GOLD IN THE CROSSHAIRS WITH PIPGUARD

Hello there, my colleagues, welcome back!

👉 From today on, I will always use this layout. If you like it, let me know by leaving a boost and a comment with your opinion!

ANALYSIS

Hello everyone, my colleagues, how are you? I hope all is well. I hope it was a great summer for all of you, that you enjoyed your days off and holidays, and that you spent time with family and friends ❤️.

Let's pick up where we left off and see what the markets are telling us. I'll start again with gold: a peculiar summer, made of stalls, endless sideways movements, and a lot of uncertainty basically like a tired marriage.

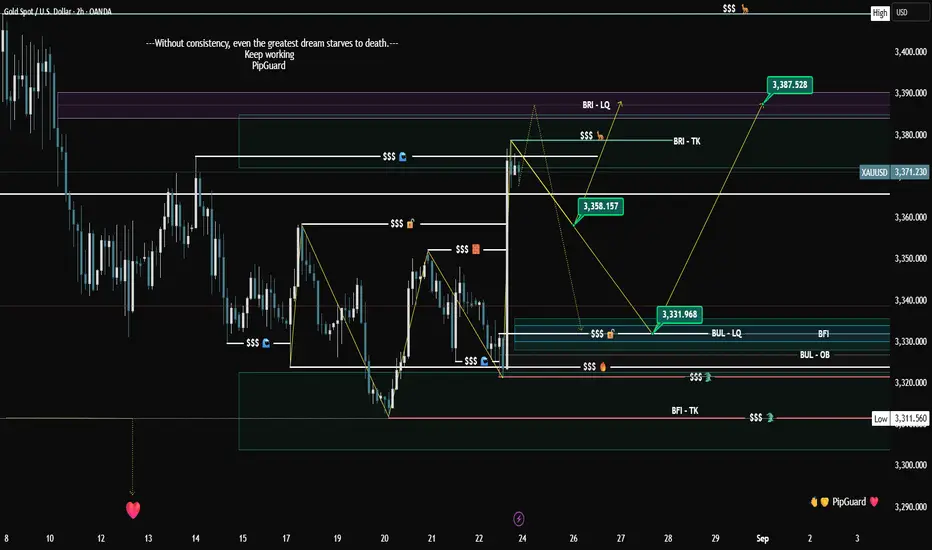

After Friday's weekly close, the price decided to shoot up over 400 pips and close beautifully above $3,370.

So what happens on Monday? Two options:

The key level is 3,365: now support, but if it breaks, it becomes resistance, worse than your boss coming back from vacation pissed off. Second support at 3,325/20.

I'm waiting for a nice retracement to re-enter long at a decent price. But one thing is for sure: the bullish target is 3,385.

NEWS

SECRETS

Here come the real gems, the ones that stink of shady deals and under-the-table agreements:

GREETINGS

Remember to leave a GREETING 🚀 or a COMMENT

Talk to you soon,

PipGuard

Article published by PipGuard™ on the TradingView® platform

Hello there, my colleagues, welcome back!

👉 From today on, I will always use this layout. If you like it, let me know by leaving a boost and a comment with your opinion!

ANALYSIS

Hello everyone, my colleagues, how are you? I hope all is well. I hope it was a great summer for all of you, that you enjoyed your days off and holidays, and that you spent time with family and friends ❤️.

Let's pick up where we left off and see what the markets are telling us. I'll start again with gold: a peculiar summer, made of stalls, endless sideways movements, and a lot of uncertainty basically like a tired marriage.

After Friday's weekly close, the price decided to shoot up over 400 pips and close beautifully above $3,370.

So what happens on Monday? Two options:

A sideways phase, the usual liquidity war where the little guys always get screwed.

A clean retracement, with two interesting points: 3,360 (the closest) and 3,330 (the nastier one, and I admit... the one I like the most).

The key level is 3,365: now support, but if it breaks, it becomes resistance, worse than your boss coming back from vacation pissed off. Second support at 3,325/20.

I'm waiting for a nice retracement to re-enter long at a decent price. But one thing is for sure: the bullish target is 3,385.

NEWS

✅ Powell continues to work his magic: the Fed kept selling smoke and mirrors about rate cuts and inflation. The result? The dollar remains strong, and gold is just watching.

✅ Central banks are gobbling up gold like there's no tomorrow: they are on track to buy over 1,000 tons in 2025. Four years in a row like this, not even a junkie on methadone.- ✅ 95% of reserve managers plan to increase their gold holdings: practically everyone. When even the white-collars decide they want more gold, you know the carousel is about to start.

SECRETS

Here come the real gems, the ones that stink of shady deals and under-the-table agreements:

🔓 The "Mar-a-Lago Accord": according to a Fed analysis, there's an $863 billion gap between the book and real value of US gold. And the Treasury is thinking of using it to set up a BTC fund with a million coins, just for kicks.

🔓 95% of reserve managers no longer trust the dollar: everyone is buying gold. Anyone who isn't is an idiot.

GREETINGS

Remember to leave a GREETING 🚀 or a COMMENT

Talk to you soon,

PipGuard

Article published by PipGuard™ on the TradingView® platform

Remember, my friend, that in the end, the important thing is risk management.

PipGuard™ t.me/PipGuard

PipGuard™ t.me/PipGuard

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Remember, my friend, that in the end, the important thing is risk management.

PipGuard™ t.me/PipGuard

PipGuard™ t.me/PipGuard

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.