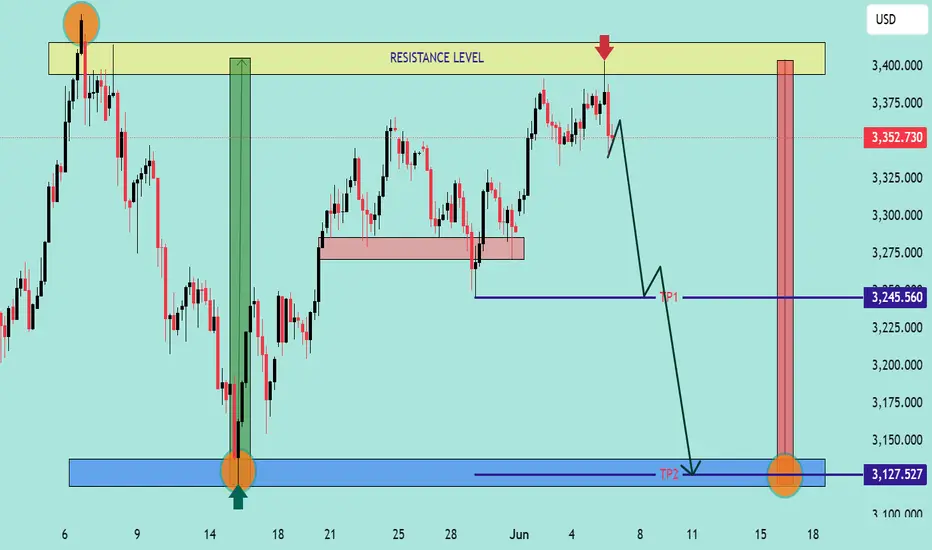

📊 XAUUSD – Bearish Outlook from Resistance Zone

🕒 Date: June 5, 2025

💰 Instrument: Gold (XAUUSD)

📍 Current Price: 3,352.730 USD

🟨 Key Resistance Level

🔴 Price has sharply reacted from the 3,375–3,400 USD zone, highlighted as a strong resistance area.

📉 This zone has previously triggered significant sell-offs, confirmed again by the current bearish rejection (red arrow 🔻).

📉 Bearish Market Structure

The price structure suggests a classic lower high rejection scenario with potential for further downside:

🔻 Immediate Drop Expected

After rejection from resistance, the price shows early signs of breakdown. A minor pullback is expected before continuation.

🧭 TP1 – First Target Zone:

📍 3,245.560 USD

This level aligns with a previous demand area (light red box), likely to act as temporary support or reaction point.

🎯 TP2 – Final Bearish Target:

📍 3,127.527 USD

This blue demand zone is a major support level, previously a strong rally base (green arrow 🟢). Expect buyers to step in here again.

🔄 Trade Idea Summary

💼 Setup Type: Resistance Rejection

🛑 Bias: Bearish

📍 Entry Zone: ~3,350–3,360 USD (confirmed rejection)

🎯 Take Profit 1: 3,245.560 USD

🎯 Take Profit 2: 3,127.527 USD

🔒 Stop Loss: Above 3,400 USD (outside resistance zone)

📌 Observations:

🔁 The market repeated its previous pattern: bouncing from the blue demand zone and rejecting at the yellow resistance zone.

🧱 A solid breakdown below TP1 could accelerate movement toward TP2.

🔍 Watch for any bullish reaction around TP2 for potential reversal setups.

📉 Bias: Bearish

📆 Outlook: Short-term to mid-term swing

🕒 Date: June 5, 2025

💰 Instrument: Gold (XAUUSD)

📍 Current Price: 3,352.730 USD

🟨 Key Resistance Level

🔴 Price has sharply reacted from the 3,375–3,400 USD zone, highlighted as a strong resistance area.

📉 This zone has previously triggered significant sell-offs, confirmed again by the current bearish rejection (red arrow 🔻).

📉 Bearish Market Structure

The price structure suggests a classic lower high rejection scenario with potential for further downside:

🔻 Immediate Drop Expected

After rejection from resistance, the price shows early signs of breakdown. A minor pullback is expected before continuation.

🧭 TP1 – First Target Zone:

📍 3,245.560 USD

This level aligns with a previous demand area (light red box), likely to act as temporary support or reaction point.

🎯 TP2 – Final Bearish Target:

📍 3,127.527 USD

This blue demand zone is a major support level, previously a strong rally base (green arrow 🟢). Expect buyers to step in here again.

🔄 Trade Idea Summary

💼 Setup Type: Resistance Rejection

🛑 Bias: Bearish

📍 Entry Zone: ~3,350–3,360 USD (confirmed rejection)

🎯 Take Profit 1: 3,245.560 USD

🎯 Take Profit 2: 3,127.527 USD

🔒 Stop Loss: Above 3,400 USD (outside resistance zone)

📌 Observations:

🔁 The market repeated its previous pattern: bouncing from the blue demand zone and rejecting at the yellow resistance zone.

🧱 A solid breakdown below TP1 could accelerate movement toward TP2.

🔍 Watch for any bullish reaction around TP2 for potential reversal setups.

📉 Bias: Bearish

📆 Outlook: Short-term to mid-term swing

JOIN MY TELEGRAM CHANNEL

t.me/StellarMarketAnalysis

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

t.me/StellarMarketAnalysis

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

JOIN MY TELEGRAM CHANNEL

t.me/StellarMarketAnalysis

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

t.me/StellarMarketAnalysis

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.