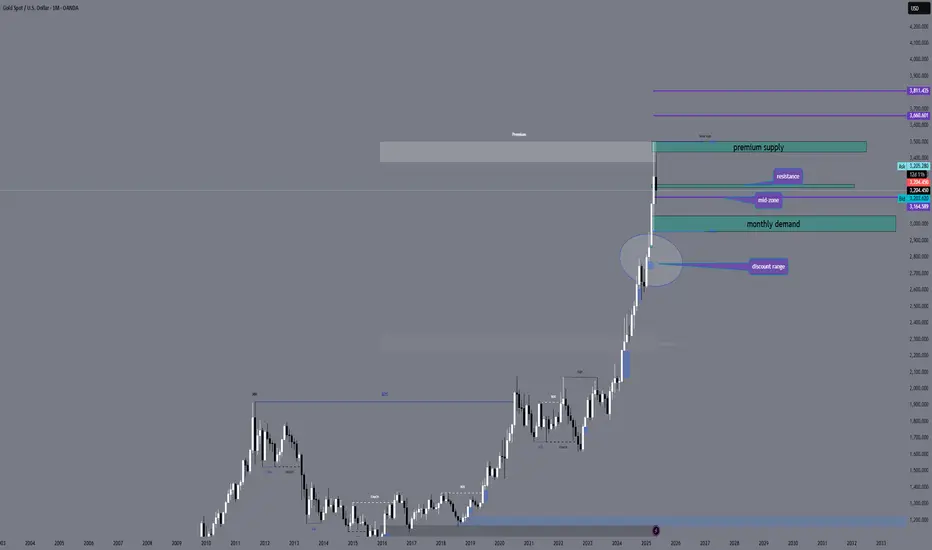

🕰️ Timeframe: Monthly

📍 Current Price: 3204

📈 Bias: Cautious Bullish-to-Neutral

📏 Trend: Long-term bullish | Near-term exhaustion

🔎 STRUCTURAL OVERVIEW

✅ HTF Break of Structure (BOS) confirmed above 2075 (2020/2022 resistance)

✅ Sustained higher highs + strong impulse candles since Oct 2023

⛔️ Price just wicked into Monthly FIB Extension Zone (1.618–2.0) = 3440–3500

⚠️ Bearish wick formed near 3500, suggesting premium rejection

🧠 KEY TECHNICAL ZONES (Monthly)

Zone Type Price Range Notes

🔼 Premium Supply 3440–3500 Monthly FIB Extension zone + rejection wick + final extension of long-term bull leg

🔼 Resistance 3222–3242 Previous OB and last BOS area before wick spike — possible retest point

⚠️ Mid-Zone 3160–3185 Equilibrium / liquidity trap area seen on H4/D1

🟩 Monthly Demand 2960–3050 Large unmitigated zone + FVG + consolidation base before impulse

🟦 Discount Range 2800–2950 Key reaccumulation blocks from 2023 rallies

🔮 MACRO + MARKET CONTEXT

💬 Geopolitical Tension: Ongoing inflation concerns and Fed credibility under fire after CPI/UoM combo

📉 UoM Sentiment: Dropped below expectations = recessionary anxiety

📊 Inflation Expectations: Came in hotter = market confused, no clean direction

🗣️ Powell speech + May FOMC aftermath = market lacks conviction, stuck in uncertainty

🧭 STRATEGIC SCENARIOS

✅ Bullish Continuation (if retracement holds above 3160–3180)

Potential reentry toward 3240–3250 and re-test upper wick zone >3440

Must see H4 CHoCH + volume confluence

❌ Bearish Retracement (if lower timeframes lose 3160)

Deeper move likely toward 3050–3080 = Monthly demand base

Below that = consolidation back to 2960

⚙️ FIBONACCI EXTENSION

Applied from breakout leg Oct 2023 (Low ~1810 to High ~2222 → projected from pullback at ~1984)

Extension targets:

1.272 = ✅ Reached

1.618 = 3440 = tapped

2.0 = 3500 = wick rejection

We are now reacting inside a fully extended bullish range, which supports a monthly cool-off.

🧠 FINAL WORD

Gold hit the monthly moonshot. Now it’s all about real structure and rotation:

💡 Watch how price respects the 3160–3180 range. Lose that — and we dive back toward 3050–3080.

Hold it — and we reload for the final frontier above 3440.

Gold’s Monthly Jetpack Ran Out of Fuel at 3500 🚀🔥 — Now It’s All About Gravity and Structure."

From FIB extensions to wick rejections, this is not the time to chase... it’s the time to react.

Comment, follow, and stay sharp — sniper mode never sleeps.

— GoldFxMinds (GoldMindsFX)

📍 Current Price: 3204

📈 Bias: Cautious Bullish-to-Neutral

📏 Trend: Long-term bullish | Near-term exhaustion

🔎 STRUCTURAL OVERVIEW

✅ HTF Break of Structure (BOS) confirmed above 2075 (2020/2022 resistance)

✅ Sustained higher highs + strong impulse candles since Oct 2023

⛔️ Price just wicked into Monthly FIB Extension Zone (1.618–2.0) = 3440–3500

⚠️ Bearish wick formed near 3500, suggesting premium rejection

🧠 KEY TECHNICAL ZONES (Monthly)

Zone Type Price Range Notes

🔼 Premium Supply 3440–3500 Monthly FIB Extension zone + rejection wick + final extension of long-term bull leg

🔼 Resistance 3222–3242 Previous OB and last BOS area before wick spike — possible retest point

⚠️ Mid-Zone 3160–3185 Equilibrium / liquidity trap area seen on H4/D1

🟩 Monthly Demand 2960–3050 Large unmitigated zone + FVG + consolidation base before impulse

🟦 Discount Range 2800–2950 Key reaccumulation blocks from 2023 rallies

🔮 MACRO + MARKET CONTEXT

💬 Geopolitical Tension: Ongoing inflation concerns and Fed credibility under fire after CPI/UoM combo

📉 UoM Sentiment: Dropped below expectations = recessionary anxiety

📊 Inflation Expectations: Came in hotter = market confused, no clean direction

🗣️ Powell speech + May FOMC aftermath = market lacks conviction, stuck in uncertainty

🧭 STRATEGIC SCENARIOS

✅ Bullish Continuation (if retracement holds above 3160–3180)

Potential reentry toward 3240–3250 and re-test upper wick zone >3440

Must see H4 CHoCH + volume confluence

❌ Bearish Retracement (if lower timeframes lose 3160)

Deeper move likely toward 3050–3080 = Monthly demand base

Below that = consolidation back to 2960

⚙️ FIBONACCI EXTENSION

Applied from breakout leg Oct 2023 (Low ~1810 to High ~2222 → projected from pullback at ~1984)

Extension targets:

1.272 = ✅ Reached

1.618 = 3440 = tapped

2.0 = 3500 = wick rejection

We are now reacting inside a fully extended bullish range, which supports a monthly cool-off.

🧠 FINAL WORD

Gold hit the monthly moonshot. Now it’s all about real structure and rotation:

💡 Watch how price respects the 3160–3180 range. Lose that — and we dive back toward 3050–3080.

Hold it — and we reload for the final frontier above 3440.

Gold’s Monthly Jetpack Ran Out of Fuel at 3500 🚀🔥 — Now It’s All About Gravity and Structure."

From FIB extensions to wick rejections, this is not the time to chase... it’s the time to react.

Comment, follow, and stay sharp — sniper mode never sleeps.

— GoldFxMinds (GoldMindsFX)

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.