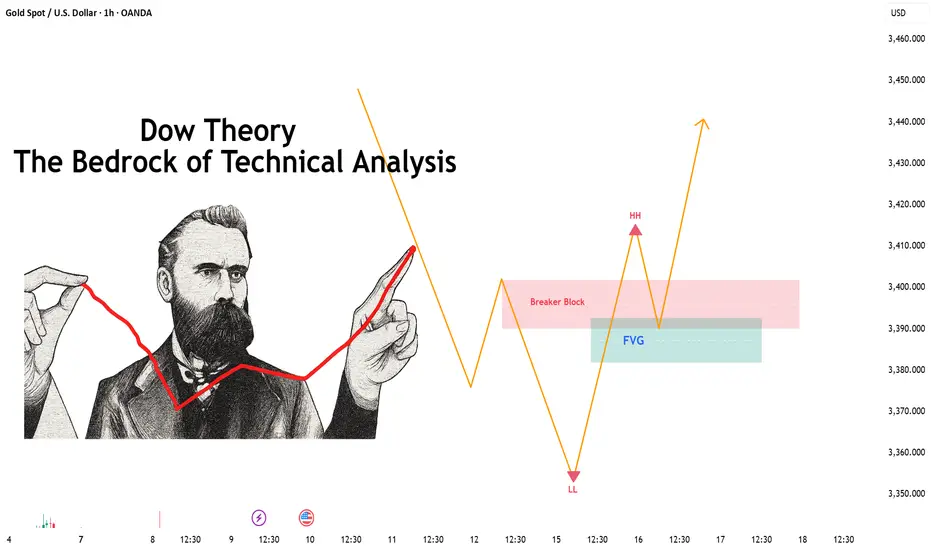

Dow Theory – Where Every Market Story Begins

Before Japanese candlesticks, before RSI or MACD — Dow Theory laid the very foundation of technical analysis. It’s not just a dry academic concept — it’s a mental map for understanding how the market truly behaves.

According to Charles Dow, markets always move in trends — and those trends unfold in natural psychological cycles: quiet accumulation, rapid momentum as the crowd joins in, and finally distribution, where smart money exits.

Sounds familiar? That’s because it still holds true to this day.

Why do I believe it’s the best?

Because it’s not an indicator.

It’s not reliant on flashy tools or complex algorithms.

Dow Theory is a mindset — a framework that teaches you how to read price charts like a seasoned analyst reads behaviour.

Over my 15 years in this industry, I’ve tested countless systems. Some worked temporarily. Most didn’t. But the one concept that’s never failed me — especially during market crashes and wild volatility — is the elegance and clarity of Dow Theory.

Once you understand how price moves with purpose, you’ll no longer:

Panic when the market swings

Enter impulsively out of fear

Or chase setups without structure

Instead, you’ll trade with calm, with logic — and with confidence.

The core concepts you must master:

First, the market moves in trends.

There are 3 types:

Primary trend – the dominant direction, lasting months or years

Secondary trend – corrections within the primary move

Minor trend – short-term noise

Second, every primary trend has 3 clear phases:

Accumulation – smart money enters quietly, while the public is still fearful

Public Participation – price breaks out, news gets good, and the crowd jumps in

Distribution – price is high, everyone’s optimistic, but the big players are already selling

Third, volume must confirm price.

A true trend is backed by commitment — and volume is the proof.

Lastly, a trend remains valid until there’s clear structural reversal.

We don’t guess tops or bottoms. We wait for break of structure — then act.

How do I apply this in the real market?

Simple. I start by asking:

What phase are we in?

Are institutions accumulating?

Is this breakout backed by volume?

Has the previous high been broken with momentum?

If yes — I wait for a pullback.

Then I look for a Pin Bar, Engulfing, or Fakey backed by volume.

Then I strike.

Not emotionally. Strategically.

That’s Dow Theory in motion:

Structure before signals

Patience before action

Precision before profit

When is Dow Theory most effective?

When the market has a clear trend

When you trade on H1 and above

When you use price action but need a solid framework

When you want to trade based on behaviour and structure, not just indicators

It works best when you’re not chasing noise — but following narrative.

Final thoughts I want to share with you:

Markets will change.

Tools will evolve.

