📰 MARKET OVERVIEW & MACRO CONTEXT

Gold begins the new week with a sharp correction after filling a major Fair Value Gap (FVG) formed two weeks ago. The early drop reflects investor caution as several key macroeconomic events loom this week:

US CPI & PPI

Unemployment Claims

Retail Sales Data

Volatility is expected to stay high from the beginning to midweek, before the market forms a clearer direction based on incoming data.

🔍 TECHNICAL ANALYSIS – FOCUS ON LIQUIDITY & SMART MONEY CONCEPTS (SMC)

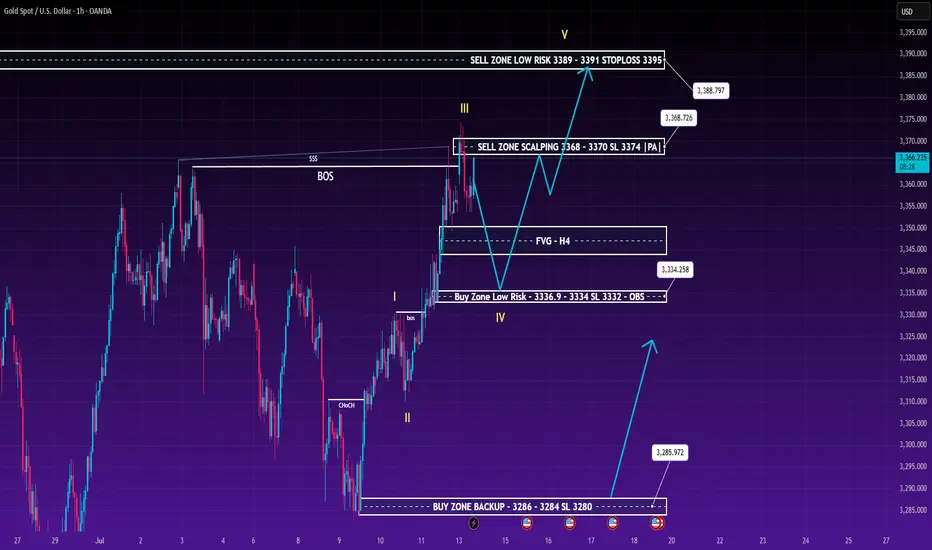

🧠 Core Logic:

Gold has swept liquidity at the recent short-term high around 3368–3370.

Price is now pulling back to hunt deeper liquidity below, particularly near:

H4 FVG zone: 3340–3334

Primary Buy Zone: 3336.9 – 3334 (aligned with intraday VPOC)

🔎 SMC Setup:

A clear Break of Structure (BOS) on H1 confirms a bullish continuation.

Price is currently retesting a confluence zone of Order Block and FVG — typical Smart Money behaviour.

If price sweeps below 3334, a sharp move to the upside is expected, targeting:

3388 – 3391 (distribution / sell zone)

🌊 Elliott Wave:

Wave III likely completed around 3388.

Market is now in corrective Wave IV.

If the structure holds, Wave V could launch with significant bullish momentum.

📌 TRADE SCENARIOS

✅ PRIMARY BUY SETUP (PREFERRED)

Entry: 3336.9 – 3334

Stop Loss: 3332

Targets:

TP1: 3368 (M15 Supply Zone)

TP2: 3388 (Previous Swing High)

TP3: 3391 (Major Distribution Zone)

🔁 BACKUP BUY SETUP

Entry: 3286 – 3284 (if deeper flush occurs)

Stop Loss: 3280

Targets: 3291 – 3299 – 3310 – Open

❌ SHORT-TERM SELL SCALP (Advanced Only)

Entry: 3368 – 3370

Stop Loss: 3374

Targets: 3363 – 3355 – 3341 – Open

🧭 OUTLOOK

Current price action suggests gold is not ready to rally just yet. Deeper liquidity must be tapped, especially around the FVG and lower OB zone, before a sustained move upward.

Priority remains on buying from liquidity zones aligned with Smart Money logic.

Scalp sells are optional but carry higher risk — trend bias remains bullish.

Gold begins the new week with a sharp correction after filling a major Fair Value Gap (FVG) formed two weeks ago. The early drop reflects investor caution as several key macroeconomic events loom this week:

US CPI & PPI

Unemployment Claims

Retail Sales Data

Volatility is expected to stay high from the beginning to midweek, before the market forms a clearer direction based on incoming data.

🔍 TECHNICAL ANALYSIS – FOCUS ON LIQUIDITY & SMART MONEY CONCEPTS (SMC)

🧠 Core Logic:

Gold has swept liquidity at the recent short-term high around 3368–3370.

Price is now pulling back to hunt deeper liquidity below, particularly near:

H4 FVG zone: 3340–3334

Primary Buy Zone: 3336.9 – 3334 (aligned with intraday VPOC)

🔎 SMC Setup:

A clear Break of Structure (BOS) on H1 confirms a bullish continuation.

Price is currently retesting a confluence zone of Order Block and FVG — typical Smart Money behaviour.

If price sweeps below 3334, a sharp move to the upside is expected, targeting:

3388 – 3391 (distribution / sell zone)

🌊 Elliott Wave:

Wave III likely completed around 3388.

Market is now in corrective Wave IV.

If the structure holds, Wave V could launch with significant bullish momentum.

📌 TRADE SCENARIOS

✅ PRIMARY BUY SETUP (PREFERRED)

Entry: 3336.9 – 3334

Stop Loss: 3332

Targets:

TP1: 3368 (M15 Supply Zone)

TP2: 3388 (Previous Swing High)

TP3: 3391 (Major Distribution Zone)

🔁 BACKUP BUY SETUP

Entry: 3286 – 3284 (if deeper flush occurs)

Stop Loss: 3280

Targets: 3291 – 3299 – 3310 – Open

❌ SHORT-TERM SELL SCALP (Advanced Only)

Entry: 3368 – 3370

Stop Loss: 3374

Targets: 3363 – 3355 – 3341 – Open

🧭 OUTLOOK

Current price action suggests gold is not ready to rally just yet. Deeper liquidity must be tapped, especially around the FVG and lower OB zone, before a sustained move upward.

Priority remains on buying from liquidity zones aligned with Smart Money logic.

Scalp sells are optional but carry higher risk — trend bias remains bullish.

🔱 Trade with Smart Money – ICT Concepts & Price Action

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔱 Trade with Smart Money – ICT Concepts & Price Action

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.