Israeli Prime Minister Benjamin Netanyahu said the operation “will continue until this threat is eliminated.” Iranian state TV reported that the commander of the Islamic Revolutionary Guard Corps, Hussein Salami, had been killed. Iran vowed a “harsh counterattack” against Israel and the United States, while other countries said they were not involved in the operation. Gold is trading near an all-time high of $3,500.10, just shy of $60.

Netanyahu said the operation “will last for days to eliminate this threat.” Israel believes the strike killed at least several Iranian nuclear scientists and senior generals, according to a military official. Iranian state TV said Islamic Revolutionary Guard Corps commander Hussein Salami may have been among the dead.

Israel's attack on Iran comes after Netanyahu repeatedly warned of attacking the OPEC oil producer to cripple its nuclear program. US and Iranian negotiators are scheduled to hold a new round of talks on Tehran's nuclear program in Oman on Sunday, but Trump said this week he was less confident a deal could be reached.

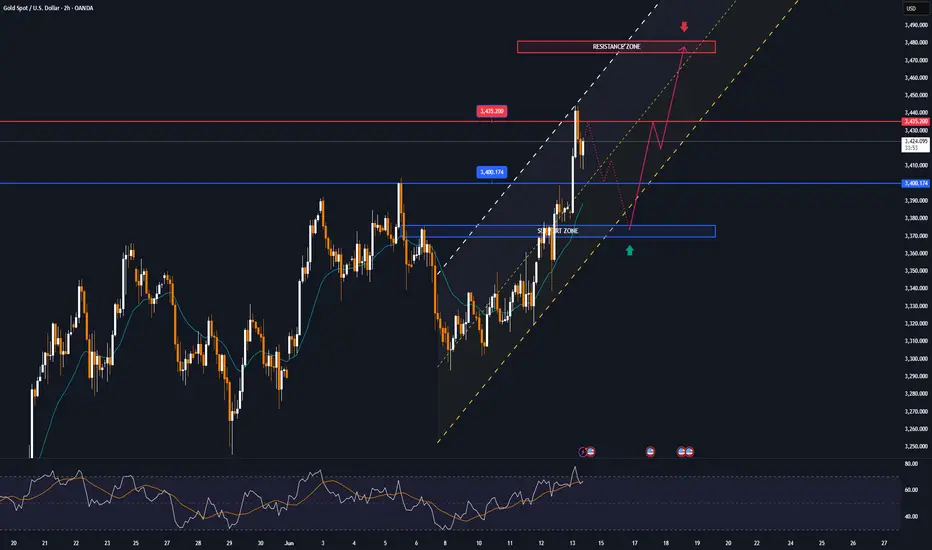

Technical Outlook Analysis

Gold continues to reach the target of $3,435 after reaching the previous upside target at the base of $3,400.

Currently, the base of $3,400 becomes the nearest support, while other than the resistance of $3,435, there is no resistance ahead to prevent gold from heading towards the all-time high of $3,500.

In terms of momentum, the Relative Strength Index (RSI) is sloping upward, still far from the overbought zone, indicating that there is still plenty of room for further upside ahead.

There are no factors that could cause gold to decline during the day, and the notable positions will also be listed as follows.

Support: 3,400 – 3,371 USD

Resistance: 3,435 – 3,500 USD

SELL XAUUSD PRICE 3480 - 3478⚡️

↠↠ Stop Loss 3384

→Take Profit 1 3472

↨

→Take Profit 2 3466

BUY XAUUSD PRICE 3373 - 3375⚡️

↠↠ Stop Loss 3369

→Take Profit 1 3381

↨

→Take Profit 2 3387

Note

Next week is shaping up to be a rollercoaster for markets, with interest rate announcements from central banks, monetary policy updates, and a slew of central bank governors speaking throughout the week.Note

▫️Spot gold erased intraday gains, with the latest quote at $3,435/ounce.Note

Faced with concerns about the developments of the war between Iran and Israel, this morning, the price of gold increased sharply, surpassing 3430 to establish a secondary peak. Immediately after that, the price of gold began to reverse and decrease to around 3410.Note

After hitting an eight-week peak, gold prices fell more than 1% to $3,385.20 an ounce due to profit-taking pressure. However, the escalation of geopolitical tensions in the Middle East, especially the ongoing conflict between Israel and Iran, still supported gold prices to rise back to $3,400 an ounce.Note

🔴Spot gold prices fell by $8 in a short time, currently at $3,380.6/ounce. New York gold futures fell below $3,400/ounce, down 0.21% on the day.Note

🔴Spot gold prices fell around $14 in the short term and are currently trading at $3,352.47 an ounce, with intraday losses extending to 0.46%.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.