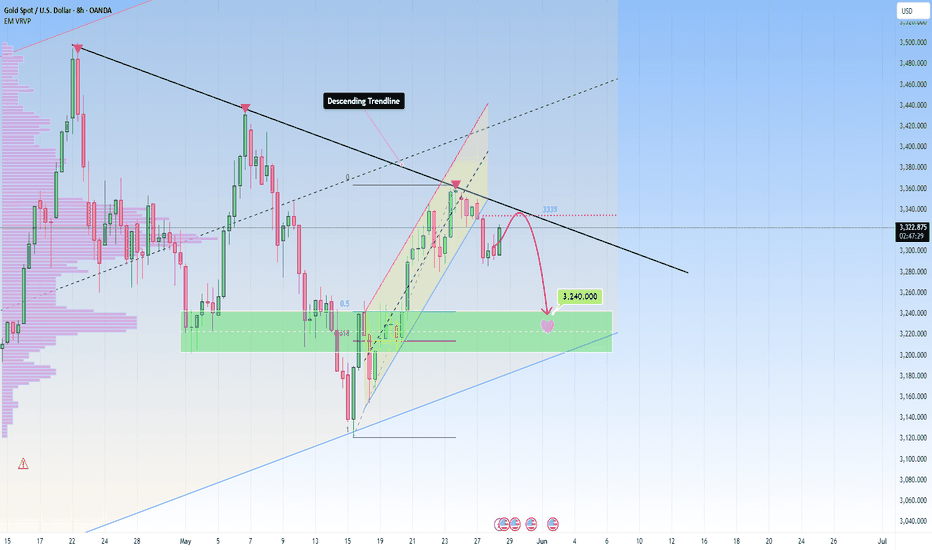

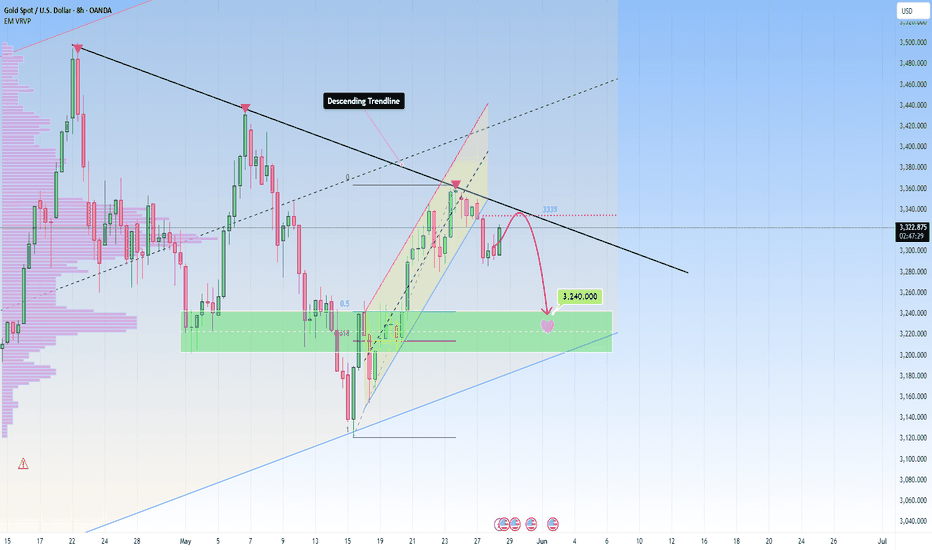

For now, we can see that Gold’s bullish momentum has stalled and since Friday Gold has been under pressure from 3325. Not surprisingly though, the market structure performed as expected this past week.

I believe that short-term price action in gold may remain choppy next week due to Trump’s temporary tariff measures so caution is advised.

My bias is still the same as before, I think that on Monday the market will open bearish likely pushing price lower initially.

As you can see in my previous analysis, the forecasted move played as expected:

So this being said I plan to react based on how price behaves at support of 3270-3250 on the lower side in the short term.

If price tags the support as shown on my chart, I’ll be watching for a possible rebound toward 3300. This range in particular should not be overlooked. This area aligns with the point of control, and given how price often gravitates back to high-volume zones after sharp moves, a recovery to that level would be a natural reaction.

Wishing you a profitable trading weekend ahead. This is just a forecast and should not be considered financial advice.

I believe that short-term price action in gold may remain choppy next week due to Trump’s temporary tariff measures so caution is advised.

My bias is still the same as before, I think that on Monday the market will open bearish likely pushing price lower initially.

As you can see in my previous analysis, the forecasted move played as expected:

So this being said I plan to react based on how price behaves at support of 3270-3250 on the lower side in the short term.

If price tags the support as shown on my chart, I’ll be watching for a possible rebound toward 3300. This range in particular should not be overlooked. This area aligns with the point of control, and given how price often gravitates back to high-volume zones after sharp moves, a recovery to that level would be a natural reaction.

- The key point lies in how the market will open and how price will behave, as well as the overall sentiment.

- Gold's next move won’t be random, there are strong confluences at play that will guide and give us hints, so it’s up to us to stay attentive.

- If we were to break upside above the $3,330 level, then we can see more bullish outlook next

- The other scenario, to be taking into account would be to start with a strong bullish candle and reach 3330 before a drop.

Wishing you a profitable trading weekend ahead. This is just a forecast and should not be considered financial advice.

Note

The market opened with an upside gap, but my overall bias is still the same as before, to stall at around 3,330 and fall towards 3,250Order cancelled

Free Telegram Signals: t.me/addlist/MLJjjTl2V-M1OTc8

👉 I recommend this Broker - Get 20% Deposit BONUS - bit.ly/trenddiva

👉 My favorite broker - go.tradenation.com/visit/?bta=37381&brand=tradenation

👉 I recommend this Broker - Get 20% Deposit BONUS - bit.ly/trenddiva

👉 My favorite broker - go.tradenation.com/visit/?bta=37381&brand=tradenation

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Telegram Signals: t.me/addlist/MLJjjTl2V-M1OTc8

👉 I recommend this Broker - Get 20% Deposit BONUS - bit.ly/trenddiva

👉 My favorite broker - go.tradenation.com/visit/?bta=37381&brand=tradenation

👉 I recommend this Broker - Get 20% Deposit BONUS - bit.ly/trenddiva

👉 My favorite broker - go.tradenation.com/visit/?bta=37381&brand=tradenation

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.