🎓 XAUUSD Market Maker Playbook – Learn How the Game Is Rigged

Traders—if you think this market is some pure, fair supply/demand mechanism, you’re getting played.

Market makers run sophisticated pump and dump cycles designed to trap you.

Today, I’m going to break down exactly how they do it, so you can start trading like a sniper, not a sheep.

🔍 Understanding the 3 Manipulation Zones

🟢 GREEN ZONE: Accumulation Range (3286–3300)

Purpose:

Market makers quietly build positions.

They create an illusion of neutrality—small candles, tight ranges.

Signs:

Repeated tests of the same level.

Volume stays steady (not exploding).

Wicks in both directions (so nobody knows who’s in control).

🟡 YELLOW ZONE: The Pump Phase (3300–3330)

Purpose:

Trigger breakout traders.

Induce FOMO buying.

Clear out short stops above the range.

Signs:

Quick impulsive candles with LOW RELATIVE VOLUME.

Price blows through resistance but struggles to hold.

Social media and news start calling “Bull Run.”

🔴 RED ZONE: Distribution & Dump (3330–3350)

Purpose:

Offload large positions into retail buying.

Leave traders trapped at the highs.

Signs:

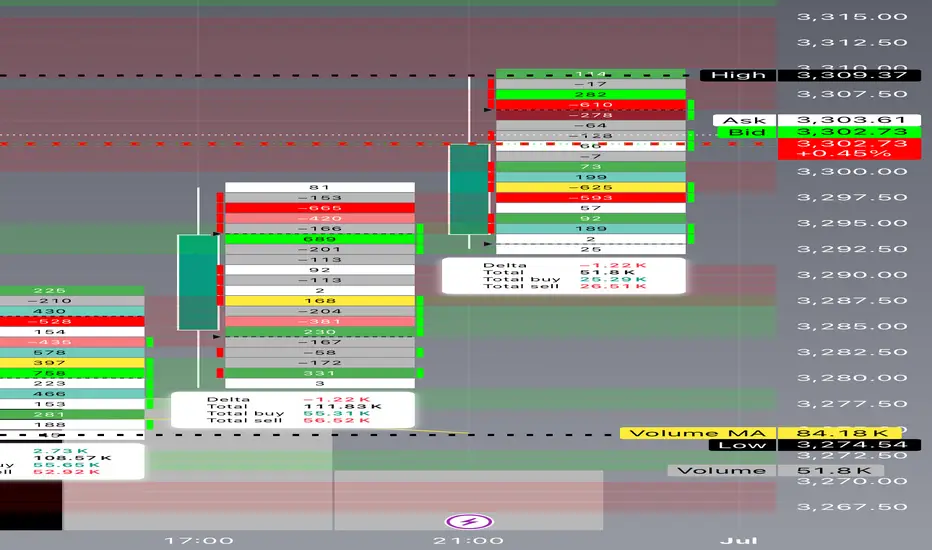

Spikes of huge volume as price stalls.

Rejection candles (long upper wicks).

Big delta shifts negative (sellers hitting bids hard).

⚔️ How the Market Maker Sequence Works

Here’s how the trap gets set:

1️⃣ Accumulate in Green Zone

Build inventory while convincing everyone “nothing is happening.”

2️⃣ Pump into Yellow Zone

Push price up just enough to trigger momentum traders.

Keep volume deceptively low—so it looks sustainable.

3️⃣ Sell in the Red Zone

Dump big positions into the buying frenzy.

Flip the tape bearish—fast.

Watch as the herd gets stopped out or bag-held.

🎯 Tomorrow’s Possible Plays

✅ Scenario 1 – Classic Pump & Dump

Phase 1: Grind in 3286–3300.

Phase 2: Spike to 3335.

Phase 3: Dump back to 3260.

✅ Scenario 2 – Fake Breakdown Reversal

Phase 1: Slam price to 3250, triggering panic selling.

Phase 2: Accumulate aggressively.

Phase 3: Rip price back to 3320, trapping shorts.

✅ Scenario 3 – Slow Grind Liquidation

Phase 1: Drift up in low volume toward 3330.

Phase 2: Distribute over several hours.

Phase 3: Liquidate longs into NY close.