But the one thing that remains constant is human emotion.

Dow Theory is your compass in that emotional jungle.

It won’t make you rich overnight.

It won’t flash signals every five minutes.

But it will keep you aligned with the market’s true rhythm.

“Great traders don’t just follow price — they understand what’s behind it. Dow Theory teaches you that.”

Would you like me to turn this into a voice-over script, YouTube video outline, or training slides for your class or content platform? Just say the word!

Before Japanese candlesticks, before RSI or MACD — Dow Theory laid the very foundation of technical analysis. It’s not just a dry academic concept — it’s a mental map for understanding how the market truly behaves.

According to Charles Dow, markets always move in trends — and those trends unfold in natural psychological cycles: quiet accumulation, rapid momentum as the crowd joins in, and finally distribution, where smart money exits.

Sounds familiar? That’s because it still holds true to this day.

Why do I believe it’s the best?

Because it’s not an indicator.

It’s not reliant on flashy tools or complex algorithms.

Dow Theory is a mindset — a framework that teaches you how to read price charts like a seasoned analyst reads behaviour.

Over my 15 years in this industry, I’ve tested countless systems. Some worked temporarily. Most didn’t. But the one concept that’s never failed me — especially during market crashes and wild volatility — is the elegance and clarity of Dow Theory.

Once you understand how price moves with purpose, you’ll no longer:

Panic when the market swings

Enter impulsively out of fear

Or chase setups without structure

Instead, you’ll trade with calm, with logic — and with confidence.

The core concepts you must master:

First, the market moves in trends.

There are 3 types:

Primary trend – the dominant direction, lasting months or years

Secondary trend – corrections within the primary move

Minor trend – short-term noise

Second, every primary trend has 3 clear phases:

Accumulation – smart money enters quietly, while the public is still fearful

Public Participation – price breaks out, news gets good, and the crowd jumps in

Distribution – price is high, everyone’s optimistic, but the big players are already selling

Third, volume must confirm price.

A true trend is backed by commitment — and volume is the proof.

Lastly, a trend remains valid until there’s clear structural reversal.

We don’t guess tops or bottoms. We wait for break of structure — then act.

How do I apply this in the real market?

Simple. I start by asking:

What phase are we in?

Are institutions accumulating?

Is this breakout backed by volume?

Has the previous high been broken with momentum?

If yes — I wait for a pullback.

Then I look for a Pin Bar, Engulfing, or Fakey backed by volume.

Then I strike.

Not emotionally. Strategically.

That’s Dow Theory in motion:

Structure before signals

Patience before action

Precision before profit

When is Dow Theory most effective?

When the market has a clear trend

When you trade on H1 and above

When you use price action but need a solid framework

When you want to trade based on behaviour and structure, not just indicators

It works best when you’re not chasing noise — but following narrative.

Final thoughts I want to share with you:

Markets will change.

Tools will evolve.

But the one thing that remains constant is human emotion.

Dow Theory is your compass in that emotional jungle.

It won’t make you rich overnight.

It won’t flash signals every five minutes.

But it will keep you aligned with the market’s true rhythm.

“Great traders don’t just follow price — they understand what’s behind it. Dow Theory teaches you that.”

Would you like me to turn this into a voice-over script, YouTube video outline, or training slides for your class or content platform? Just say the word!

✅ Get 7–10 high-quality trading signals daily (Forex, Gold, Bitcoin)

✅ Real-time updates – precise and timely alerts

✅ Perfect for both beginners and seasoned traders

👉 Click the link to join now: t.me/+xo3AwHaKIcZhZDg9

✅ Real-time updates – precise and timely alerts

✅ Perfect for both beginners and seasoned traders

👉 Click the link to join now: t.me/+xo3AwHaKIcZhZDg9

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅ Get 7–10 high-quality trading signals daily (Forex, Gold, Bitcoin)

✅ Real-time updates – precise and timely alerts

✅ Perfect for both beginners and seasoned traders

👉 Click the link to join now: t.me/+xo3AwHaKIcZhZDg9

✅ Real-time updates – precise and timely alerts

✅ Perfect for both beginners and seasoned traders

👉 Click the link to join now: t.me/+xo3AwHaKIcZhZDg9

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.