Good day traders 🌟

🌍 MACRO PULSE & CONTEXT

USD Sentiment: Dollar showing mixed signals as markets await fresh catalysts. No major USD movers today keeping gold in pure structural play mode. Fed remains hawkish but dovish pivot expectations keep safe-haven flows active. Gold sitting in premium territory testing institutional patience.

Key Events: Watch for any surprise USD strength that could accelerate moves through key levels. Current levels showing distribution vs accumulation battle.

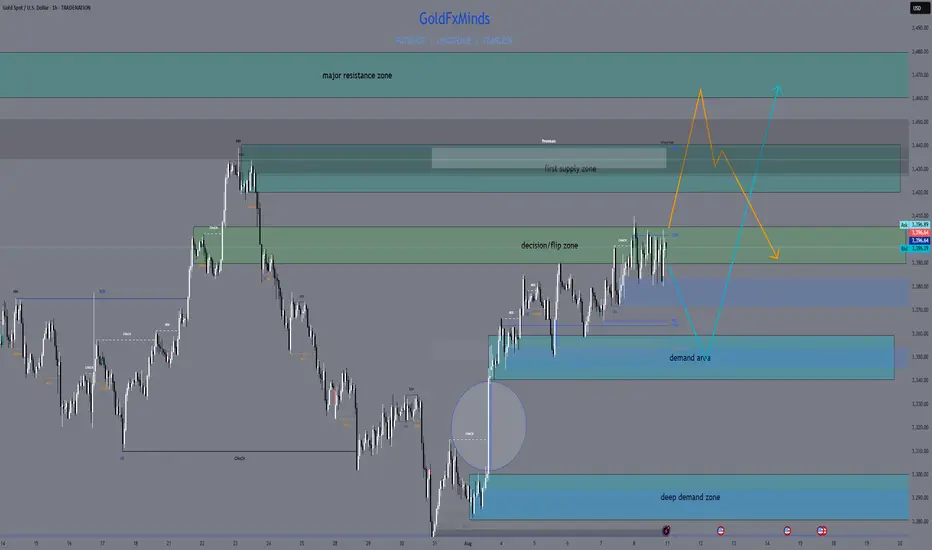

📊 HTF OVERVIEW (D1 → H4 → H1)

Daily Bias: BULLISH BUT EXTENDED

Long-term trend remains bullish with higher highs intact

Price in premium territory - caution for longs

Multiple supply layers above current price creating resistance stack

H4 Bias: CONSOLIDATION IN PREMIUM

Price testing upper structural boundaries

Bull case: Hold above 3380 for continuation toward higher supply zones

Bear case: Break below 3360 for deeper correction to demand

H1 Bias: MIXED - CRITICAL DECISION ZONE

Sitting at key structural level at 3396

Breakout zone: 3390-3405 range

Direction of next move will define short-term bias

🎯 STRUCTURAL ZONES (SMC/ICT CONFLUENCE)

PREMIUM SUPPLY ZONES - STACKED RESISTANCE

🔴 3540-3560 | Weekly Nuclear Supply

Ultimate resistance - weekly structural ceiling

Major institutional distribution zone

Final target for any extreme bullish scenario

🔴 3500-3520 | Daily Major Supply

Strong daily supply block with heavy rejection history

Key institutional selling zone

Secondary target for bullish extensions

🔴 3460-3480 | H4 Supply Block

Immediate major resistance above current consolidation

Previous rejection area with bearish OB formation

First major target if bulls break above 3440

🔴 3420-3440 | H4 Near Supply

Current upper boundary resistance

Recent high rejection point

Scalp short opportunity zone

DISCOUNT DEMAND ZONES

🟢 3280-3300 | H4 Nuclear Demand

Major structural support with institutional backing

Previous breakout point turned support

High probability bounce zone if deep correction occurs

🟢 3340-3360 | H1 Key Demand

Critical pullback support level

Clean demand block with previous respect

First major support below current price

CURRENT BATTLEFIELD

⚡ 3390-3405 | Decision Zone

Critical range where price currently consolidates

Breakout either direction will dictate next major leg

Low probability zone for range entries

⚡ CURRENT ACTION PLAN

IMMEDIATE FOCUS: 3396 in critical decision zone - patience required

BULL SCENARIO ROADMAP:

Above 3405 = Target 3420-3440 first supply test

Above 3440 = Target 3460-3480 major supply

Above 3480 = Target 3500-3520 daily supply

Above 3520 = Target 3540+ nuclear supply

BEAR SCENARIO ROADMAP:

Below 3390 = Target 3340-3360 demand test

Below 3340 = Target 3280-3300 nuclear demand

Below 3280 = Major trend shift - deeper correction

ZONE INVALIDATION:

Bull case compromised: Below 3280 major demand with volume

Bear case invalidated: Above 3540 nuclear supply with momentum

BEST R:R ZONES:

3340-3360 long - Perfect H1 demand with multiple targets above

3460-3480 short - Major supply with deep correction potential

3280-3300 long - Nuclear support with massive upside potential

🎯 FINAL BATTLE SUMMARY

Gold at 3396 sits in the eye of the premium storm - multiple supply layers stacked above like a fortress, while solid demand zones wait below. This is institutional chess at its finest.

