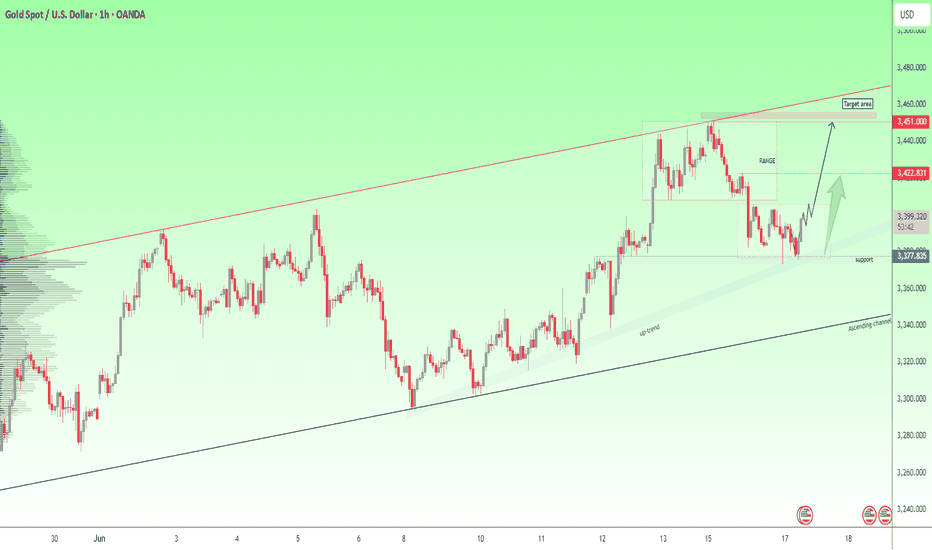

Price has rejected the upper channel resistance (\~3,446–3,422 zone) after multiple failed breakout attempts.

The consolidation zone above 3,400 has now broken down — shifting market structure to a potential short-term bearish bias We’re now seeing a lower high forming hinting at a pullback toward key trendline support

If price drops into the 3,339–3,340 zone and reacts with strength we could see a bounce continuation play.

A clean higher low above the ascending trendline and a reclaim of 3,366/3,377 could open the path back to

Resistance; levels 3,408 – 3,422 3,446

Support: levels 3,366 – 3,340

Trading Insight

This is a classic order block + pullback setup inside a bullish channel. Structure remains bullish as long as the ascending trendline holds. Trade the reaction, not the prediction

Bias Neutral to Bearish short-term → Bullish medium-term StrategySell pullback → Buy dip from structure Outlook Validity Next 1–3 trading sessions

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you!

Best Regards TrendLinford!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.