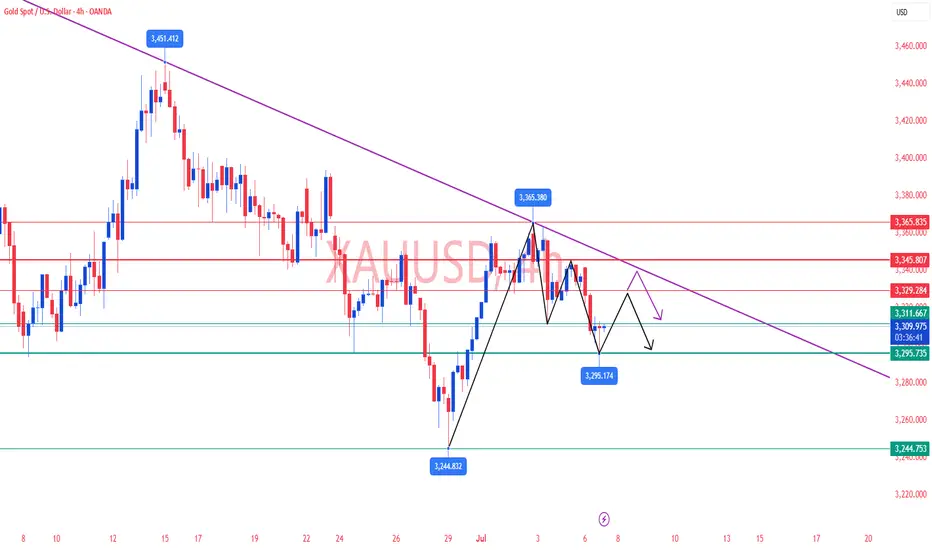

✅Gold opened weakly during the Asian session today, with prices dropping nearly $40 in early trading—likely due to technical selling pressure from above. The rebound once again failed to break the key 3345 resistance level, which serves as the neckline of the previous “M-top” pattern formed at the 3365 high. This level has become a clear resistance zone. If gold continues to struggle below this line, the short-term trend remains biased toward consolidation with a bearish tone.

✅ 4-Hour Chart Structure:

Since retreating from the 3365 high, multiple rebound attempts have been capped around the 3345 area. Last Friday, a second rally failed at the mid-Bollinger Band and closed lower, forming a local double-top pattern. This morning’s rebound to 3342 was again rejected, confirming continued downward pressure in this area.

✅ 1-Hour Chart Structure:

After the release of last week's non-farm payrolls data, gold formed a short-term double top. After breaking the neckline, the rebound lacked momentum, reaffirming that sellers dominate near resistance. In the short term, bearish pressure remains in control.

✅ Key Technical Levels:

🔴Short-term Resistance: 3325–3330

🔴Major Resistance Zone: 3345 (M-top neckline)

🔴Strong Resistance: 3365 (M-top peak)

🟢Short-term Support: 3305

🟢Critical Support: 3295

🟢A break below 3295 could open further downside toward 3275 or even 3246

✅Intraday Trading Strategy:

🔻 Short Position Strategy:

Consider layering into short positions around the 3325–3330 area. Stop-loss: 8–10 $

Targets: 3310–3300; if 3300 breaks, watch for a move toward 3295

🔺 Long Position Strategy:

If price pulls back and stabilizes around 3295–3298, consider layering into long positions. Stop-loss: 8–10 $

Targets: 3305–3315; if 3315 breaks, look for a move toward 3325

✅Strategy Summary & Outlook:

Gold remains in a broad high-level consolidation phase, with frequent short-term shifts between bullish and bearish sentiment. We recommend a range-trading approach—selling on rallies and buying on dips—while closely monitoring whether the 3345–3350 resistance zone is breached. This key area will likely determine the directional breakout this week.

✅Maintain disciplined risk management, avoid chasing moves, and stay alert to intraday momentum shifts.

✅ 4-Hour Chart Structure:

Since retreating from the 3365 high, multiple rebound attempts have been capped around the 3345 area. Last Friday, a second rally failed at the mid-Bollinger Band and closed lower, forming a local double-top pattern. This morning’s rebound to 3342 was again rejected, confirming continued downward pressure in this area.

✅ 1-Hour Chart Structure:

After the release of last week's non-farm payrolls data, gold formed a short-term double top. After breaking the neckline, the rebound lacked momentum, reaffirming that sellers dominate near resistance. In the short term, bearish pressure remains in control.

