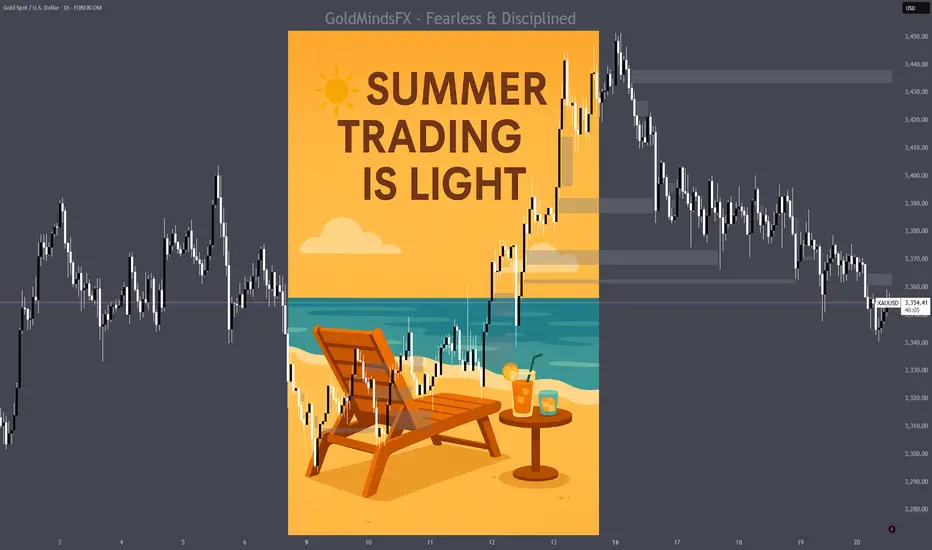

☀️ Summer Trading Blues? Here’s How to Stay Sharp Without Burning Out

Summer trading on Gold isn’t for the impulsive or the greedy. Liquidity dries up, sessions lose momentum, and the clean, aggressive price action we love? It goes on vacation too.

But that’s not a bad thing. It’s an opportunity.

This is the season where traders either burn out... or build.

Here’s how to keep your edge sharp while the markets slow down — and why a positive, focused mindset is your biggest asset until volatility returns.

Why Summer PA Feels “Off” on Gold

You’re not imagining it — gold price action does shift in the summer, and here’s why:

🏖️ Bank Holidays & Institutional Slowdowns

• Major global banks take scheduled breaks — including in the US, UK, EU, and Asia.

• Trading desks reduce activity, and high-volume players shift into passive management mode.

• This results in lower volume, fewer impulsive moves, and more algorithmic fakeouts.

📆 Official Holidays + "August Mode"

• US Independence Day (July 4), UK Summer Bank Holiday (late August), and more → NY and London sessions thin out or lack follow-through.

• Most institutional traders go on leave. Some desks run skeleton crews. No joke.

• Unless a major geopolitical catalyst (e.g. war escalation or surprise central bank move) hits the headlines, price will drift or trap.

🏄♂️ Retail Overreach & Emotional Traps & Vacation Time

• Retail traders often “force” trades in quiet markets to stay busy.

• This leads to chasing, overtrading, and emotional fatigue — the exact trap smart traders avoid.

• Most regular traders also go on vacation or scale back — unless they’re mentally obsessed with Gold and can’t let it go.

Bottom line:

Summer PA is slower, trickier, and full of emotional bait. Learn to read the stillness — not fight it.

💡 Your Summer Trading Mindset Kit

Instead of complaining about the range, use this time to train your mindset.

Here’s how:

⚖️ Stay Emotionally Neutral — Even When Price Isn’t

Summer markets bait your emotions: fake breakouts, slow reactions, and dead zones.

To stay in control, build structure around your execution:

✅ Pre-market: Make a clear plan with meaningful zones and set alerts — don’t wing it on hopes and dreams

✅ Post-market: Write down why you stayed out or why your trade was clean — not just wins or losses

Neutrality isn’t passive — it’s disciplined clarity, even when the chart’s doing nothing.

🎯 Focus Over FOMO

Short sessions. Laser focus. Clean execution.

→ Limit distractions

→ Trade only clear, structured setups

→ Respect no-trade days as productive days

Flow isn’t magic — it’s discipline + environment.

🤝 Find the Trading Circle That Matches Your Style — to reinforce your style

Not every group fits you — and not every voice deserves your attention.

Look for people who:

• Respect structure over noise

• Give thoughtful, honest feedback

• Celebrate patience and growth, not screenshots and bragging and 20-30 pips wins

A real trading circle matches your energy and raises your game — not your cortisol.

💭 Reconnect With Your “Why”

If you’re here just to “make money,” summer will test you hard.

Purpose anchors you when price doesn’t. Ask yourself:

• Why do I trade?

