⚔️ XAUUSD Daily Institutional Analysis

Monday, June 30, 2025

⸻

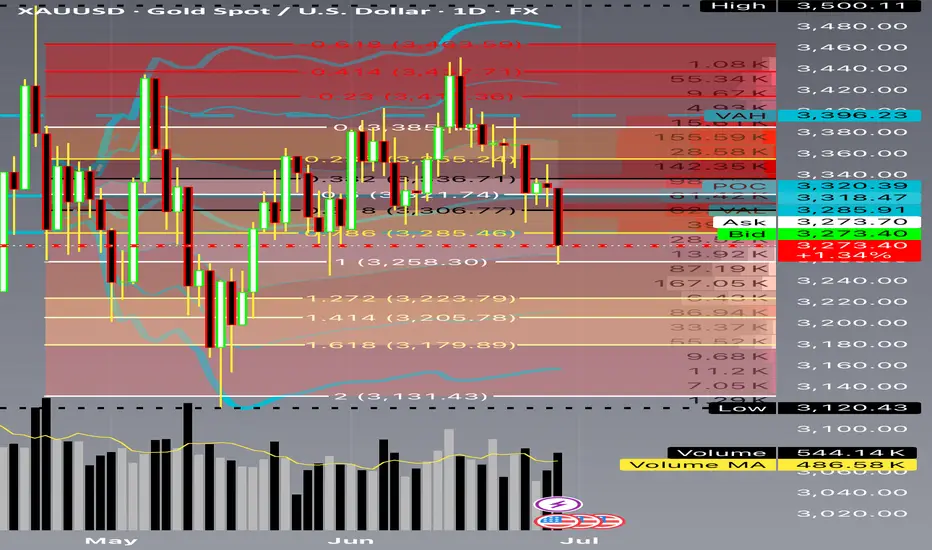

1️⃣ Price Structure & Context

Current Market Snapshot:

• Daily Close (June 28): 3,273.40

• Key Technical Breaks:

• Closed decisively below the 0.5 Fibonacci Retracement (3,288)

• Breached and retested the Value Area Low (VAL) at 3,285.91

• Clear rejection of the 0.618 retracement (3,316)

• Now sitting just above the final liquidity shelf around 3,250.

Structural Interpretation:

• This marks the final stage of distribution, transitioning into a momentum-driven decline.

• Lower Highs: 3,500 > 3,420 > 3,390 > 3,330

• Lower Lows: 3,273 is the weakest daily close in 6 weeks.

• Repeated failure to reclaim even modest retracements signals strong bearish acceptance.

⸻

2️⃣ Volume Profile & Footprint

Volume Clusters:

• POC: 3,320.39 (major supply concentration)

• VAH: 3,396.23 (untested for weeks)

• VAL: 3,285.91 (broken and retested)

Footprint Analysis:

• Persistent negative delta below 3,300 (heavy hitting into bids)

• Friday’s volume: 544K vs. 486K average, confirming conviction

• No evidence of absorption or meaningful buying at the lows

Institutional Interpretation:

• 3,320–3,330: Active institutional sell zone

• 3,285–3,250: Dense stop clusters from trapped longs

• A clean break below 3,250 likely triggers a vacuum flush toward 3,200–3,180

⸻

3️⃣ Trend & Momentum

• Daily Trend: Steepening bearish slope

• Weekly Trend: Ongoing Wave 3 breakdown

• Momentum Indicators:

• RSI: Sub-45 (bearish bias)

• ATR: Expanding (increased volatility)

• Failed retracements reinforce selling pressure

Conclusion:

Momentum remains decisively bearish, accelerating into illiquid conditions.

⸻

4️⃣ Wave & Fibonacci Confluence

Measured Extension Targets:

• 1.0 Extension: ~3,258

• 1.272 Extension: ~3,220

• 1.618 Extension: ~3,180

Interpretation:

• Primary Target: 3,258–3,250

• Extended Target (if liquidity collapses): 3,180

⸻

5️⃣ Liquidity & July 4th Market Closure

Schedule:

• Monday, June 30: Full liquidity

• Tuesday–Wednesday: Gradual volume decline

• Thursday, July 3: Early closes, pre-holiday squaring

• Friday, July 4: NY COMEX & CME Globex metals closed

• Monday, July 7: Liquidity resumes

Tactical Impact:

• Monday is the only fully liquid session for reliable positioning.

• Mid-week thin liquidity is highly prone to false rallies and stop hunts.

• Real directional moves typically return after the holiday closure.

⸻

6️⃣ Stop Hunt & Liquidity Pools

Above Price:

• 3,316–3,330: Clustered short stops above failed retracement

• 3,350: Minor breakout stops

Below Price:

• 3,250–3,240: Dense stop pockets from dip buyers

• Under 3,240: Limited liquidity down to ~3,200–3,180

Institutional Playbook:

• Monday–Tuesday: Potential tactical squeeze up to 3,316–3,330 to trigger stops.

• Post-sweep fade back to 3,260–3,250.

• Friday likely muted due to closure.

• Monday, July 7: High-probability directional expansion.

⸻

7️⃣ Monday, June 30 – Precise Daily Trading Playbook

⸻

🎯 Scenario A – Reversion Rally into Supply

Setup:

• Price rallies into 3,316–3,330 during London–NY overlap.

• Footprint shows negative delta reappearing.

Execution:

• Entry: Sell limit 3,320–3,325

• Stop: 3,355

• Target 1: 3,260

• Target 2: 3,220–3,200

• Confidence: 70%

⸻

🎯 Scenario B – Direct Breakdown

Setup:

• Price fails to reclaim 3,288

• 1-hour close below 3,250 on expanding volume

Execution:

• Entry: Sell stop 3,248

• Stop: 3,300

• Target 1: 3,200

• Target 2: 3,180

• Confidence: 85%

⸻

🎯 Scenario C – Dead Range Pre-Holiday

Setup:

• Price consolidates between 3,270–3,290

• Volume collapses below 300K

Execution:

• No trade – stand aside until liquidity returns

⸻

8️⃣ Hypothetical Institutional Trade Setup

• Order Type: Sell Stop

• Trigger: 1-hour close under 3,250 on 2x normal volume

• Entry: 3,248

• Stop: 3,300

• Target: 3,200

• Position Size: 0.75–1% account risk

• Probability: 85%

⸻

9️⃣ Executive Summary

✅ Trend: Dominant bearish

✅ Momentum: Accelerating downwards

✅ Liquidity: Normal Monday, low mid-week, reactivating post-holiday

✅ Institutional Bias: Sell rallies and exploit stops under 3,250

✅ Psychology:

• Retail FOMO on rallies above 3,316

• Panic if 3,250 breaks

✅ Key Dates:

• Monday: Execution window

• Mid-week: Thin liquidity, false moves

• Friday: Market closure

• Monday, July 7: Expected main move

⸻

⚠️ Disclaimer: This analysis is hypothetical and educational. You are solely responsible for your trading decisions.

Mohamed

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Mohamed

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.