✅ Key Technical Levels:

🔴Short-term Resistance: 3325–3330

🔴Major Resistance Zone: 3345 (M-top neckline)

🔴Strong Resistance: 3365 (M-top peak)

🟢Short-term Support: 3305

🟢Critical Support: 3295

🟢A break below 3295 could open further downside toward 3275 or even 3246

✅Intraday Trading Strategy:

🔻 Short Position Strategy:

Consider layering into short positions around the 3325–3330 area. Stop-loss: 8–10 $

Targets: 3310–3300; if 3300 breaks, watch for a move toward 3295

🔺 Long Position Strategy:

If price pulls back and stabilizes around 3295–3298, consider layering into long positions. Stop-loss: 8–10 $

Targets: 3305–3315; if 3315 breaks, look for a move toward 3325

✅Strategy Summary & Outlook:

Gold remains in a broad high-level consolidation phase, with frequent short-term shifts between bullish and bearish sentiment. We recommend a range-trading approach—selling on rallies and buying on dips—while closely monitoring whether the 3345–3350 resistance zone is breached. This key area will likely determine the directional breakout this week.

✅Maintain disciplined risk management, avoid chasing moves, and stay alert to intraday momentum shifts.

Trade active

📊 As we anticipated in our morning analysis, gold successfully found support and rebounded near the 3295 level, precisely reaching our first target at 3315, and then continued rising toward the short-term resistance zone of 3322–3325.🎯 Our trading strategy has once again been perfectly validated — direction, entry, target, and timing were all spot on!

👏 Congratulations to those who followed the trade — you're already sitting on solid floating profits. At this level, we recommend gradually taking partial profits and moving the stop-loss on remaining positions to breakeven to lock in gains.

✅This proves that with a professional mentor guiding you, you can truly avoid many costly mistakes.

You just need to focus on solid execution — leave the market analysis and strategy to us!

🎯 Professional analysis, precise strategies, and steady trading — that’s the key to consistent profits!

✅𝐃𝐚𝐢𝐥𝐲 𝟐-𝟒 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 𝐒𝐢𝐠𝐧𝐚𝐥𝐬🔥

✅𝐇𝐢𝐠𝐡 𝐀𝐜𝐜𝐮𝐫𝐚𝐜𝐲 𝟗𝟎%-𝟗𝟓% 🔥

✅𝐖𝐞𝐞𝐤𝐥𝐲 𝐲𝐢𝐞𝐥𝐝 𝟔𝟎%-𝟖𝟓%🔥

👉Free Group:t.me/+RQhjYR-k6i4yOTA1

✉️VIP Channel : t.me/Jack_blackwell

✅𝐇𝐢𝐠𝐡 𝐀𝐜𝐜𝐮𝐫𝐚𝐜𝐲 𝟗𝟎%-𝟗𝟓% 🔥

✅𝐖𝐞𝐞𝐤𝐥𝐲 𝐲𝐢𝐞𝐥𝐝 𝟔𝟎%-𝟖𝟓%🔥

👉Free Group:t.me/+RQhjYR-k6i4yOTA1

✉️VIP Channel : t.me/Jack_blackwell

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅𝐃𝐚𝐢𝐥𝐲 𝟐-𝟒 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 𝐒𝐢𝐠𝐧𝐚𝐥𝐬🔥

✅𝐇𝐢𝐠𝐡 𝐀𝐜𝐜𝐮𝐫𝐚𝐜𝐲 𝟗𝟎%-𝟗𝟓% 🔥

✅𝐖𝐞𝐞𝐤𝐥𝐲 𝐲𝐢𝐞𝐥𝐝 𝟔𝟎%-𝟖𝟓%🔥

👉Free Group:t.me/+RQhjYR-k6i4yOTA1

✉️VIP Channel : t.me/Jack_blackwell

✅𝐇𝐢𝐠𝐡 𝐀𝐜𝐜𝐮𝐫𝐚𝐜𝐲 𝟗𝟎%-𝟗𝟓% 🔥

✅𝐖𝐞𝐞𝐤𝐥𝐲 𝐲𝐢𝐞𝐥𝐝 𝟔𝟎%-𝟖𝟓%🔥

👉Free Group:t.me/+RQhjYR-k6i4yOTA1

✉️VIP Channel : t.me/Jack_blackwell

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.