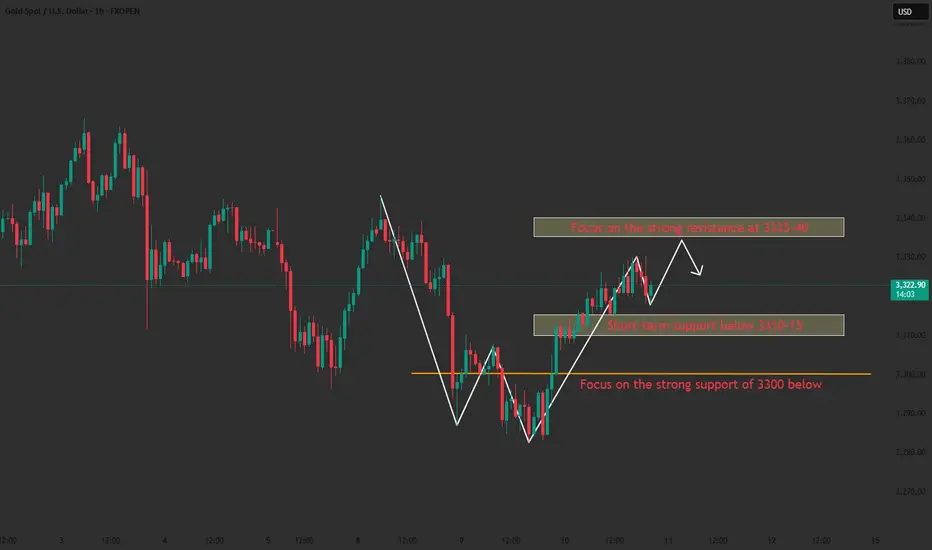

The current gold market is showing a weak rebound pattern. Although there was a small rebound on Wednesday, if it cannot stand above 3330, the overall trend will still be weak.

From the daily level, the support level is 3300 and the resistance level is 3335. The price is oscillating between the middle and lower tracks of the Bollinger Bands, and there is a possibility of upward or downward breakthrough.

Focus on the H4 cycle trend: if the rebound can stand above 3330, the price may further rise to 3335 US dollars;

Once it stands at 3335, it can be basically confirmed that the callback is over, and the subsequent challenge of 3345 resistance level may be repeated.

It is recommended to adopt a long-on-dip strategy near the support level, focusing on the support strength of the 3310-15 area below; the resistance level of 3335-3340 should be paid attention to above.

In terms of specific operations, if the price rebounds to the 3335-3340 range, short selling can be considered; if it pulls back to the 3310-3315 range, long selling can be considered.

From the daily level, the support level is 3300 and the resistance level is 3335. The price is oscillating between the middle and lower tracks of the Bollinger Bands, and there is a possibility of upward or downward breakthrough.

Focus on the H4 cycle trend: if the rebound can stand above 3330, the price may further rise to 3335 US dollars;

Once it stands at 3335, it can be basically confirmed that the callback is over, and the subsequent challenge of 3345 resistance level may be repeated.

It is recommended to adopt a long-on-dip strategy near the support level, focusing on the support strength of the 3310-15 area below; the resistance level of 3335-3340 should be paid attention to above.

In terms of specific operations, if the price rebounds to the 3335-3340 range, short selling can be considered; if it pulls back to the 3310-3315 range, long selling can be considered.

Join My Telegram Channel

t.me/+fnp-H0nQpQU4ODQ8

Join my signal channel

t.me/+fnp-H0nQpQU4ODQ8

t.me/+fnp-H0nQpQU4ODQ8

Join my signal channel

t.me/+fnp-H0nQpQU4ODQ8

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join My Telegram Channel

t.me/+fnp-H0nQpQU4ODQ8

Join my signal channel

t.me/+fnp-H0nQpQU4ODQ8

t.me/+fnp-H0nQpQU4ODQ8

Join my signal channel

t.me/+fnp-H0nQpQU4ODQ8

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.