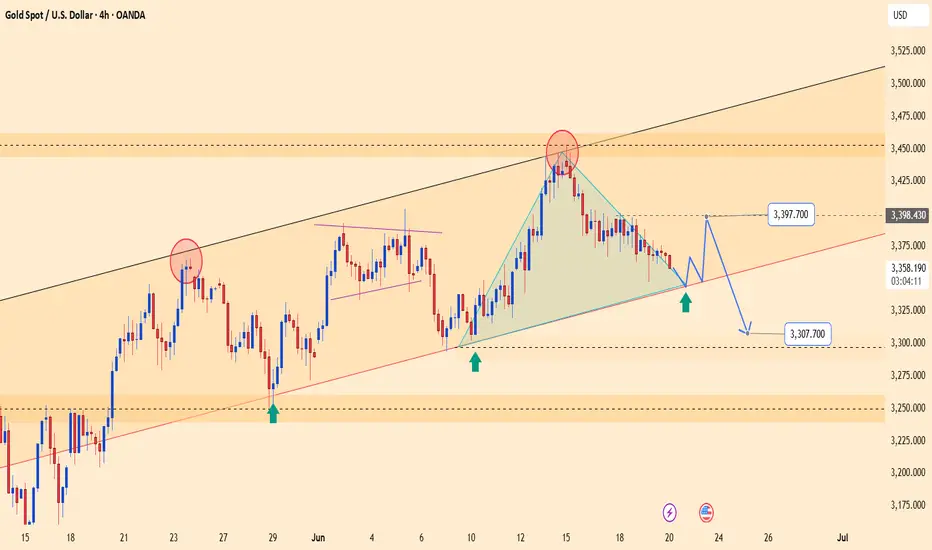

Gold is currently testing the lower boundary of the ascending channel after pulling back from the 3,398 USD resistance zone. The recent breakdown from a triangle pattern signals growing bearish pressure.

If the price fails to reclaim the 3,397 USD area, a continued move down toward 3,307 USD becomes likely — a level that coincides with key technical support. The latest FOMC minutes reaffirmed a “hawkish” stance, boosting the USD and adding downside pressure on gold.

The bearish outlook will strengthen if gold fails to hold the current support zone.

If the price fails to reclaim the 3,397 USD area, a continued move down toward 3,307 USD becomes likely — a level that coincides with key technical support. The latest FOMC minutes reaffirmed a “hawkish” stance, boosting the USD and adding downside pressure on gold.

The bearish outlook will strengthen if gold fails to hold the current support zone.

Trade active

Top trading opportunities are waiting for you! : t.me/+TaRRH29IRysyNGJl

🔥 High-quality signals – Win rate up to 85%

📍 Accurate, verified technical analysis

⚡ Fast updates – Never miss a golden entry

🔥 High-quality signals – Win rate up to 85%

📍 Accurate, verified technical analysis

⚡ Fast updates – Never miss a golden entry

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Top trading opportunities are waiting for you! : t.me/+TaRRH29IRysyNGJl

🔥 High-quality signals – Win rate up to 85%

📍 Accurate, verified technical analysis

⚡ Fast updates – Never miss a golden entry

🔥 High-quality signals – Win rate up to 85%

📍 Accurate, verified technical analysis

⚡ Fast updates – Never miss a golden entry

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.