The market is also struggling to cope with growing political and economic uncertainties.

Federal Reserve officials remain cautious on easing policy; markets await initial jobless claims and nonfarm payrolls data for further policy clues.

The first major data release on Wednesday, the ADP jobs report, dubbed the “mini-nonfarm,” showed the number of private jobs created in the United States was the lowest in two years.

Payroll processor ADP reported on Wednesday that private-sector job creation nearly stalled in May, hitting its lowest level in more than two years amid signs of labor market weakness.

Jobs increased by just 37,000 in the month, down from a revised 60,000 in April and below Dow Jones' forecast of 110,000.

This was the lowest monthly job gain since March 2023, according to ADP statistics. Following the ADP private sector jobs report, US President Trump immediately urged Federal Reserve Chairman Powell to cut interest rates in a furious manner.

Trump posted on Truth Social: "ADP data is out!!! Powell, who is 'too late', must cut interest rates now."

Trump's order to double tariffs on steel and aluminum imports has taken effect, and the White House has confirmed rumors that it has asked trading partners to submit their "best offer" by Wednesday to avoid higher tariffs.

Gold is considered a safe haven from political and economic uncertainty and typically performs well in low-interest-rate environments.

This Friday, the US Bureau of Labor Statistics will release its highly anticipated non-farm payrolls data, with markets expecting 125,000 new jobs and the unemployment rate to remain unchanged at 4.2%.

