Core influencing factors

Risk aversion cools down: Despite frequent geopolitical risk events, market panic has not significantly increased, weakening gold safe-haven buying.

US dollar strengthens: US economic data supports the continuous rise of the US dollar, and funds flow back to US dollar assets, suppressing the attractiveness of gold.

ETF holdings outflow: Short-term risk appetite has rebounded, and gold ETFs have seen a slight outflow of funds, reflecting the cautious attitude of the market.

Key events focus:

US-EU and US-China trade negotiations: If progress is optimistic, gold prices may fall to the $3,300/ounce mark.

Federal Reserve resolution: Pay attention to policy independence (affected by Trump's pressure) and interest rate guidance.

Non-farm data: Released on Friday, if the employment data is strong, it may strengthen the US dollar to further suppress gold.

Key technical points

Weekly level:

Watershed $3,325: If it is held, it will maintain high-level fluctuations, and if it is lost, it will open up downward space.

Support area: If the daily support is broken, the weekly support may be tested (reference 3300-3310).

Daily level:

Key support: The current daily support is facing the risk of breaking down, and we need to be alert to the acceleration of short positions.

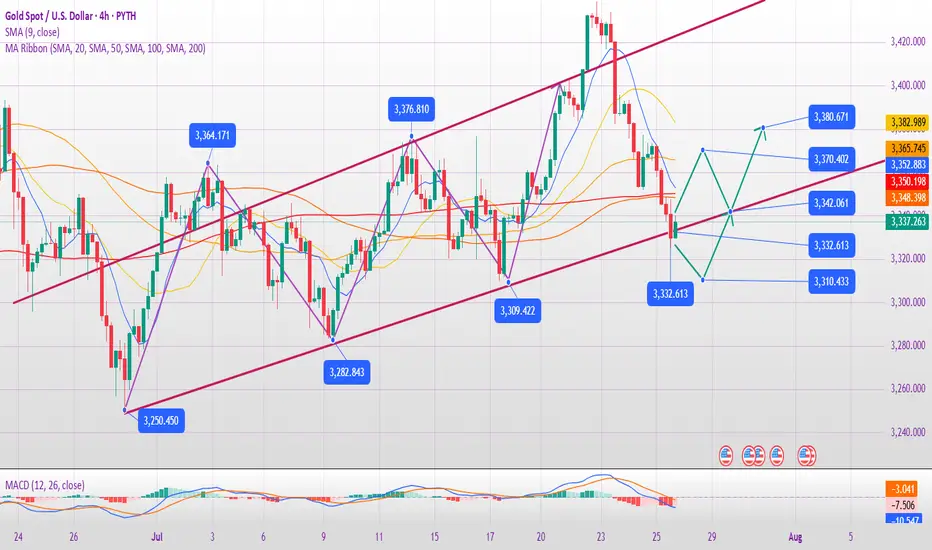

4-hour level:

Resistance 3388 US dollars (middle track): Before the rebound is not broken, the short-term is short.

Weak signal: The price continues to run below 3363, and the rebound is weak.

Hourly chart:

Strong and weak boundary 3363 US dollars: Maintain weakness before breaking, and avoid bottom-fishing against the trend in the negative market.

Operation strategy suggestions

Short-term direction: Short-selling on rebound is the main, supplemented by light-weight buying at key support levels.

Short-term selling opportunities:

Ideal entry: 3370-3375 area (below the 4-hour middle track), stop loss above 3380.

Target: 3320-3310, if it breaks down, look at 3300.

Opportunities to buy long orders in the short term:

Participate cautiously: If the support of 3320-3310 stabilizes, combine the K-line signal to hold a light long position, and stop loss below 3300.

Quick in and out: You can exit the market when it rebounds to 3340-3350.

Risk warning:

Before the Fed’s decision: Avoid heavy positions, and be wary of unexpected hawkish policies that cause volatility.

Non-agricultural data: If the data exceeds expectations, it will be bearish for gold.

Summary: Gold is short-term technically bearish, but be wary of event-driven reversals. Trading requires strict stop losses and flexible response to data and policy risks.

Trade active

Optimization of trading strategies and key risk tips at the beginning of the gold week:

1. Current core driving factors of the market

Federal Reserve FOMC meeting (key focus): The market generally expects interest rates to remain unchanged, but it is necessary to pay attention to whether the dot plot and Powell's speech release interest rate cut signals. If it is dovish, gold may rise in the short term (3400+); if it is neutral/hawkish, it may fall back below 3300.

Economic data (GDP, PCE, non-agricultural): If the data is weaker than expected (such as GDP growth slowing down, PCE inflation cooling down), it will strengthen the expectation of interest rate cuts and benefit gold; conversely, strong data may suppress gold prices.

