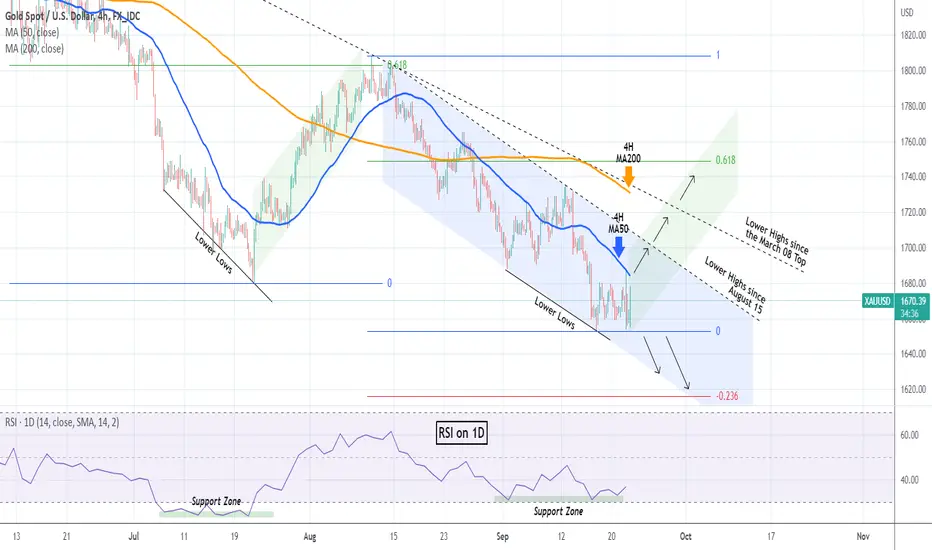

Gold (XAUUSD) despite the enormous volatility after the Fed Rate Decision yesterday (0.75% Rate Hike), held the 1653 Support. At the same time though it held and got rejected on the 4H MA50 (blue trend-line), which is the short-term Resistance.

Technically, the medium-term trend (as well as the long one) has been bearish within a Channel Down since the August 10 High. As long as its top is not breached, the short-term target is the bottom (Lower Lows trend-line), limited on the -0.236 Fibonacci extension (1616).

The recent Lower Lows though have been formed while the RSI on the 1D time-frame has been holding its Support Zone. The last time we saw that pattern was during the July 06 - July 21 Lower Lows. The RSI then bounced on its Support Zone and Gold rallied to its 0.618 Fibonacci level that was eventually the August 10 High.

As a result, we are willing to buy the break above the current Channel Down and target first the 4H MA200 (orange trend-line) and the 0.618 Fib (1749) in extension.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

Technically, the medium-term trend (as well as the long one) has been bearish within a Channel Down since the August 10 High. As long as its top is not breached, the short-term target is the bottom (Lower Lows trend-line), limited on the -0.236 Fibonacci extension (1616).

The recent Lower Lows though have been formed while the RSI on the 1D time-frame has been holding its Support Zone. The last time we saw that pattern was during the July 06 - July 21 Lower Lows. The RSI then bounced on its Support Zone and Gold rallied to its 0.618 Fibonacci level that was eventually the August 10 High.

As a result, we are willing to buy the break above the current Channel Down and target first the 4H MA200 (orange trend-line) and the 0.618 Fib (1749) in extension.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.