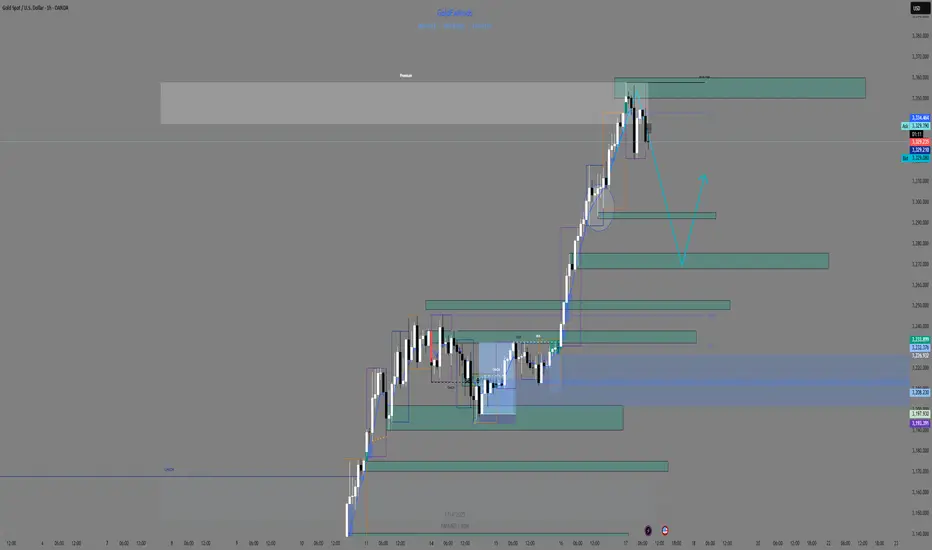

🧠 Updated Structure & Trend (April 17 – Pre-Weekend Trading)

✅ HTF (D1, H4): Price has made a new all-time high at 3357, extending the bullish run — but we're now deep in premium exhaustion territory.

🟠 M30–H1: First signs of distribution and internal CHoCH on M15 are showing. No follow-through above ATH. Price is stalling, likely waiting for NY volume.

⚠️ Volatility is low, and Friday is a market holiday, so any manipulation or rejection will likely happen today.

🔼 New ATH: 3357

This makes previous zones like 3333–3340 less relevant for traps.

Focus shifts to the true inducement zone:

🔻 3355–3365 → Main sniper short zone, valid only with clear M5 structure (BOS or reversal FVG).

🔻 Key Sell Zones (Updated):

3355–3365 → Final inducement / exhaustion zone near new ATH

3342–3345 → OB retest below weak high, valid only if confirmed with bearish PA on M5

🟢 Key Buy Zones (Same):

3284–3288 → OB + FVG + discount zone

3260–3265 → H1 equilibrium and last clean demand

3230–3235 → Deeper reentry zone if we get a flash crash before NY

📊 Trading Logic:

If NY session spikes again into 3355–3365, we're ready to snipe with precision.

If price fails to reclaim 3345 and breaks M5 structure, we target early shorts.

On a clean dump, we look for longs in the 3280–3260 range, with confirmation.

✅ HTF (D1, H4): Price has made a new all-time high at 3357, extending the bullish run — but we're now deep in premium exhaustion territory.

🟠 M30–H1: First signs of distribution and internal CHoCH on M15 are showing. No follow-through above ATH. Price is stalling, likely waiting for NY volume.

⚠️ Volatility is low, and Friday is a market holiday, so any manipulation or rejection will likely happen today.

🔼 New ATH: 3357

This makes previous zones like 3333–3340 less relevant for traps.

Focus shifts to the true inducement zone:

🔻 3355–3365 → Main sniper short zone, valid only with clear M5 structure (BOS or reversal FVG).

🔻 Key Sell Zones (Updated):

3355–3365 → Final inducement / exhaustion zone near new ATH

3342–3345 → OB retest below weak high, valid only if confirmed with bearish PA on M5

🟢 Key Buy Zones (Same):

3284–3288 → OB + FVG + discount zone

3260–3265 → H1 equilibrium and last clean demand

3230–3235 → Deeper reentry zone if we get a flash crash before NY

📊 Trading Logic:

If NY session spikes again into 3355–3365, we're ready to snipe with precision.

If price fails to reclaim 3345 and breaks M5 structure, we target early shorts.

On a clean dump, we look for longs in the 3280–3260 range, with confirmation.

Trade active

🚨 GOLD UPDATE – April 17 | TP3 HIT + New Structure Loaded💥 Sell setup from 3350–3352 played out to perfection — TP3 at 3285 hit like a sniper.

🔻 Trade Recap:

• Entry: 3350–3352 (fake breakout trap)

• TP1: 3330 ✅

• TP2: 3305 ✅

• TP3: 3285 ✅

• +260 pips secured, clean structure-based trade

🧠 Updated Structure (Post-TP3):

• Price dropped as expected into 328x region

• Now reacting from our original OB+FVG buy zone

• New 30M CHoCH forming, watching for NY session reaction

📌 Next Levels to Watch:

• 🔼 Short again at: 3355–3365 (only with M5 confirmation)

• 🔽 Long scalp zone: 3284–3288

• ⬇️ Deeper buys: 3260–3265 or 3230 if flash crash

💡 Expecting sharp reaction either way before Friday's holiday lull.

🔁 Follow for sniper entries, not guesses. Structure never lies.

👇 Who caught the move? Drop a 💣 in the comments.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.