⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) fails to build on Thursday’s sharp rebound from the $3,120 area — its lowest level since April 10 — and comes under renewed selling pressure during Friday’s Asian session. The 90-day trade truce between the US and China has alleviated some of the strain on global financial markets, weighing on demand for the safe-haven metal.

Nevertheless, lingering geopolitical tensions and a weaker US Dollar continue to offer underlying support, limiting the downside. Additionally, growing market expectations for further interest rate cuts by the Federal Reserve may deter traders from adopting strong bearish positions on gold in the near term.

⭐️Personal comments NOVA:

Gold prices recover, buyers are determined to keep prices stable around the 3200 mark in May. Waiting for new bullish momentum after tariff negotiations end

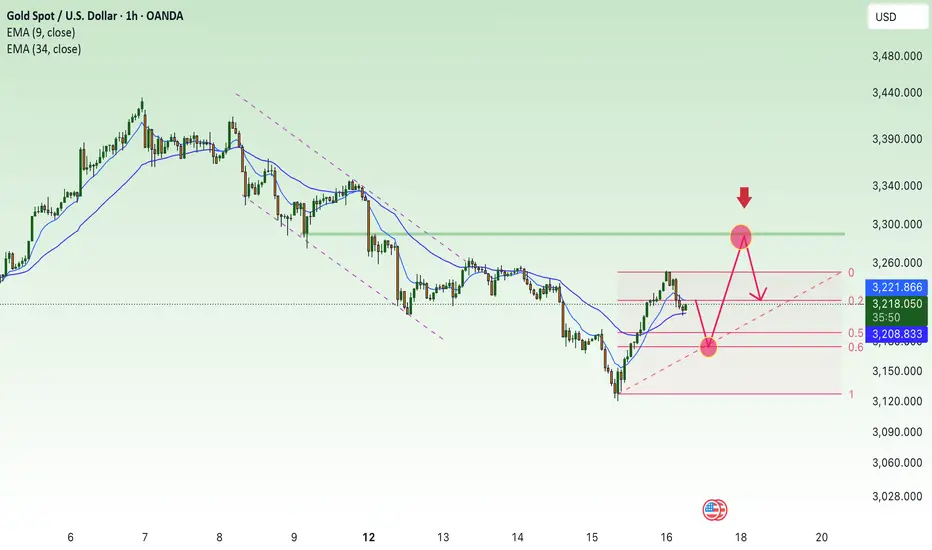

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3287- 3290 SL 3294

TP1: $3270

TP2: $3260

TP3: $3250

🔥BUY GOLD zone: $3173 - $3175 SL $3168

TP1: $3188

TP2: $3200

TP3: $3218

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price (XAU/USD) fails to build on Thursday’s sharp rebound from the $3,120 area — its lowest level since April 10 — and comes under renewed selling pressure during Friday’s Asian session. The 90-day trade truce between the US and China has alleviated some of the strain on global financial markets, weighing on demand for the safe-haven metal.

Nevertheless, lingering geopolitical tensions and a weaker US Dollar continue to offer underlying support, limiting the downside. Additionally, growing market expectations for further interest rate cuts by the Federal Reserve may deter traders from adopting strong bearish positions on gold in the near term.

⭐️Personal comments NOVA:

Gold prices recover, buyers are determined to keep prices stable around the 3200 mark in May. Waiting for new bullish momentum after tariff negotiations end

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3287- 3290 SL 3294

TP1: $3270

TP2: $3260

TP3: $3250

🔥BUY GOLD zone: $3173 - $3175 SL $3168

TP1: $3188

TP2: $3200

TP3: $3218

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Dear My Friends,

NOVA returns and updates new information

✅ Gold Scalping Signal: 4 - 6 signals.

✅ Forex Signal: 5 - 8 signals.

✅ Trading Idea / Setup / Technical.

✅ NEW UPDATE : Signals free in Telegram:

t.me/+1mFSljRaI5RlNjg1

NOVA returns and updates new information

✅ Gold Scalping Signal: 4 - 6 signals.

✅ Forex Signal: 5 - 8 signals.

✅ Trading Idea / Setup / Technical.

✅ NEW UPDATE : Signals free in Telegram:

t.me/+1mFSljRaI5RlNjg1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Dear My Friends,

NOVA returns and updates new information

✅ Gold Scalping Signal: 4 - 6 signals.

✅ Forex Signal: 5 - 8 signals.

✅ Trading Idea / Setup / Technical.

✅ NEW UPDATE : Signals free in Telegram:

t.me/+1mFSljRaI5RlNjg1

NOVA returns and updates new information

✅ Gold Scalping Signal: 4 - 6 signals.

✅ Forex Signal: 5 - 8 signals.

✅ Trading Idea / Setup / Technical.

✅ NEW UPDATE : Signals free in Telegram:

t.me/+1mFSljRaI5RlNjg1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.