The Setup: Stacked resistance creates multiple short opportunities on any push higher, while solid demand zones below offer high R:R long setups. The market is loaded and ready for explosive moves.

The Mindset: Premium territory with multiple supply layers demands surgical precision. Don't force trades at current levels - wait for the extremes where smart money reveals their true intentions.

Next Move: Any fundamental catalyst could trigger violent moves through these stacked zones. Clean breaks of structure with institutional volume will separate high-probability setups from noise.

The beauty of this setup is the multiple layers - bulls have targets, bears have multiple ambush points. Perfect battlefield for patient snipers.

If this layered battlefield analysis brought clarity to your gold game, smash that 🚀🚀🚀, drop your bias in the comments, and follow for precision execution intel. No fluff, just pure structural warfare.

📎 Disclosure: Part of TradeNation's Influencer Program - charts used for educational analysis only.

🌍 MACRO PULSE & CONTEXT

USD Sentiment: Dollar showing mixed signals as markets await fresh catalysts. No major USD movers today keeping gold in pure structural play mode. Fed remains hawkish but dovish pivot expectations keep safe-haven flows active. Gold sitting in premium territory testing institutional patience.

Key Events: Watch for any surprise USD strength that could accelerate moves through key levels. Current levels showing distribution vs accumulation battle.

📊 HTF OVERVIEW (D1 → H4 → H1)

Daily Bias: BULLISH BUT EXTENDED

Long-term trend remains bullish with higher highs intact

Price in premium territory - caution for longs

Multiple supply layers above current price creating resistance stack

H4 Bias: CONSOLIDATION IN PREMIUM

Price testing upper structural boundaries

Bull case: Hold above 3380 for continuation toward higher supply zones

Bear case: Break below 3360 for deeper correction to demand

H1 Bias: MIXED - CRITICAL DECISION ZONE

Sitting at key structural level at 3396

Breakout zone: 3390-3405 range

Direction of next move will define short-term bias

🎯 STRUCTURAL ZONES (SMC/ICT CONFLUENCE)

PREMIUM SUPPLY ZONES - STACKED RESISTANCE

🔴 3540-3560 | Weekly Nuclear Supply

Ultimate resistance - weekly structural ceiling

Major institutional distribution zone

Final target for any extreme bullish scenario

🔴 3500-3520 | Daily Major Supply

Strong daily supply block with heavy rejection history

Key institutional selling zone

Secondary target for bullish extensions

🔴 3460-3480 | H4 Supply Block

Immediate major resistance above current consolidation

Previous rejection area with bearish OB formation

First major target if bulls break above 3440

🔴 3420-3440 | H4 Near Supply

Current upper boundary resistance

Recent high rejection point

Scalp short opportunity zone

DISCOUNT DEMAND ZONES

🟢 3280-3300 | H4 Nuclear Demand

Major structural support with institutional backing

Previous breakout point turned support

High probability bounce zone if deep correction occurs

🟢 3340-3360 | H1 Key Demand

Critical pullback support level

Clean demand block with previous respect

First major support below current price

CURRENT BATTLEFIELD

⚡ 3390-3405 | Decision Zone

Critical range where price currently consolidates

Breakout either direction will dictate next major leg

Low probability zone for range entries

⚡ CURRENT ACTION PLAN

IMMEDIATE FOCUS: 3396 in critical decision zone - patience required

BULL SCENARIO ROADMAP:

Above 3405 = Target 3420-3440 first supply test

Above 3440 = Target 3460-3480 major supply

Above 3480 = Target 3500-3520 daily supply

Above 3520 = Target 3540+ nuclear supply

BEAR SCENARIO ROADMAP:

Below 3390 = Target 3340-3360 demand test

Below 3340 = Target 3280-3300 nuclear demand

Below 3280 = Major trend shift - deeper correction

ZONE INVALIDATION:

Bull case compromised: Below 3280 major demand with volume

Bear case invalidated: Above 3540 nuclear supply with momentum

BEST R:R ZONES:

3340-3360 long - Perfect H1 demand with multiple targets above

3460-3480 short - Major supply with deep correction potential

3280-3300 long - Nuclear support with massive upside potential

🎯 FINAL BATTLE SUMMARY

Gold at 3396 sits in the eye of the premium storm - multiple supply layers stacked above like a fortress, while solid demand zones wait below. This is institutional chess at its finest.

The Setup: Stacked resistance creates multiple short opportunities on any push higher, while solid demand zones below offer high R:R long setups. The market is loaded and ready for explosive moves.

The Mindset: Premium territory with multiple supply layers demands surgical precision. Don't force trades at current levels - wait for the extremes where smart money reveals their true intentions.

Next Move: Any fundamental catalyst could trigger violent moves through these stacked zones. Clean breaks of structure with institutional volume will separate high-probability setups from noise.

The beauty of this setup is the multiple layers - bulls have targets, bears have multiple ambush points. Perfect battlefield for patient snipers.

If this layered battlefield analysis brought clarity to your gold game, smash that 🚀🚀🚀, drop your bias in the comments, and follow for precision execution intel. No fluff, just pure structural warfare.

📎 Disclosure: Part of TradeNation's Influencer Program - charts used for educational analysis only.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.