Risk aversion cools down: The easing of the US-EU/US-Japan trade situation weakens the safe-haven demand for gold and limits the upside space.

2. Key technical points

Short-term long-short watershed: US$3350

Under pressure at 3350: Continue to fluctuate downward, target 3330→3310.

Breaking through 3350: The rebound continues, looking up to 3370-3375, strong resistance 3396-3405.

Medium and long-term trend:

The monthly line has a long upper shadow (April-June). If the upper shadow is closed again in July, the top structure is confirmed, and the market may drop to 3245→3120→3000-2950 area.

Key support: 3300 (psychological barrier), 3245 (June low); key resistance: 3400 (historical high), 3500 (psychological barrier).

3. Refined operation strategy

(1) Long strategy (buy low)

Entry area: 3330-3335 (short-term support).

Stop loss setting: stop loss 3325.

Target: 3350 (first pressure) → 3365 (second pressure). If it breaks through 3370, it can partially reduce the position.

(2) Short strategy (sell high)

Entry area: 3360-3365 (initial resistance) or 3396-3405 (strong resistance).

Stop loss setting: above 3375 (if entering at 3360-3365), or 3410 (if entering at 3400 area).

Target: 3350→3330→3310. If it breaks below 3300, hold and look at 3245.

Trade closed: target reached

Will gold continue to fall on July 29:

Comprehensive analysis of the gold market and trading strategy recommendations

News analysis

Short-term support factors

Weakened US dollar: The market is in a wait-and-see mood before the Fed's interest rate meeting, and the US dollar bulls are temporarily suspended, providing support for interest-free assets such as gold.

Safe-haven demand: Policy uncertainty (such as the Fed's interest rate decision) may trigger a short-term return of funds to gold.

Repressive factors

Trade situation easing: The US-EU tariff agreement, US-Japan and US-China trade progress boost risk appetite and weaken the safe-haven appeal of gold.

Bull-bear game: Gold is currently at a balance between "macro game" and "technical adjustment", and needs to wait for the FOMC statement and economic data (GDP, PCE) to guide the direction.

Technical analysis

Long-term trend (monthly/weekly)

Top signal appears: 3 consecutive months of long upper shadows (April-June). If the long upper shadow is closed again in July, it may confirm that the bears are dominant, and the market may drop to the 3000-2950 area in the future.

Key resistance: 3400-3500 area is a historically strong pressure. Even if the Fed cuts interest rates to stimulate the rise, it may form a "lure to buy" and then reverse.

Short-term key position (daily/4 hours)

Bull-short watershed: 3350 is the short-term strong and weak boundary. If it breaks through, it will look up to 3370-3405; if it is under pressure, it will look down to 3330-3290.

Oscillation characteristics: The recent long-short continuity is poor (such as last week's sharp rise and then a sharp drop), so be wary of repeated washes.

Today's operation strategy

Short-order opportunity

Entry area: 3330-3340 (aggressive investors can arrange in batches), stop loss above 3350.

Target position: 3290-3280, look at 3245 after breaking down.

Long-order opportunity

Pullback support: 3290-3280 light position to try long, stop loss below 3270, target 3310-3320 (short-term rebound).

Breakthrough follow-up

Break above 3350: Wait and see if it is a false breakthrough. If it stabilizes, you can buy short-term to 3370-3405 (need to cooperate with the Fed's dovish signal).

Break below 3280: Be cautious when chasing shorts, avoid low-level sweeps, and pay attention to the support of 3245.

Risk warning

Federal Reserve decision: If the interest rate is cut but the "hawkish expectations" are released (such as the subsequent suspension of interest rate cuts), gold may rise and fall.

Data impact: If GDP/PCE is stronger than expected, it may strengthen the US dollar and suppress gold prices.

Summary: At present, gold is in a volatile bearish pattern. It is recommended to sell short at the rebound high as the main trading idea, and strictly stop loss. Conservatives can wait for the trend to become clear after the Fed's decision before making a layout.

❤️Free gold trading signals:t.me/+OJSbWQ6F4KM2Mzk1

💥Gold trading analyst | Technology + logic dual drive

💯Intraday/band strategy analysis | Risk control first, win in stability

💥Gold trading analyst | Technology + logic dual drive

💯Intraday/band strategy analysis | Risk control first, win in stability

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

❤️Free gold trading signals:t.me/+OJSbWQ6F4KM2Mzk1

💥Gold trading analyst | Technology + logic dual drive

💯Intraday/band strategy analysis | Risk control first, win in stability

💥Gold trading analyst | Technology + logic dual drive

💯Intraday/band strategy analysis | Risk control first, win in stability

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.