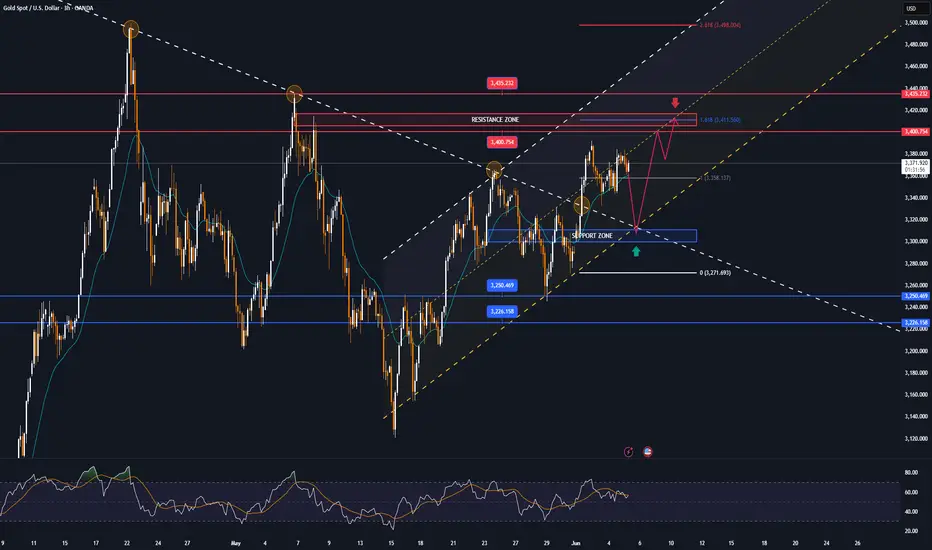

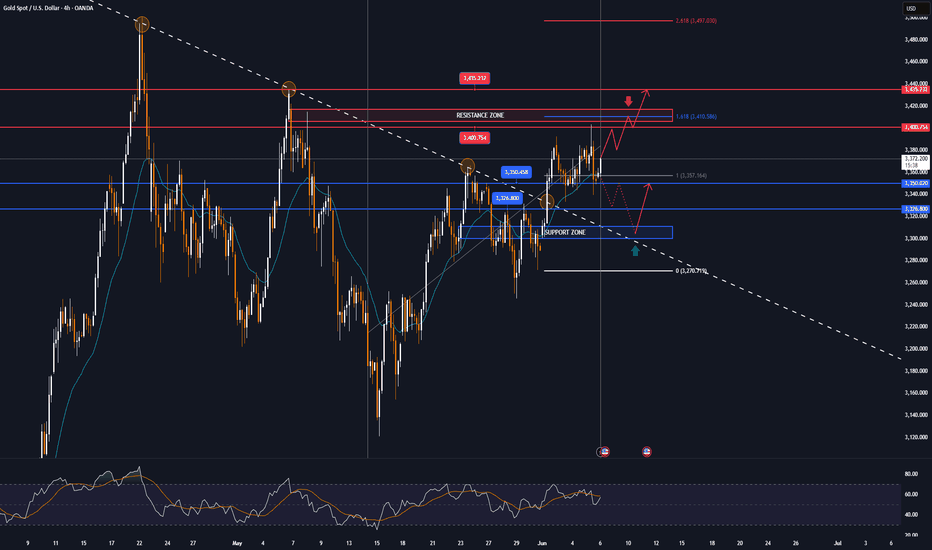

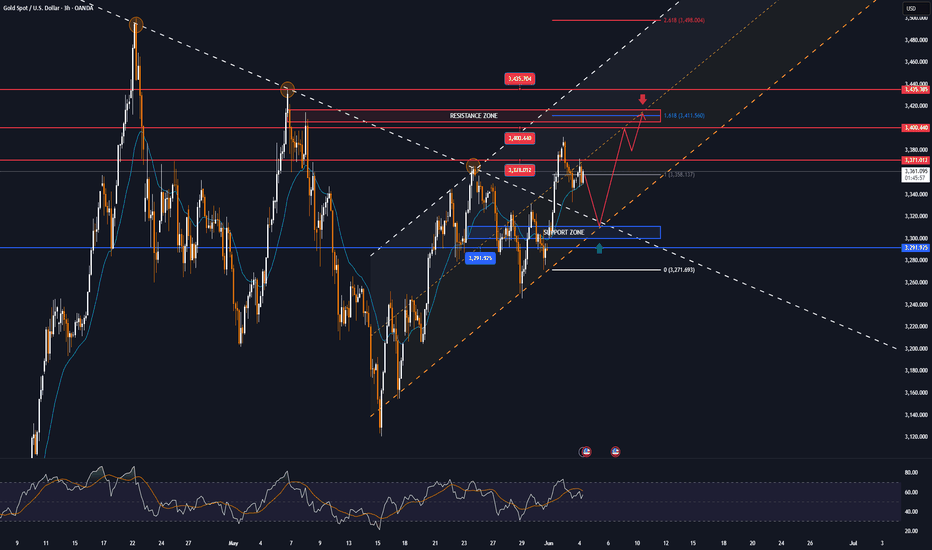

Technical Outlook Analysis

Gold continues to hit the first bullish target of note to readers in the past 2 weeks at $3,371, the price point of the 0.236% Fibonacci retracement.

Currently, gold is also trading around this level, with price action above $3,371 opening the door for a new bullish outlook and the next target around $3,400 in the short term.

In terms of momentum, gold still has a lot of room to rise as the RSI is operating above 50 pointing upwards but still far from overbought territory, which should be considered a bullish signal in the coming trading session.

There are no technical factors that suggest the possibility of a decline becoming a specific trend, the declines as long as gold remains within/above the price channel should only be considered as a short-term correction or a buying opportunity. Meanwhile, the nearest support is the confluence of the EMA21 with the 0.382% Fibonacci retracement and the short-term trend is highlighted by the price channel.

Finally, the bullish outlook for gold prices during the day will be highlighted by the following positions.

Support: 3,350 – 3,326 USD

Resistance: 3,400 – 3,435 USD

SELL XAUUSD PRICE 3412 - 3410⚡️

↠↠ Stop Loss 3416

→Take Profit 1 3404

↨

→Take Profit 2 3398

BUY XAUUSD PRICE 3299 - 3301⚡️

↠↠ Stop Loss 3295

→Take Profit 1 3307

↨

→Take Profit 2 3313

Note

GOLD is reacting negatively to the situation after a positive phone call from TRUMP and XI JINPINGNote

Gold prices fell slightly on June 6 after hitting $3,403 an ounce as signs of cooling from the phone call between Trump and Xi Jinping reduced demand for safe havens.Note

🔴Spot gold prices fell below $3,300/ounce, down 0.35% on the day.Note

▫️Spot gold price reached 3330 USD/ounce, up 0.22% on the day.Note

On June 12, spot gold prices in Asia rose to a weekly high of $3,373.25 an ounce. The increase was supported by lower-than-expected US CPI data in May.Note

Next week is shaping up to be a rollercoaster for markets, with interest rate announcements from central banks, monetary policy updates, and a slew of central bank governors speaking throughout the week.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.