⭐️GOLDEN INFORMATION:

Gold prices slipped by approximately 0.48% on Thursday, retreating from a two-week peak of $3,345 and falling below the key $3,300 level. The decline was driven by renewed strength in the US Dollar, even as Treasury yields pulled back from their intraday highs. The pressure on the yellow metal intensified after the US House of Representatives passed President Trump’s budget proposal, which now heads to the Senate for final approval. At the time of writing, XAU/USD is trading at $3,289, marking a 0.83% daily loss.

While sentiment in the broader market has seen a modest rebound, it remains fragile following Moody’s recent downgrade of US sovereign debt. The fiscal package approved by the House is expected to raise the national debt ceiling by a staggering $4 trillion, amplifying concerns over long-term fiscal sustainability.

⭐️Personal comments NOVA:

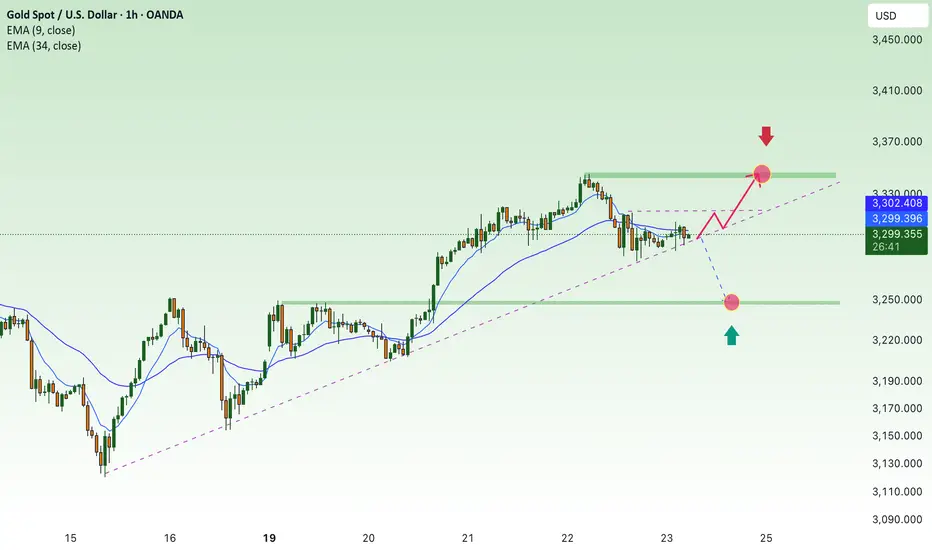

Gold price is still moving in the H1 uptrend line, buying power is still quite strong.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3344- 3346 SL 3351

TP1: $3335

TP2: $3322

TP3: $3307

🔥BUY GOLD zone: $3248- $3246 SL $3241

TP1: $3258

TP2: $3270

TP3: $3280

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold prices slipped by approximately 0.48% on Thursday, retreating from a two-week peak of $3,345 and falling below the key $3,300 level. The decline was driven by renewed strength in the US Dollar, even as Treasury yields pulled back from their intraday highs. The pressure on the yellow metal intensified after the US House of Representatives passed President Trump’s budget proposal, which now heads to the Senate for final approval. At the time of writing, XAU/USD is trading at $3,289, marking a 0.83% daily loss.

While sentiment in the broader market has seen a modest rebound, it remains fragile following Moody’s recent downgrade of US sovereign debt. The fiscal package approved by the House is expected to raise the national debt ceiling by a staggering $4 trillion, amplifying concerns over long-term fiscal sustainability.

⭐️Personal comments NOVA:

Gold price is still moving in the H1 uptrend line, buying power is still quite strong.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3344- 3346 SL 3351

TP1: $3335

TP2: $3322

TP3: $3307

🔥BUY GOLD zone: $3248- $3246 SL $3241

TP1: $3258

TP2: $3270

TP3: $3280

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Trade active

+ 60 pips , sell PLAN DAY : 3346-3344, great Dear My Friends,

NOVA returns and updates new information

✅ Gold Scalping Signal: 4 - 6 signals.

✅ Forex Signal: 5 - 8 signals.

✅ Trading Idea / Setup / Technical.

✅ NEW UPDATE : Signals free in Telegram:

t.me/+1mFSljRaI5RlNjg1

NOVA returns and updates new information

✅ Gold Scalping Signal: 4 - 6 signals.

✅ Forex Signal: 5 - 8 signals.

✅ Trading Idea / Setup / Technical.

✅ NEW UPDATE : Signals free in Telegram:

t.me/+1mFSljRaI5RlNjg1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Dear My Friends,

NOVA returns and updates new information

✅ Gold Scalping Signal: 4 - 6 signals.

✅ Forex Signal: 5 - 8 signals.

✅ Trading Idea / Setup / Technical.

✅ NEW UPDATE : Signals free in Telegram:

t.me/+1mFSljRaI5RlNjg1

NOVA returns and updates new information

✅ Gold Scalping Signal: 4 - 6 signals.

✅ Forex Signal: 5 - 8 signals.

✅ Trading Idea / Setup / Technical.

✅ NEW UPDATE : Signals free in Telegram:

t.me/+1mFSljRaI5RlNjg1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.