Hey team!

Hope you're all feeling sharp and focused — here’s what we’re watching this week on XAUUSD 👇Week of June 9–13, 2025

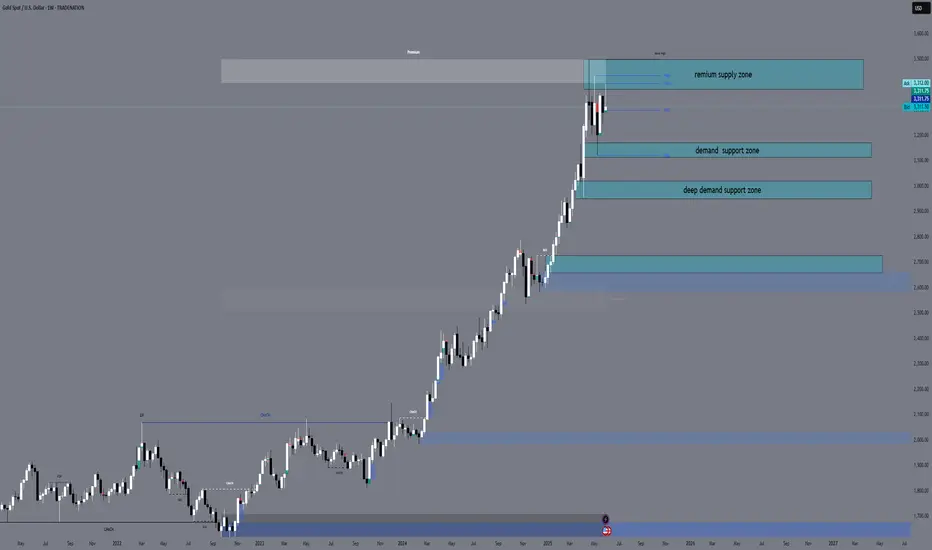

📍 Bias: Bullish, but cautiously reactive at premium supply

🔹 1. 🔍 Market Structure (W1)

Strong impulsive BOS continuation from 3245 → current price near 3312.

Weekly structure shows clean Higher Highs (HH) and Higher Lows (HL) since Q4 2023.

The premium zone around 3380–3500 is now in play — it’s a weak high zone with upside liquidity targets still intact.

🔹 2. 🧱 Key Weekly Zones

Zone Type Price Range Notes

🔼 Premium Supply Zone 3380 – 3500 Final weak high zone, imbalance + OB supply above

🔽 Demand Support 1 3115 – 3170 Recent impulsive candle origin & imbalance

🔽 Demand Support 2 2950 – 3020 Prior CHoCH base & last HL support

🔽 Long-Term Demand 2660 – 2720 Weekly OB, deep discount zone

🔹 3. 📊 EMAs Context

EMA 5 / 21 / 50 / 100 / 200: Full bullish alignment.

Price is aggressively extended above all EMAs, suggesting possible retracement into the 3115–3170 zone if price fails to break above premium supply cleanly.

🔹 4. 🎯 Fibonacci Swing Analysis

Main fib: 3245 (last HL) → 3395 (current swing high).

50% retracement = ~3320, current price is hovering around this equilibrium.

A move back to 3115–3170 = golden zone, could serve as a clean long re-entry if premium gets rejected.

🔹 5. 🧠 RSI Context

Weekly RSI remains overbought, hovering near 70+.

Momentum remains strong, but any failure to break the weak high may trigger a cooling phase (pullback to EMA50 or fib 61.8%).

🔹 6. 🌍 Macro + Geopolitical Notes

NFP released Friday (June 6): Mixed impact — job creation weak but hourly earnings slightly strong.

Fed still data-dependent → CPI (next week) will be key.

Gold remains sensitive to inflation + Fed rate expectations. A dovish shift or inflation spike could send price beyond 3400.

📌 Weekly Scenarios

🔼 Bullish Continuation

Break above 3380–3395 → 3450–3500 target zone

Needs impulsive close above premium with volume and no rejection wick.

🔽 Retracement Play

Failure to break 3380 → pullback into 3115–3170

Clean demand, imbalance, and fib confluence support re-entry.

✅ GoldFxMinds Final Note

Gold is now in premium pricing — either distribution begins, or we’ll witness a parabolic extension into 3450–3500.

🧠 Watch reactions, not just zones. Trade confirmation.

💬 Let us know how you're positioning for the week — are you buying dips or fading premium?

Stay sharp,

— GoldFxMinds 💡

Hope you're all feeling sharp and focused — here’s what we’re watching this week on XAUUSD 👇Week of June 9–13, 2025

📍 Bias: Bullish, but cautiously reactive at premium supply

🔹 1. 🔍 Market Structure (W1)

Strong impulsive BOS continuation from 3245 → current price near 3312.

Weekly structure shows clean Higher Highs (HH) and Higher Lows (HL) since Q4 2023.

The premium zone around 3380–3500 is now in play — it’s a weak high zone with upside liquidity targets still intact.

🔹 2. 🧱 Key Weekly Zones

Zone Type Price Range Notes

🔼 Premium Supply Zone 3380 – 3500 Final weak high zone, imbalance + OB supply above

🔽 Demand Support 1 3115 – 3170 Recent impulsive candle origin & imbalance

🔽 Demand Support 2 2950 – 3020 Prior CHoCH base & last HL support

🔽 Long-Term Demand 2660 – 2720 Weekly OB, deep discount zone

🔹 3. 📊 EMAs Context

EMA 5 / 21 / 50 / 100 / 200: Full bullish alignment.

Price is aggressively extended above all EMAs, suggesting possible retracement into the 3115–3170 zone if price fails to break above premium supply cleanly.

🔹 4. 🎯 Fibonacci Swing Analysis

Main fib: 3245 (last HL) → 3395 (current swing high).

50% retracement = ~3320, current price is hovering around this equilibrium.

A move back to 3115–3170 = golden zone, could serve as a clean long re-entry if premium gets rejected.

🔹 5. 🧠 RSI Context

Weekly RSI remains overbought, hovering near 70+.

Momentum remains strong, but any failure to break the weak high may trigger a cooling phase (pullback to EMA50 or fib 61.8%).

🔹 6. 🌍 Macro + Geopolitical Notes

NFP released Friday (June 6): Mixed impact — job creation weak but hourly earnings slightly strong.

Fed still data-dependent → CPI (next week) will be key.

Gold remains sensitive to inflation + Fed rate expectations. A dovish shift or inflation spike could send price beyond 3400.

📌 Weekly Scenarios

🔼 Bullish Continuation

Break above 3380–3395 → 3450–3500 target zone

Needs impulsive close above premium with volume and no rejection wick.

🔽 Retracement Play

Failure to break 3380 → pullback into 3115–3170

Clean demand, imbalance, and fib confluence support re-entry.

✅ GoldFxMinds Final Note

Gold is now in premium pricing — either distribution begins, or we’ll witness a parabolic extension into 3450–3500.

🧠 Watch reactions, not just zones. Trade confirmation.

💬 Let us know how you're positioning for the week — are you buying dips or fading premium?

Stay sharp,

— GoldFxMinds 💡

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS ⭐

Telegram: t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS ⭐

Telegram: t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS ⭐

Telegram: t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS ⭐

Telegram: t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.