“Snipers wait. Structure tells the story.”

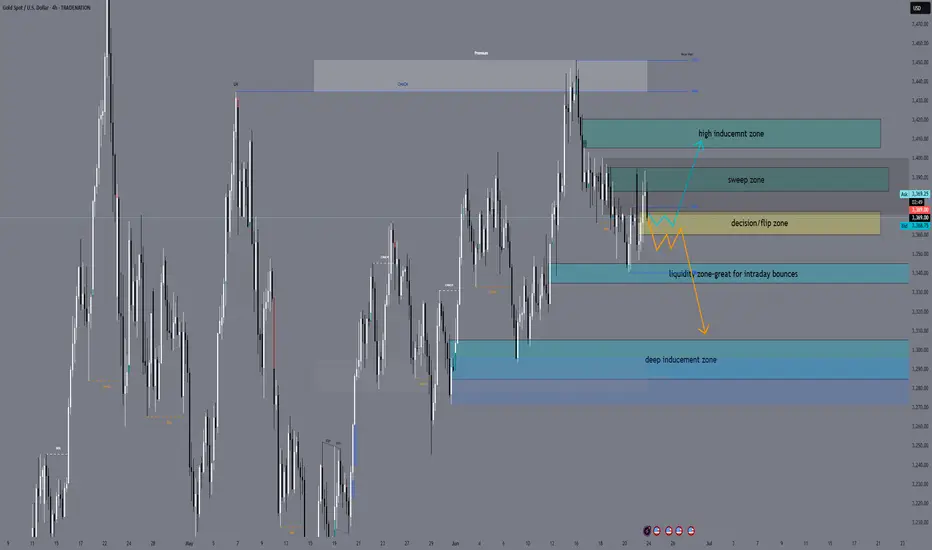

Hello traders! The market is stuck between the FOMC high at 3452 and the confirmed low at 3340. Price is compressing under H1 supply and above a key liquidity pocket. Here's your full plan with all sniper zones — now including a decision zone for intraday confirmation.

📰 Macro + Fundamental Context

Powell Testimony + multiple FOMC speeches today → high potential for dollar-driven volatility.

Inflation concerns and hawkish tone expected → short-term gold bearish pressure unless structure reclaims 3415+.

Smart money likely hunting liquidity both below 3340 and above 3400.

🔸 HTF Structure Summary (D1 → H4 → H1)

D1: Consolidation between 3452 and 3340. No new BOS.

H4: LL formed at 3340. LH not confirmed. Market is compressing under resistance.

H1: CHoCH + BOS confirmed. Current price sits in mid-range.

🔍 Sniper Entry Zones

🟥 Sell Zone 1: 3382–3395

H1 supply zone with previous rejection.

Includes order block + FVG.

Valid for new short entries if price returns and rejects.

🟥 Sell Zone 2: 3406–3420

High-risk spike zone from FOMC.

Only valid during fast, news-driven price movement.

Not a default entry unless confirmed rejection.

🟨 Decision Zone (Flip Area): 3360–3372

This is the key intraday flip level.

If price stays below, sell zones remain valid.

If price closes above, short bias is invalid and market may aim higher.

Use this zone to confirm bias before entering from either side.

🟩 Buy Zone 1: 3335–3345

Strong demand under equal lows.

OB + small imbalance on M15.

Valid for intraday long setups if confirmed with bullish price action.

🟦 Buy Zone 2: 3305–3285

H4 demand zone with major liquidity below.

Deep reversal area — only valid if price breaks 3340.

Smart money may be waiting here.

📌 Key Levels Summary

Zone Type Price Range Explanation

🔺 Premium OB 3450–3480 Daily supply zone

🟥 Sell Zone 1 3382–3395 Active H1 supply

🟥 Sell Zone 2 3406–3420 FOMC wick inducement

🟨 Flip Zone 3360–3372 Decision area — confirm bias

🟩 Buy Zone 1 3335–3345 Demand under equal lows

🟦 Buy Zone 2 3305–3285 H4 demand + deep liquidity

📣 Final Notes

📌 The market is at a critical moment. The flip zone (3360–3372) will decide tomorrow’s control: bear continuation or deeper retracement.

Watch price at the zone. Let the structure speak. Trade only where the logic is clean.

👁 Good luck in the market tomorrow, traders!

— GoldFxMinds

🟨 Disclosure: I am part of TradeNation’s Influencer Program and receive a monthly fee for using their TradingView charts in educational work.

