Let’s get one thing straight: if you seriously think you’ve discovered a “secret” setup that you saw in a YouTube video with 1 million views, and it’s right there on the chart – clean, centered, elegant – congrats. You’re already on the hook.

Welcome. You’re liquidity.

🧼 “Clean breakout” = dig your own grave, enthusiastically

It’s honestly beautiful how thousands of traders see the same “clean breakout,” the same “double bottom,” the same “bullish engulfing,” and all believe they’re geniuses. They enter confidently, with a “perfect oversold” RSI, a “confirmed” MACD, and maybe even the moon in Capricorn.

Then, of course, the market spits their orders back in their face at 300 km/h.

Standard response? “It was manipulation.”

No, bro. It was bait. You were the fish. You bit. The market says thank you for your participation and moves on.

🧠 If you see what everyone else sees, it’s useless

What most don’t get is this: if a setup looks “too clean,” it will most probably not work. If you see it, everyone sees it. If everyone thinks something is “about to explode,” that means it’s being used – to attract orders. Your money. Your emotions. Exactly what bigger players need to exit, gracefully – on your dime.

The market is like an exclusive party: if you found out about it, it’s already lame.

💅 That warm feeling of “certainty”? Yeah, you’re screwed

The irony? The moments when a trader feels most certain are exactly the moments when they’re most exposed. The market wants you to feel relaxed. Wants you to think “this is the one.” It’s like a drug dealer giving you your first hit for free, with a smile. Not because he likes you, but because he knows you’re hooked.

So when you feel “sure” – check your mouth. You might already be on the hook.

🤡 “But it was an A+ setup!”

Of course it was. The A+ setup – seen, tested, recycled, and re-sold thousands of times. The one that works great in textbooks, backtests, webinars, and in the wet dreams of those who think they just need “a perfect strategy”.

But the market isn’t here to validate your setup. It’s here to take your money. From whom? From those who still think it’s a “fair game.”

Spoiler: it’s not.

🤔 If you’re gonna bite, at least ask: who’s holding the line?

Look at any “clear opportunity” and ask the magic question:

“Who benefits from what I’m seeing right now?”

If the answer is “me” – you’re in trouble.

If you don’t know – you’re in even more trouble.

The market is full of traps dressed up as opportunities. Hooks that move slowly, with sexy candles, to lure in the kind of trader who only learned the “buy low, sell high” part – but skipped the chapter on “don’t bite every shiny thing you see.”

🎬 Bottom line:

The market doesn’t try to fool you. You’re already doing that yourself.

The market doesn’t need complex tricks. All it needs is people in a hurry, easy to excite, who never ask the right questions. Who see a green candle and think, “This is it.”

Who don’t bother looking for the hook because they’re too busy dreaming about the profits.

If you want to trade seriously, it’s simple:

Don’t ask “Where do I enter?”

Ask: “Where do they want me to enter?”

And if you’re already there… run.

🧭 Alright, now seriously

(I mean, I tried to be funny above – but let’s get real for a second)

Let’s look at a few concrete recent examples from the market:

📉 EUR/USD

On Monday, I mentioned that price was testing resistance and could offer a nice selling opportunity.

But… I changed my mind. (You know... dynamic probabilities)

The pattern was way too clean, too clear, too pretty.

And of course, price broke above.

Because if it looks too obvious – it’s probably already bait.

