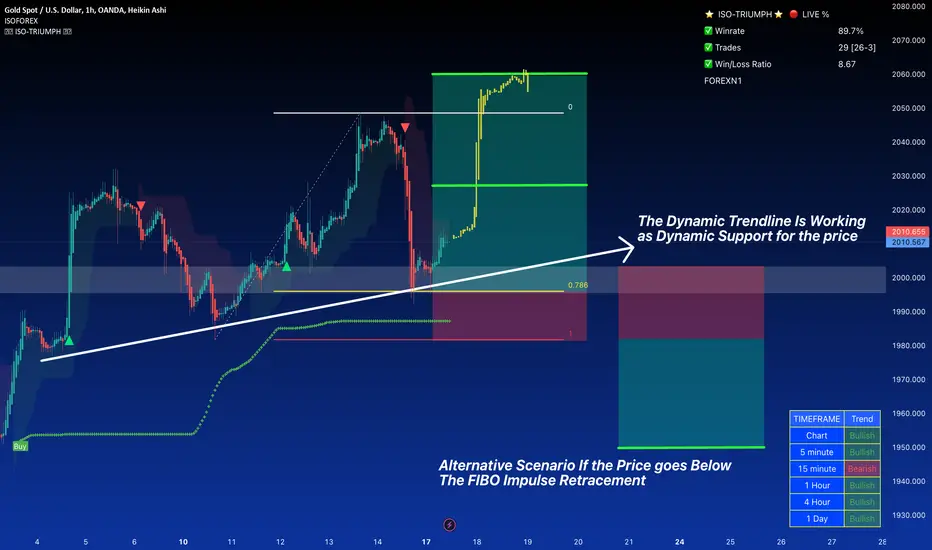

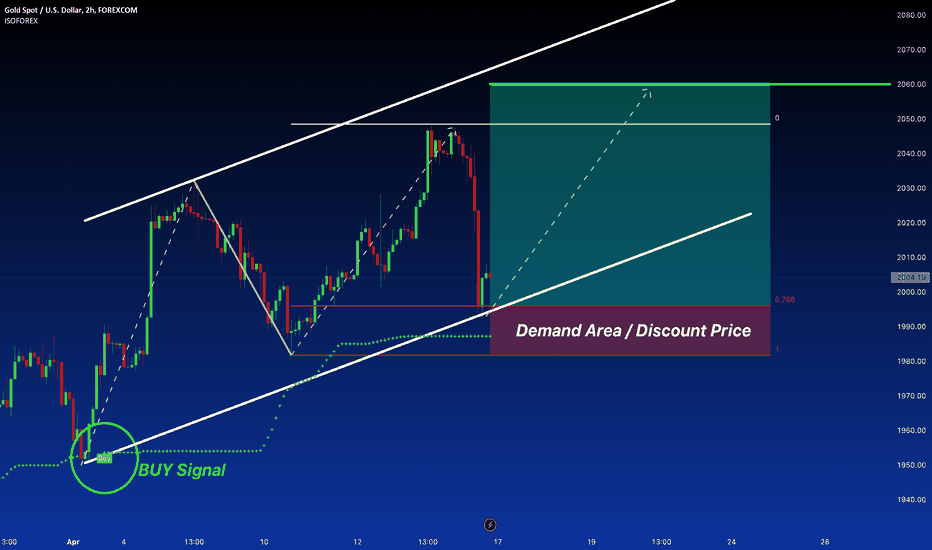

During the Asian session, the gold price XAU/USD appears to be susceptible above the psychological barrier of  2,000.00. Although the precious metal had initially shown signs of recovery after reaching a low of

2,000.00. Although the precious metal had initially shown signs of recovery after reaching a low of  1,992.50 over a four-day period, the upside movement remains limited due to the bullish outlook for the US Dollar Index (DXY).

1,992.50 over a four-day period, the upside movement remains limited due to the bullish outlook for the US Dollar Index (DXY).

Our analysis indicates the possibility of a new long impulse for gold after it bounces back from the 78.6% Fibonacci Level in conjunction with the dynamic trendline. However, if the price drops below the first Fibo leg, we will consider a potential trend reversal.

Our analysis indicates the possibility of a new long impulse for gold after it bounces back from the 78.6% Fibonacci Level in conjunction with the dynamic trendline. However, if the price drops below the first Fibo leg, we will consider a potential trend reversal.

✅ TELEGRAM CHANNEL: t.me/+VECQWxY0YXKRXLod

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅ TELEGRAM CHANNEL: t.me/+VECQWxY0YXKRXLod

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.