• Who am I becoming through this process?

No purpose = burnout.

Purpose = clarity, even in silence.

📈 Discipline Pays When Gold Doesn’t

Forget chasing fireworks in dead markets.

Summer rewards the trader who does less but does it right:

✅ You skipped noise? That’s a win.

✅ You waited for your zone? Pro-level move.

✅ You tracked your behavior? You’re not guessing — you’re evolving.

While others burn out chasing crumbs, you’re stacking discipline — and that’s what you’ll cash in when the real moves return.

Final Words: Quiet Traders Get Loud Later

Summer might be slow. But your growth doesn’t have to be.

While others force trades, smart traders sharpen edge.

You’re not falling behind by sitting out chop — you’re building mastery for when real money moves return.

🗓️ So in September YOU are going to show up: stronger, clearer, and 3x more prepared.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more published ideas.

Summer trading on Gold isn’t for the impulsive or the greedy. Liquidity dries up, sessions lose momentum, and the clean, aggressive price action we love? It goes on vacation too.

But that’s not a bad thing. It’s an opportunity.

This is the season where traders either burn out... or build.

Here’s how to keep your edge sharp while the markets slow down — and why a positive, focused mindset is your biggest asset until volatility returns.

Why Summer PA Feels “Off” on Gold

You’re not imagining it — gold price action does shift in the summer, and here’s why:

🏖️ Bank Holidays & Institutional Slowdowns

• Major global banks take scheduled breaks — including in the US, UK, EU, and Asia.

• Trading desks reduce activity, and high-volume players shift into passive management mode.

• This results in lower volume, fewer impulsive moves, and more algorithmic fakeouts.

📆 Official Holidays + "August Mode"

• US Independence Day (July 4), UK Summer Bank Holiday (late August), and more → NY and London sessions thin out or lack follow-through.

• Most institutional traders go on leave. Some desks run skeleton crews. No joke.

• Unless a major geopolitical catalyst (e.g. war escalation or surprise central bank move) hits the headlines, price will drift or trap.

🏄♂️ Retail Overreach & Emotional Traps & Vacation Time

• Retail traders often “force” trades in quiet markets to stay busy.

• This leads to chasing, overtrading, and emotional fatigue — the exact trap smart traders avoid.

• Most regular traders also go on vacation or scale back — unless they’re mentally obsessed with Gold and can’t let it go.

Bottom line:

Summer PA is slower, trickier, and full of emotional bait. Learn to read the stillness — not fight it.

💡 Your Summer Trading Mindset Kit

Instead of complaining about the range, use this time to train your mindset.

Here’s how:

⚖️ Stay Emotionally Neutral — Even When Price Isn’t

Summer markets bait your emotions: fake breakouts, slow reactions, and dead zones.

To stay in control, build structure around your execution:

✅ Pre-market: Make a clear plan with meaningful zones and set alerts — don’t wing it on hopes and dreams

✅ Post-market: Write down why you stayed out or why your trade was clean — not just wins or losses

Neutrality isn’t passive — it’s disciplined clarity, even when the chart’s doing nothing.

🎯 Focus Over FOMO

Short sessions. Laser focus. Clean execution.

→ Limit distractions

→ Trade only clear, structured setups

→ Respect no-trade days as productive days

Flow isn’t magic — it’s discipline + environment.

🤝 Find the Trading Circle That Matches Your Style — to reinforce your style

Not every group fits you — and not every voice deserves your attention.

Look for people who:

• Respect structure over noise

• Give thoughtful, honest feedback

• Celebrate patience and growth, not screenshots and bragging and 20-30 pips wins

A real trading circle matches your energy and raises your game — not your cortisol.

💭 Reconnect With Your “Why”

If you’re here just to “make money,” summer will test you hard.

Purpose anchors you when price doesn’t. Ask yourself:

• Why do I trade?

• Who am I becoming through this process?

No purpose = burnout.

Purpose = clarity, even in silence.

📈 Discipline Pays When Gold Doesn’t

Forget chasing fireworks in dead markets.

Summer rewards the trader who does less but does it right:

✅ You skipped noise? That’s a win.

✅ You waited for your zone? Pro-level move.

✅ You tracked your behavior? You’re not guessing — you’re evolving.

While others burn out chasing crumbs, you’re stacking discipline — and that’s what you’ll cash in when the real moves return.

Final Words: Quiet Traders Get Loud Later

Summer might be slow. But your growth doesn’t have to be.

While others force trades, smart traders sharpen edge.

You’re not falling behind by sitting out chop — you’re building mastery for when real money moves return.

🗓️ So in September YOU are going to show up: stronger, clearer, and 3x more prepared.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more published ideas.

Telegram t.me/GoldMindsFX_AI ⭐

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Telegram t.me/GoldMindsFX_AI ⭐

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.