Hello traders! The market is stuck between the FOMC high at 3452 and the confirmed low at 3340. Price is compressing under H1 supply and above a key liquidity pocket. Here's your full plan with all sniper zones — now including a decision zone for intraday confirmation.

📰 Macro + Fundamental Context

Powell Testimony + multiple FOMC speeches today → high potential for dollar-driven volatility.

Inflation concerns and hawkish tone expected → short-term gold bearish pressure unless structure reclaims 3415+.

Smart money likely hunting liquidity both below 3340 and above 3400.

🔸 HTF Structure Summary (D1 → H4 → H1)

D1: Consolidation between 3452 and 3340. No new BOS.

H4: LL formed at 3340. LH not confirmed. Market is compressing under resistance.

H1: CHoCH + BOS confirmed. Current price sits in mid-range.

🔍 Sniper Entry Zones

🟥 Sell Zone 1: 3382–3395

H1 supply zone with previous rejection.

Includes order block + FVG.

Valid for new short entries if price returns and rejects.

🟥 Sell Zone 2: 3406–3420

High-risk spike zone from FOMC.

Only valid during fast, news-driven price movement.

Not a default entry unless confirmed rejection.

🟨 Decision Zone (Flip Area): 3360–3372

This is the key intraday flip level.

If price stays below, sell zones remain valid.

If price closes above, short bias is invalid and market may aim higher.

Use this zone to confirm bias before entering from either side.

🟩 Buy Zone 1: 3335–3345

Strong demand under equal lows.

OB + small imbalance on M15.

Valid for intraday long setups if confirmed with bullish price action.

🟦 Buy Zone 2: 3305–3285

H4 demand zone with major liquidity below.

Deep reversal area — only valid if price breaks 3340.

Smart money may be waiting here.

📌 Key Levels Summary

Zone Type Price Range Explanation

🔺 Premium OB 3450–3480 Daily supply zone

🟥 Sell Zone 1 3382–3395 Active H1 supply

🟥 Sell Zone 2 3406–3420 FOMC wick inducement

🟨 Flip Zone 3360–3372 Decision area — confirm bias

🟩 Buy Zone 1 3335–3345 Demand under equal lows

🟦 Buy Zone 2 3305–3285 H4 demand + deep liquidity

📣 Final Notes

📌 The market is at a critical moment. The flip zone (3360–3372) will decide tomorrow’s control: bear continuation or deeper retracement.

Watch price at the zone. Let the structure speak. Trade only where the logic is clean.

👁 Good luck in the market tomorrow, traders!

— GoldFxMinds

🟨 Disclosure: I am part of TradeNation’s Influencer Program and receive a monthly fee for using their TradingView charts in educational work.

Trade active

🔻 XAUUSD Market Update – June 24, 2025 (Post-Powell Precision)Current Price: 3306

Bias: Bearish | Structure: Lower Low (3295) just printed | Status: Pullback developing

—

🔍 What’s Happening Now?

✅ Price broke structure and swept liquidity to form a clean Lower Low at 3295

✅ From there, we’re now seeing a retracement bounce toward premium, currently pausing at 3306

🔻 This move is correctional, not a trend reversal

—

🎙️ Powell’s Testimony Recap

Reaffirmed: no July rate cut, eyes on September or later

Acknowledged strong labor market but warned of inflation uncertainty

USD weakened post-speech → gold bounced from extreme discount (3295)

Market now pricing in slower Fed cuts = short-term gold support, but long-term structure stays bearish

—

🔎 What to Watch Next:

🟠 3318–3328 → Minor reaction zone (M15 OB)

Could cause a pause or trap — but not strong enough for sniper entries

🟥 3338–3348 → First real sell zone

M15–M30 OB + FVG + EMA 21/50

Look for rejection confirmation (CHoCH + bearish PA)

🟥 3355–3365 → Ideal sniper sell zone

H1 OB + FIB 61.8% + EMA 50 = stacked confluence

If reached = best RR for reentry short

Still valid unless price closes above 3366

—

🎯 Bearish Targets

3295 → Retest of current LL

3280 → Major liquidity pool & HTF demand zone

Structure remains bearish unless H1 closes above 3366

—

💡 This is a retracement. Not a reversal.

Let gold come up. Watch reaction zones. Then strike.

—

📌 Follow GoldFxMinds for sniper-level updates

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Free: t.me/GoldMindsFX_AI

⭐ VIP ACCESS & Mentorship XAUUSD ⭐

Telegram: t.me/GoldMindsFX_A

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.