Trump said Russia wants to make a “big” trade deal with the United States. Trump posted on his Truth Social account that he spoke with Putin on Monday to discuss the deal. “I just had a two hour phone call with Putin and I think it went very well.”

Trump said he discussed a number of issues with Putin, primarily the ceasefire agreement between Putin and Ukraine. “Russia and Ukraine will immediately begin negotiations to achieve a ceasefire and, more importantly, an end to the war,” Trump wrote. “Both sides will negotiate the terms of this agreement, which is only possible because they have details of the negotiations that others do not. The tone and atmosphere of the talks were very good.”

After announcing the ceasefire, Trump also wrote that Putin was looking for a trade deal with the United States. “Russia wants to engage in massive trade with the United States after this disastrous ‘bloodbath’ is over, and I agree. Russia has a tremendous opportunity to create many jobs and wealth. The potential is limitless.” Trump also said that Ukraine could also benefit from a potential trade deal with the United States. He even added that the Vatican, represented by the new pope, would be willing to hold trade/ceasefire talks.

Recent cooperative initiatives between Putin and Trump, including the US President receiving a painting from Putin, have raised questions about how the US-Russia axis will affect trade dynamics between the two countries. The two countries have maintained active communication since Trump took office in January. Given the current global tensions, a new US-Russia trade deal would be a significant step forward.

Trump discussed peace in Ukraine with Putin on Monday after the US said it may have to pull out of a stalemate over ending Europe’s bloodiest conflict since World War II.

Looking ahead, markets are focused on a speech by Federal Reserve Chairman Powell, with traders now betting that the chances of a rate cut in the summer are extremely low.

The more positive news the market gets, the more pressure gold will face as cooling safe-haven demand will send investors looking for riskier assets.

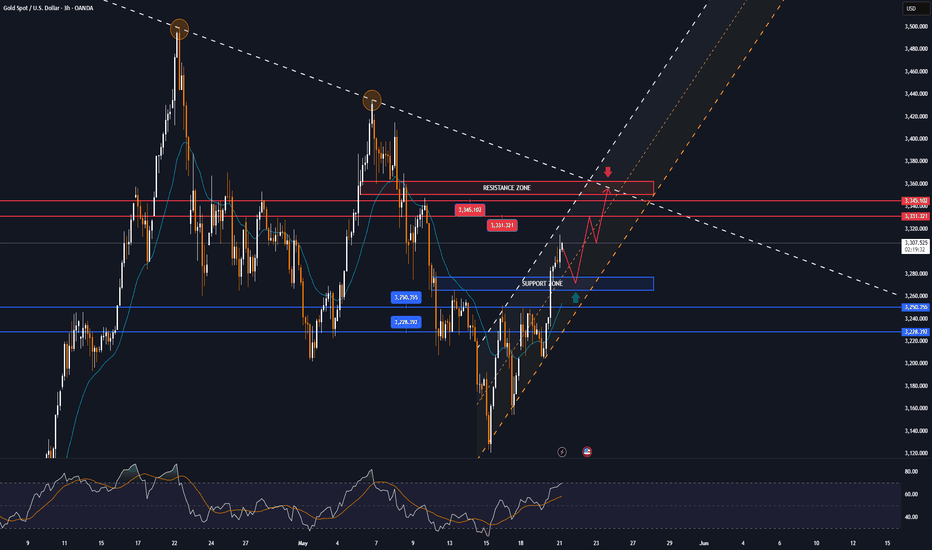

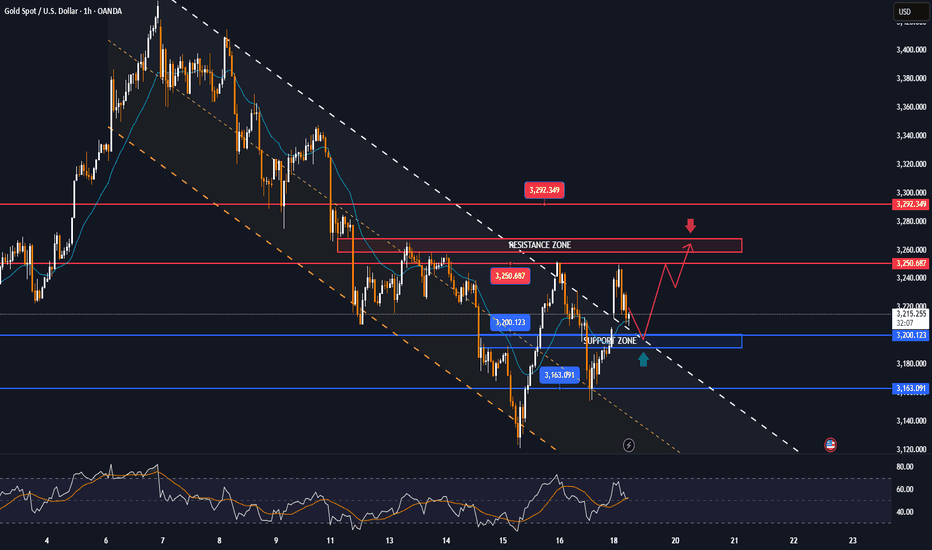

Technical Outlook Analysis

As noted to readers in previous publications since gold was sold below EMA21, up to now, it still has a short-term technical trend leaning towards the downside. Specifically, gold has repeatedly failed to overcome the resistance level of 3,250 USD and has decreased in price every time it approaches this level. And in terms of momentum, the Relative Strength Index (RSI) remains below 50, far from the oversold zone, indicating that there is still room for momentum to decline ahead.

For gold to be in a position to enter a new bullish cycle, the most important condition is that it needs to break above the $3,300 base level then target around $3,371 in the short term.

On the other hand, once gold breaks below the $3,200 support point it could continue to decline with the target then around the 0.618% Fibonacci retracement in the short term.

For the rest of the day, the technical outlook for gold is bearish with notable positions listed as follows.

Support: $3,200 – $3,163 – $3,120

Resistance: $3,250 – $3,292

SELL XAUUSD PRICE 3226 - 3224⚡️

↠↠ Stop Loss 3230

→Take Profit 1 3218

↨

→Take Profit 2 3212

BUY XAUUSD PRICE 3150 - 3152⚡️

↠↠ Stop Loss 3146

→Take Profit 1 3158

↨

→Take Profit 2 3164

Trade active

Plan SELL +40pips close a part move SL to entry.🔥Trade closed: target reached

Plan SELL HIT TP1 +75pips. Heading to TP2 😵😵😵Note

Gold prices hover above $3,300/ozNote

According to technical analysis, gold is on the rise with the next resistance levels being 3,350 – 3,400 – 3,438 and could head towards the historical peak of 3,500 USD/oz if it does not fall below the support level of 3,300 USD.Note

Gold price turns down to below 3,310 USD/ozNote

▫️ Spot gold fell more than $16 in 15 minutes, back below $3,290 an ounce, down 0.14% on the day.Note

Gold price continues to increase strongly to nearly 3,330 USD/ozNote

* World gold prices turned around and increased sharply after Mr. Trump threatened to impose new import taxes.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.