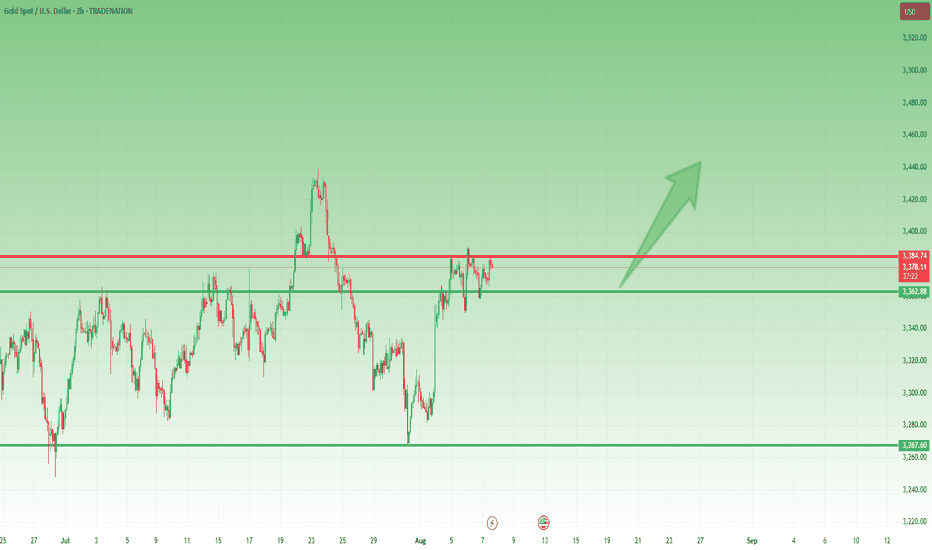

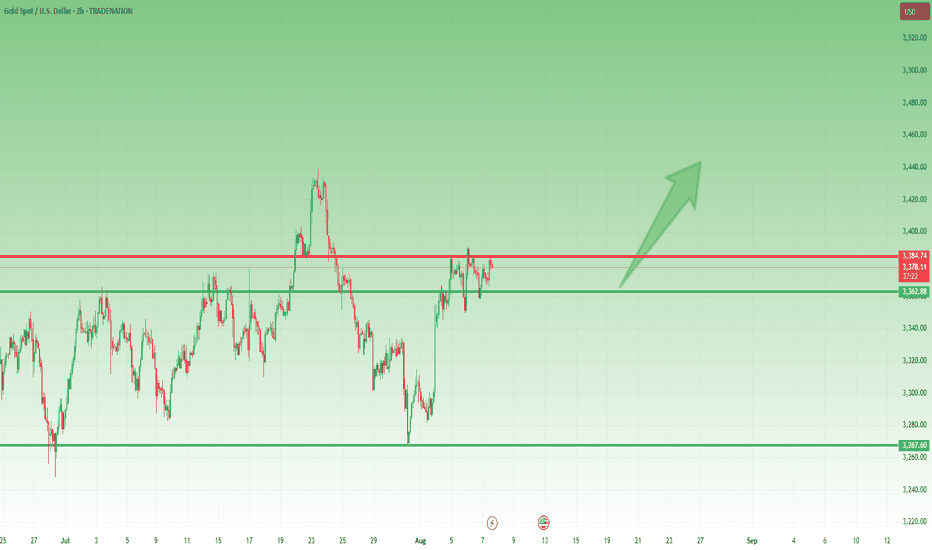

🟡 XAU/USD (Gold)

Since yesterday, I’ve been talking about the potential for an upside breakout.

Why?

Because 3380–3385 resistance zone is way too clean.

Everyone sees it. Everyone talks about it. Everyone sells there.

Which makes me ask: if everyone’s expecting a drop… isn’t that, once again, just bait?

Here is my Gold analysis from today:

BTC/USD

We all see the confluence of support. The perfect alignment. The setup that screams “Buy me.”

But what if it’s too perfect to be true?

What if it’s just another classic trap – the kind that gets everyone excited before the drop comes.

💡 Now don’t get me wrong – this isn’t about abandoning technical analysis.

Far from it. For me, it’s essential.

But we’ve got to use it differently.

✅ Not as a treasure map

❌ But as a battlefield map showing us where the traps are laid

So maybe… don’t bite like a lizard the second something shiny pops up on your chart.

Instead, ask yourself:

“Does this make sense… or does it make too much sense?”

Because in trading, when something looks too clean – that’s exactly when it gets dirty.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Welcome. You’re liquidity.

🧼 “Clean breakout” = dig your own grave, enthusiastically

It’s honestly beautiful how thousands of traders see the same “clean breakout,” the same “double bottom,” the same “bullish engulfing,” and all believe they’re geniuses. They enter confidently, with a “perfect oversold” RSI, a “confirmed” MACD, and maybe even the moon in Capricorn.

