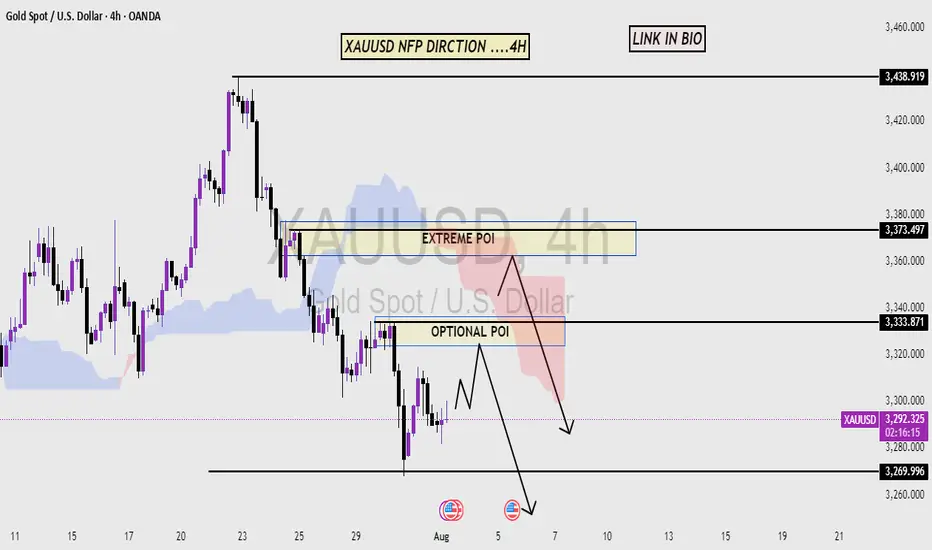

This chart analysis is for XAU/USD (Gold vs. U.S. Dollar) on the 4-hour timeframe. The focus is on a bearish market structure, highlighting potential Price of Interest (POI) zones for a short (sell) setup.

Key Elements:

Market Structure: Clear downtrend with lower highs and lower lows.

POIs Identified:

Optional POI: An initial supply zone where price might react.

Extreme POI: A more significant supply zone marked for a stronger potential reversal.

Labels & Notes:

The price levels are marked between 3,320 – 3,340, showing where the reversal is expected.

Interpretation:

The chart anticipates a retracement upward into the POIs before continuing the bearish move. Traders may look to enter short positions around these zones, especially the Extreme POI, which is seen as a high-probability reversal area.

Key Elements:

Market Structure: Clear downtrend with lower highs and lower lows.

POIs Identified:

Optional POI: An initial supply zone where price might react.

Extreme POI: A more significant supply zone marked for a stronger potential reversal.

Labels & Notes:

The price levels are marked between 3,320 – 3,340, showing where the reversal is expected.

Interpretation:

The chart anticipates a retracement upward into the POIs before continuing the bearish move. Traders may look to enter short positions around these zones, especially the Extreme POI, which is seen as a high-probability reversal area.

Trade active

📊 XAUUSD (GOLD) TRADE ACTIVE – NFP DIRECTION 4H 📉Gold is currently reacting around the EXTREME POI zone, with potential for a bearish continuation.

Price action suggests a rejection near 3318–3322, signaling a sell-off towards the FINAL POI zone.

🔻 Monitoring for further confirmations

📍 Stay updated as the NFP volatility unfolds

📌 Trade Active – Follow for next move

📲 Link in Bio | Pips Hunter Forex

📈 For More Setups & Updates —

🚀 Join our Telegram Channel!

👉 t.me/+vWVmX9cov69kNTU1

Step Into the Winners' Circle — Join Our VIP Signals Group Now!

t.me/+nnIo1DeoMLE5NjY0

🚀 Join our Telegram Channel!

👉 t.me/+vWVmX9cov69kNTU1

Step Into the Winners' Circle — Join Our VIP Signals Group Now!

t.me/+nnIo1DeoMLE5NjY0

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 For More Setups & Updates —

🚀 Join our Telegram Channel!

👉 t.me/+vWVmX9cov69kNTU1

Step Into the Winners' Circle — Join Our VIP Signals Group Now!

t.me/+nnIo1DeoMLE5NjY0

🚀 Join our Telegram Channel!

👉 t.me/+vWVmX9cov69kNTU1

Step Into the Winners' Circle — Join Our VIP Signals Group Now!

t.me/+nnIo1DeoMLE5NjY0

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.