🧠 Updated Structure & Trend (April 17 – Pre-Weekend Trading)

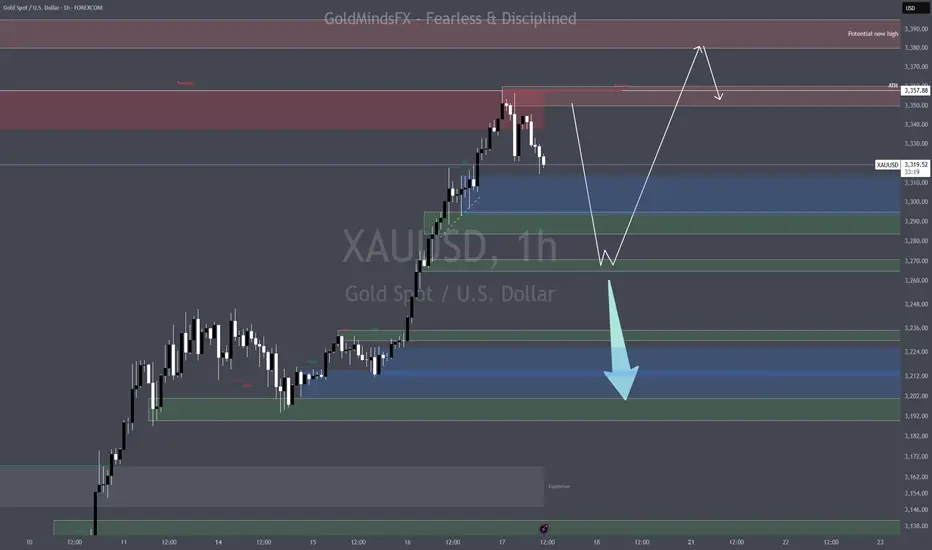

✅ HTF (D1, H4): Price has made a new all-time high at 3357, extending the bullish run — but we're now deep in premium exhaustion territory.

🟠 M30–H1: First signs of distribution and internal CHoCH on M15 are showing. No follow-through above ATH. Price is stalling, likely waiting for NY volume.

⚠️ Volatility is low, and Friday is a market holiday, so any manipulation or rejection will likely happen today.

🔼 New ATH: 3357

This makes previous zones like 3333–3340 less relevant for traps.

Focus shifts to the true inducement zone:

🔻 3355–3365 → Main sniper short zone, valid only with clear M5 structure (BOS or reversal FVG).

🔻 Key Sell Zones (Updated):

3355–3365 → Final inducement / exhaustion zone near new ATH

3342–3345 → OB retest below weak high, valid only if confirmed with bearish PA on M5

🟢 Key Buy Zones (Same):

3284–3288 → OB + FVG + discount zone

3260–3265 → H1 equilibrium and last clean demand

3230–3235 → Deeper reentry zone if we get a flash crash before NY

📊 Trading Logic:

If NY session spikes again into 3355–3365, we're ready to snipe with precision.

If price fails to reclaim 3345 and breaks M5 structure, we target early shorts.

On a clean dump, we look for longs in the 3280–3260 range, with confirmation.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

✅ HTF (D1, H4): Price has made a new all-time high at 3357, extending the bullish run — but we're now deep in premium exhaustion territory.

🟠 M30–H1: First signs of distribution and internal CHoCH on M15 are showing. No follow-through above ATH. Price is stalling, likely waiting for NY volume.

⚠️ Volatility is low, and Friday is a market holiday, so any manipulation or rejection will likely happen today.

🔼 New ATH: 3357

This makes previous zones like 3333–3340 less relevant for traps.

Focus shifts to the true inducement zone:

🔻 3355–3365 → Main sniper short zone, valid only with clear M5 structure (BOS or reversal FVG).

🔻 Key Sell Zones (Updated):

3355–3365 → Final inducement / exhaustion zone near new ATH

3342–3345 → OB retest below weak high, valid only if confirmed with bearish PA on M5

🟢 Key Buy Zones (Same):

3284–3288 → OB + FVG + discount zone

3260–3265 → H1 equilibrium and last clean demand

3230–3235 → Deeper reentry zone if we get a flash crash before NY

📊 Trading Logic:

If NY session spikes again into 3355–3365, we're ready to snipe with precision.

If price fails to reclaim 3345 and breaks M5 structure, we target early shorts.

On a clean dump, we look for longs in the 3280–3260 range, with confirmation.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⭐ VIP ACCESS & Mentorship XAUUSD⭐Telegram t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.