📊 Market Drivers:

• Gold spiked to $3,350/oz early in the day but later dropped to $3,310/oz as profit-taking kicked in and U.S. yields recovered slightly.

• Market is in a wait-and-see mode ahead of PCE inflation data on Friday, limiting upside momentum late in the session.

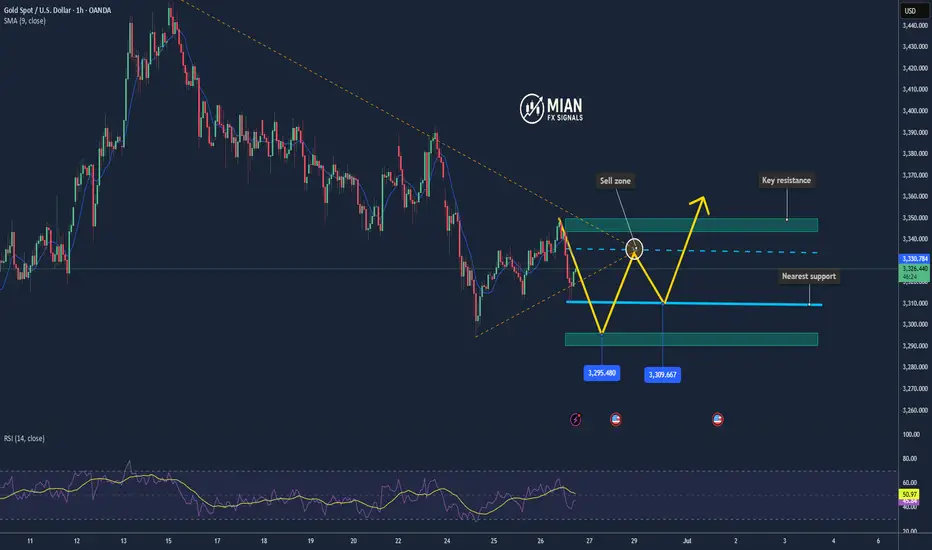

📉 Technical Analysis:

• Key resistance: $3,345–3,350 (daily high)

• Nearest support: $3,310 – session low; then $3,290

• EMA09: Price trading above EMA09, but below EMA21, signaling a neutral bias

• Candle/momentum: Formed shooting star reversal near $3,348 on H1 with declining volume → short-term weakness ahead

📌 Outlook:

Gold may pull back toward $3,300–3,290 short-term if USD rebounds and selling persists. But medium-term bullish bias remains if inflation data disappoints and USD continues weakening.

💡 Trade Ideas:

🔻 SELL XAU/USD at: 3,335–3,345

🎯 TP: 3,315

❌ SL: 3,352

🔺 BUY XAU/USD at: 3,295–3,305

🎯 TP: 3,315

❌ SL: 3,285

• Gold spiked to $3,350/oz early in the day but later dropped to $3,310/oz as profit-taking kicked in and U.S. yields recovered slightly.

• Market is in a wait-and-see mode ahead of PCE inflation data on Friday, limiting upside momentum late in the session.

📉 Technical Analysis:

• Key resistance: $3,345–3,350 (daily high)

• Nearest support: $3,310 – session low; then $3,290

• EMA09: Price trading above EMA09, but below EMA21, signaling a neutral bias

• Candle/momentum: Formed shooting star reversal near $3,348 on H1 with declining volume → short-term weakness ahead

📌 Outlook:

Gold may pull back toward $3,300–3,290 short-term if USD rebounds and selling persists. But medium-term bullish bias remains if inflation data disappoints and USD continues weakening.

💡 Trade Ideas:

🔻 SELL XAU/USD at: 3,335–3,345

🎯 TP: 3,315

❌ SL: 3,352

🔺 BUY XAU/USD at: 3,295–3,305

🎯 TP: 3,315

❌ SL: 3,285

Trade active

Gold may retest the 3300 zone once more before moving higher.📊 Forex | Gold | Crypto Market Insights & Signals

📰 Real-time news updates & expert analysis

📈 Daily Buy/Sell signals for investors

💡 Technical breakdowns & market outlooks

🔗 Join our free group: t.me/+DmS-dVFJMm40MDM9

📰 Real-time news updates & expert analysis

📈 Daily Buy/Sell signals for investors

💡 Technical breakdowns & market outlooks

🔗 Join our free group: t.me/+DmS-dVFJMm40MDM9

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📊 Forex | Gold | Crypto Market Insights & Signals

📰 Real-time news updates & expert analysis

📈 Daily Buy/Sell signals for investors

💡 Technical breakdowns & market outlooks

🔗 Join our free group: t.me/+DmS-dVFJMm40MDM9

📰 Real-time news updates & expert analysis

📈 Daily Buy/Sell signals for investors

💡 Technical breakdowns & market outlooks

🔗 Join our free group: t.me/+DmS-dVFJMm40MDM9

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.