One and a half month ago, I posted the following analysis, making a case of the similarities of the Ukraine - Russia war parabolic rise, with the blow-off top of August 2020:

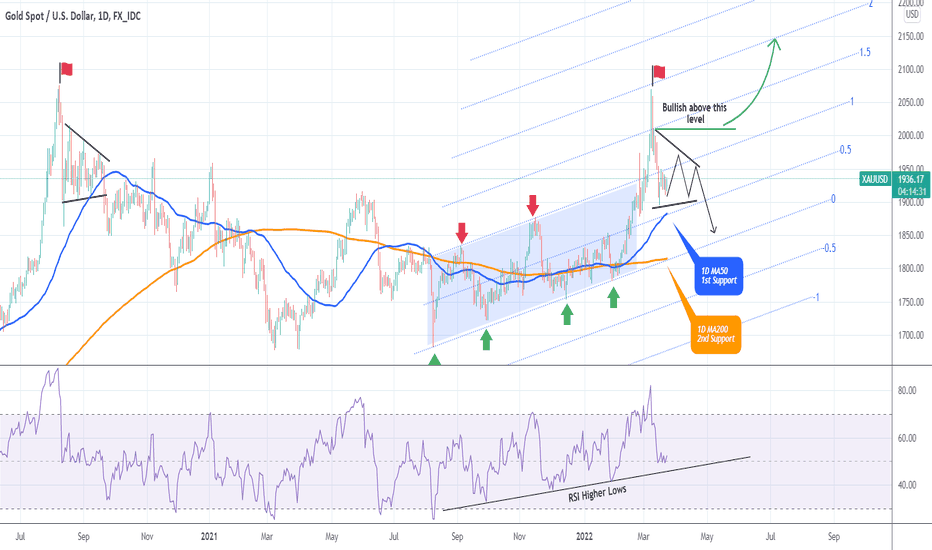

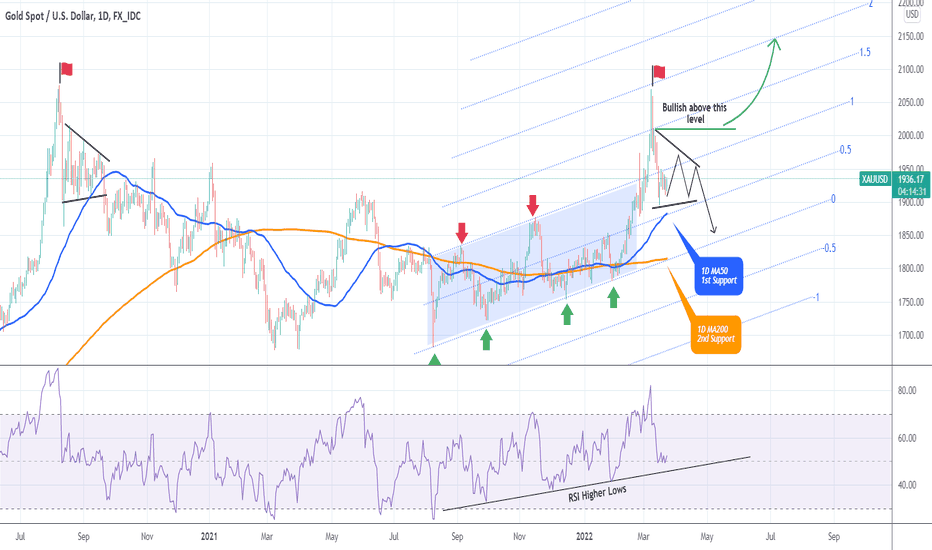

The long-term levels were clearly stated and as you see, Gold's (XAUUSD) price action has followed my projection fairly well. The bullish invalidation level (green trend-line), remains intact, and the longer it does, the more likely it is for Gold to dive lower.

However, it has come close to the first important Support level of this correction, the 1D MA200 (orange trend-line). As you see, this happens to be exactly on the Higher Lows trend-line of the Channel Up that started after the August 09 2021 Low and broke parabolically with the war in Ukraine. In the late September 2020 fractal, that led to a medium-term rebound to the 0.5 Fibonacci retracement level. That level is a little above 1960 and swing traders can use this as a short-term target.

On top of that, the 1D RSI has entered its multi-year Buy Zone. Notice also the lower Fibonacci extensions of the Channel (-0.5 and -1.00). Similar to the 1.5 and 2.0 upper extensions that were hit as the war escalated, those are the lower extensions that may be hit as the war deescalates and Gold loses its value as a safe haven to the USD, which has seen enormous strength lately.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

The long-term levels were clearly stated and as you see, Gold's (XAUUSD) price action has followed my projection fairly well. The bullish invalidation level (green trend-line), remains intact, and the longer it does, the more likely it is for Gold to dive lower.

However, it has come close to the first important Support level of this correction, the 1D MA200 (orange trend-line). As you see, this happens to be exactly on the Higher Lows trend-line of the Channel Up that started after the August 09 2021 Low and broke parabolically with the war in Ukraine. In the late September 2020 fractal, that led to a medium-term rebound to the 0.5 Fibonacci retracement level. That level is a little above 1960 and swing traders can use this as a short-term target.

On top of that, the 1D RSI has entered its multi-year Buy Zone. Notice also the lower Fibonacci extensions of the Channel (-0.5 and -1.00). Similar to the 1.5 and 2.0 upper extensions that were hit as the war escalated, those are the lower extensions that may be hit as the war deescalates and Gold loses its value as a safe haven to the USD, which has seen enormous strength lately.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.