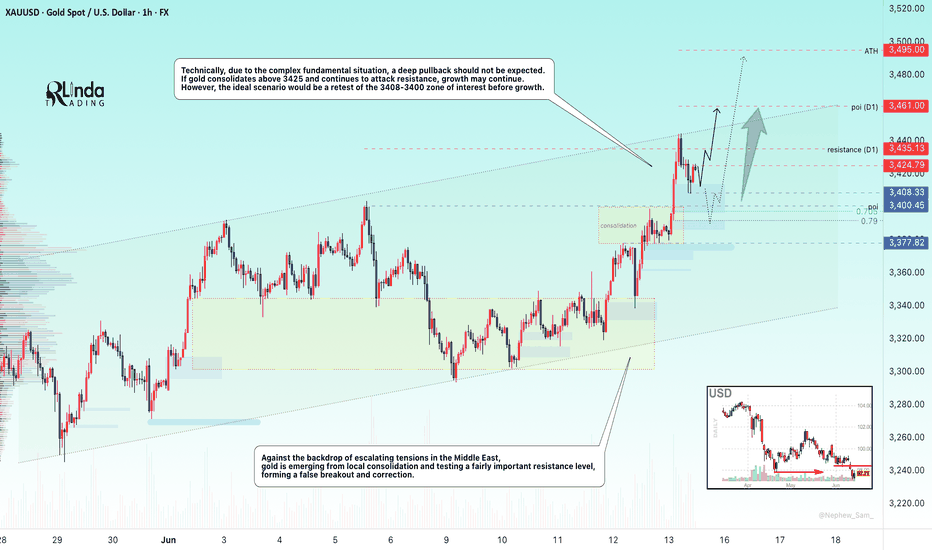

The price of gold briefly retreated from a two-month high above $3,450 amid a recovery in the dollar and investor caution. Escalating tensions between Israel and Iran are dampening risk appetite, while markets await decisions from the Fed and the Bank of Japan. Expectations of a dovish Fed continue to support interest in gold, but fresh impetus is needed for further gains.

Technically, the market is bullish. Gold is forming a correction to the key support and liquidity zone amid an uptrend. The price is within the range, and a retest of 3400 could trigger growth.

Support levels: 3408, 3400

Resistance levels: 3446, 3500

A retest of support and liquidity capture amid the current challenging situation (high interest in the metal) and a bullish trend could support the price, allowing gold to continue its growth.

Best regards, R. Linda!

🌹TRADING is a CASINO💔!?

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🌹TRADING is a CASINO💔!?

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.