At the moment, gold is testing $3,400, but is ready for a correction pending new data from the US. However, further decline may be limited for the following reasons: Weak dollar: The probability of a Fed rate cut in September is estimated at 90%. Trump-Fed conflict: Pressure on Fed Chair Lisa Cook undermines confidence in the dollar. Trade wars: New US tariffs (on India) and retaliatory measures (Mexico, Canada against China) increase demand for "safe havens"

What is important: Political uncertainty and soft rhetoric of the Fed continue to play in favor of gold. Any attempts to reduce will be supported by buyers. It is also worth paying attention to the GDP and Initial Jobless Claims, which will be published today at 12:30 GMT.

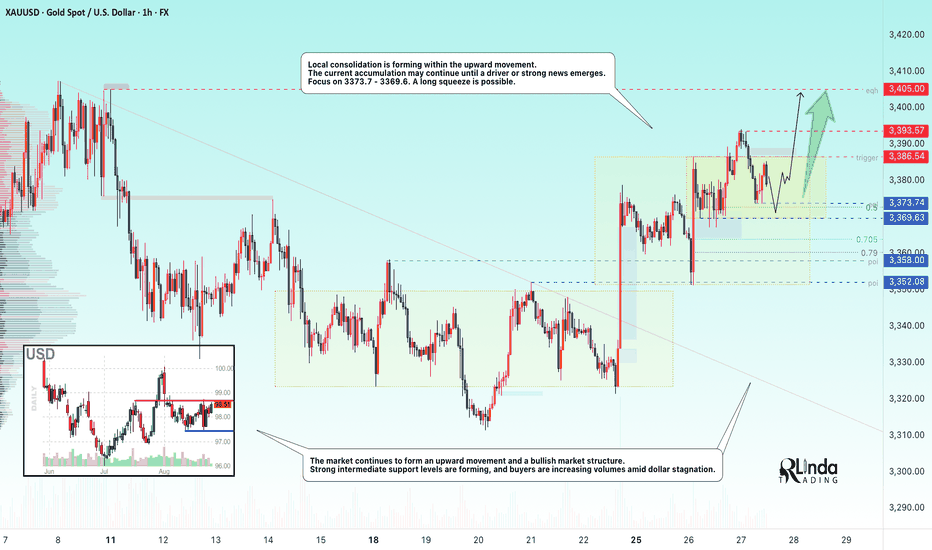

Resistance levels: 3405, 3420, 3433

Support levels: 3386, 3373, 3369

Technically, the situation is ambiguous and everything depends on the reaction to 3405 and further news. Weakening of the fundamental background may lead to consolidation or correction to 3373 - 3369. However, if traders feel support, then the retest of 3405 may end with a small consolidation around the level and subsequent breakout and growth to the specified targets (I am more inclined to this scenario based on the above situation)

Best regards, R. Linda!

🌹TRADING is a CASINO💔!?

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🌹TRADING is a CASINO💔!?

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.