📚 How YOU Can Spot This Manipulation

Here’s your checklist—save this:

✅ Volume vs. Price Analysis

Big price moves WITHOUT proportionate volume = FAKEOUT.

Big volume at tops/bottoms = Institutional distribution or accumulation.

✅ Delta Confirmation

Positive delta = buyers aggressive.

Negative delta = sellers slamming bids.

Watch for divergence (price up but delta down = hidden selling).

✅ Candlestick Clues

Rejection wicks.

Engulfing candles at key zones.

Multiple failures to break past a level.

✅ Timing

London open and NY open are prime manipulation hours.

Thin liquidity in Asia can exaggerate moves.

💡 Pro Tip:

“The crowd chases price. The professionals track volume, delta, and timing.”

— Technical Analysis and Stock Market Profits

🚀 Stay sharp. Think like a market maker. Trade like a predator.

#XAUUSD #MarketMakerEducation #ForexTrading #PriceAction #LearnT

Traders—if you think this market is some pure, fair supply/demand mechanism, you’re getting played.

Market makers run sophisticated pump and dump cycles designed to trap you.

Today, I’m going to break down exactly how they do it, so you can start trading like a sniper, not a sheep.

🔍 Understanding the 3 Manipulation Zones

🟢 GREEN ZONE: Accumulation Range (3286–3300)

Purpose:

Market makers quietly build positions.

They create an illusion of neutrality—small candles, tight ranges.

Signs:

Repeated tests of the same level.

Volume stays steady (not exploding).

Wicks in both directions (so nobody knows who’s in control).

🟡 YELLOW ZONE: The Pump Phase (3300–3330)

Purpose:

Trigger breakout traders.

Induce FOMO buying.

Clear out short stops above the range.

Signs:

Quick impulsive candles with LOW RELATIVE VOLUME.

Price blows through resistance but struggles to hold.

Social media and news start calling “Bull Run.”

🔴 RED ZONE: Distribution & Dump (3330–3350)

Purpose:

Offload large positions into retail buying.

Leave traders trapped at the highs.

Signs:

Spikes of huge volume as price stalls.

Rejection candles (long upper wicks).

Big delta shifts negative (sellers hitting bids hard).

⚔️ How the Market Maker Sequence Works

Here’s how the trap gets set:

1️⃣ Accumulate in Green Zone

Build inventory while convincing everyone “nothing is happening.”

2️⃣ Pump into Yellow Zone

Push price up just enough to trigger momentum traders.

Keep volume deceptively low—so it looks sustainable.

3️⃣ Sell in the Red Zone

Dump big positions into the buying frenzy.

Flip the tape bearish—fast.

Watch as the herd gets stopped out or bag-held.

🎯 Tomorrow’s Possible Plays

✅ Scenario 1 – Classic Pump & Dump

Phase 1: Grind in 3286–3300.

Phase 2: Spike to 3335.

Phase 3: Dump back to 3260.

✅ Scenario 2 – Fake Breakdown Reversal

Phase 1: Slam price to 3250, triggering panic selling.

Phase 2: Accumulate aggressively.

Phase 3: Rip price back to 3320, trapping shorts.

✅ Scenario 3 – Slow Grind Liquidation

Phase 1: Drift up in low volume toward 3330.

Phase 2: Distribute over several hours.

Phase 3: Liquidate longs into NY close.

📚 How YOU Can Spot This Manipulation

Here’s your checklist—save this:

✅ Volume vs. Price Analysis

Big price moves WITHOUT proportionate volume = FAKEOUT.

Big volume at tops/bottoms = Institutional distribution or accumulation.

✅ Delta Confirmation

Positive delta = buyers aggressive.

Negative delta = sellers slamming bids.

Watch for divergence (price up but delta down = hidden selling).

✅ Candlestick Clues

Rejection wicks.

Engulfing candles at key zones.

Multiple failures to break past a level.

✅ Timing

London open and NY open are prime manipulation hours.

Thin liquidity in Asia can exaggerate moves.

💡 Pro Tip:

“The crowd chases price. The professionals track volume, delta, and timing.”

— Technical Analysis and Stock Market Profits

🚀 Stay sharp. Think like a market maker. Trade like a predator.

#XAUUSD #MarketMakerEducation #ForexTrading #PriceAction #LearnT

Mohamed

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Mohamed

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.