Then, of course, the market spits their orders back in their face at 300 km/h.

Standard response? “It was manipulation.”

No, bro. It was bait. You were the fish. You bit. The market says thank you for your participation and moves on.

🧠 If you see what everyone else sees, it’s useless

What most don’t get is this: if a setup looks “too clean,” it will most probably not work. If you see it, everyone sees it. If everyone thinks something is “about to explode,” that means it’s being used – to attract orders. Your money. Your emotions. Exactly what bigger players need to exit, gracefully – on your dime.

The market is like an exclusive party: if you found out about it, it’s already lame.

💅 That warm feeling of “certainty”? Yeah, you’re screwed

The irony? The moments when a trader feels most certain are exactly the moments when they’re most exposed. The market wants you to feel relaxed. Wants you to think “this is the one.” It’s like a drug dealer giving you your first hit for free, with a smile. Not because he likes you, but because he knows you’re hooked.

So when you feel “sure” – check your mouth. You might already be on the hook.

🤡 “But it was an A+ setup!”

Of course it was. The A+ setup – seen, tested, recycled, and re-sold thousands of times. The one that works great in textbooks, backtests, webinars, and in the wet dreams of those who think they just need “a perfect strategy”.

But the market isn’t here to validate your setup. It’s here to take your money. From whom? From those who still think it’s a “fair game.”

Spoiler: it’s not.

🤔 If you’re gonna bite, at least ask: who’s holding the line?

Look at any “clear opportunity” and ask the magic question:

“Who benefits from what I’m seeing right now?”

If the answer is “me” – you’re in trouble.

If you don’t know – you’re in even more trouble.

The market is full of traps dressed up as opportunities. Hooks that move slowly, with sexy candles, to lure in the kind of trader who only learned the “buy low, sell high” part – but skipped the chapter on “don’t bite every shiny thing you see.”

🎬 Bottom line:

The market doesn’t try to fool you. You’re already doing that yourself.

The market doesn’t need complex tricks. All it needs is people in a hurry, easy to excite, who never ask the right questions. Who see a green candle and think, “This is it.”

Who don’t bother looking for the hook because they’re too busy dreaming about the profits.

If you want to trade seriously, it’s simple:

Don’t ask “Where do I enter?”

Ask: “Where do they want me to enter?”

And if you’re already there… run.

🧭 Alright, now seriously

(I mean, I tried to be funny above – but let’s get real for a second)

Let’s look at a few concrete recent examples from the market:

📉 EUR/USD

On Monday, I mentioned that price was testing resistance and could offer a nice selling opportunity.

But… I changed my mind. (You know... dynamic probabilities)

The pattern was way too clean, too clear, too pretty.

And of course, price broke above.

Because if it looks too obvious – it’s probably already bait.

🟡 XAU/USD (Gold)

Since yesterday, I’ve been talking about the potential for an upside breakout.

Why?

Because 3380–3385 resistance zone is way too clean.

Everyone sees it. Everyone talks about it. Everyone sells there.

Which makes me ask: if everyone’s expecting a drop… isn’t that, once again, just bait?

Here is my Gold analysis from today:

BTC/USD

We all see the confluence of support. The perfect alignment. The setup that screams “Buy me.”

But what if it’s too perfect to be true?

What if it’s just another classic trap – the kind that gets everyone excited before the drop comes.

💡 Now don’t get me wrong – this isn’t about abandoning technical analysis.

Far from it. For me, it’s essential.

But we’ve got to use it differently.

✅ Not as a treasure map

❌ But as a battlefield map showing us where the traps are laid

So maybe… don’t bite like a lizard the second something shiny pops up on your chart.

Instead, ask yourself:

“Does this make sense… or does it make too much sense?”

Because in trading, when something looks too clean – that’s exactly when it gets dirty.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

📈 Forex & XAU/USD Channel:

t.me/intradaytradingsignals

💎 Crypto Channel:

t.me/FanCryptocurrency

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 Forex & XAU/USD Channel:

t.me/intradaytradingsignals

💎 Crypto Channel:

t.me/FanCryptocurrency

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.