The bargain-hunting wave has supported  XAUUSD in the short term. In addition, weaker-than-expected US CPI in April, cooling expectations for a Fed rate cut, a fall in the US Dollar Index from a one-month high, and geopolitical concerns have all provided bullish momentum for gold. Spot gold was trading in a narrow range in early trading on Wednesday (May 14), currently trading around $3,245/ounce.

XAUUSD in the short term. In addition, weaker-than-expected US CPI in April, cooling expectations for a Fed rate cut, a fall in the US Dollar Index from a one-month high, and geopolitical concerns have all provided bullish momentum for gold. Spot gold was trading in a narrow range in early trading on Wednesday (May 14), currently trading around $3,245/ounce.

Inflation data

Data from the US Labor Department, a key indicator of Federal Reserve policy, released on Tuesday showed that the CPI rose just 0.2% month-on-month in April, below the expected 0.3%.

This mild inflation report is like a tonic, injecting new life into gold prices. This data will not hinder the Fed's interest rate cut, and the market generally expects the Fed to cut interest rates again in September.

It is worth noting that while inflationary pressures are not high now, inflation could pick up again in the coming months as the impact of tariffs becomes clear. Such expectations are prompting many investors to turn to gold as an inflation hedge.

On the same day on Tuesday, Do Nam Trung once again called on the Federal Reserve to cut interest rates

On Tuesday, Trump reiterated his call for the Federal Reserve to cut interest rates, saying that the prices of gasoline, groceries and “almost everything else” are falling.

Geopolitics: “Safe Haven Fire”

In addition to economic factors, continued tensions in the global geopolitical situation also provide strong support for gold. The possible face-to-face talks between Ukrainian President Zelensky and Russian President Putin are fraught with uncertainty, and despite a temporary ceasefire in the India-Pakistan conflict, the underlying tensions between the two sides have not changed. These uncertainties mean that gold still has the potential to rise in price once market risks suddenly occur.

Looking Ahead: Gold’s Challenges

Looking ahead, gold faces three key variables:

• First, the further progress of the Sino-US trade talks. Although the two sides have reached a 90-day truce, the comprehensive tariff policy remains in effect.

• Second, the Federal Reserve's monetary policy direction. A soft performance in inflation data could pave the way for a rate cut.

• Finally, global geopolitical risks, especially the developments in the Russia-Ukraine peace talks and the India-Pakistan conflict.

There is relatively little economic data on the trading day. US Secretary of State Rubio will attend the informal meeting of NATO foreign ministers from May 14 to 16 to discuss NATO security priorities, including increased defense spending and ending the Russia-Ukraine war. In addition, several Federal Reserve officials will speak, which investors should pay attention to.

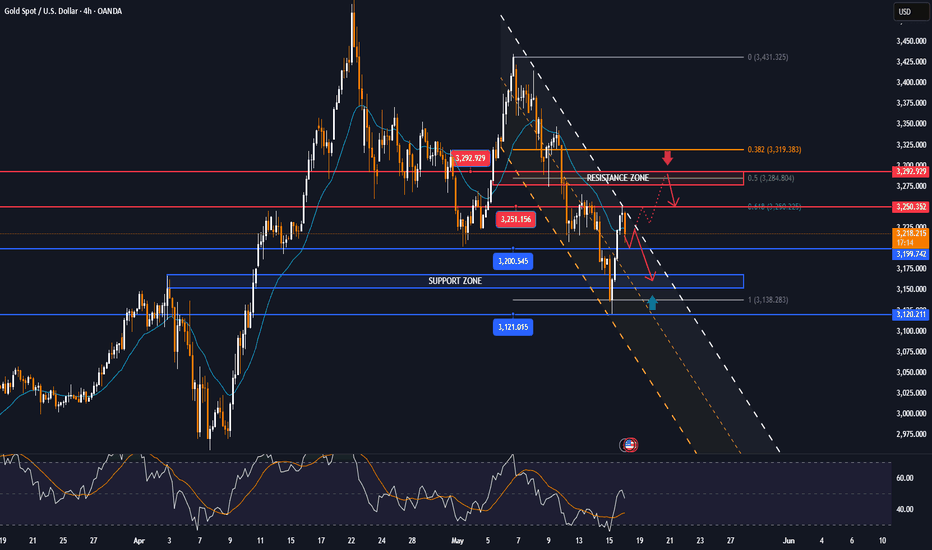

Technical Outlook Analysis XAUUSD

XAUUSD

On the daily chart, gold is still trading in a narrow range with short-term conditions leaning towards the downside with the main pressure from the EMA21.

However, the downside momentum is currently limited by the 0.50% Fibonacci retracement level, which is also the nearest support. If gold is sold below $3,228, it will have the prospect of continuing to decline with the next target around $3,163 in the short term.

For gold to resume its uptrend, the necessary condition is that the price action needs to be pushed above the EMA21 and break above the raw price level of 3,300 USD.

Although the main trend from the price channel has not been broken yet, the short-term outlook for gold is bearish, and the notable positions will also be listed as follows.

Support: 3,228 – 3,200 – 3,163 USD

Resistance: 3,245 – 3,292 – 3,300 USD

SELL XAUUSD PRICE 3284 - 3282⚡️

↠↠ Stop Loss 3288

→Take Profit 1 3276

↨

→Take Profit 2 3370

BUY XAUUSD PRICE 3165 - 3167⚡️

↠↠ Stop Loss 3161

→Take Profit 1 3173

↨

→Take Profit 2 3179

Inflation data

Data from the US Labor Department, a key indicator of Federal Reserve policy, released on Tuesday showed that the CPI rose just 0.2% month-on-month in April, below the expected 0.3%.

This mild inflation report is like a tonic, injecting new life into gold prices. This data will not hinder the Fed's interest rate cut, and the market generally expects the Fed to cut interest rates again in September.

It is worth noting that while inflationary pressures are not high now, inflation could pick up again in the coming months as the impact of tariffs becomes clear. Such expectations are prompting many investors to turn to gold as an inflation hedge.

On the same day on Tuesday, Do Nam Trung once again called on the Federal Reserve to cut interest rates

On Tuesday, Trump reiterated his call for the Federal Reserve to cut interest rates, saying that the prices of gasoline, groceries and “almost everything else” are falling.

Geopolitics: “Safe Haven Fire”

In addition to economic factors, continued tensions in the global geopolitical situation also provide strong support for gold. The possible face-to-face talks between Ukrainian President Zelensky and Russian President Putin are fraught with uncertainty, and despite a temporary ceasefire in the India-Pakistan conflict, the underlying tensions between the two sides have not changed. These uncertainties mean that gold still has the potential to rise in price once market risks suddenly occur.

Looking Ahead: Gold’s Challenges

Looking ahead, gold faces three key variables:

• First, the further progress of the Sino-US trade talks. Although the two sides have reached a 90-day truce, the comprehensive tariff policy remains in effect.

• Second, the Federal Reserve's monetary policy direction. A soft performance in inflation data could pave the way for a rate cut.

• Finally, global geopolitical risks, especially the developments in the Russia-Ukraine peace talks and the India-Pakistan conflict.

There is relatively little economic data on the trading day. US Secretary of State Rubio will attend the informal meeting of NATO foreign ministers from May 14 to 16 to discuss NATO security priorities, including increased defense spending and ending the Russia-Ukraine war. In addition, several Federal Reserve officials will speak, which investors should pay attention to.

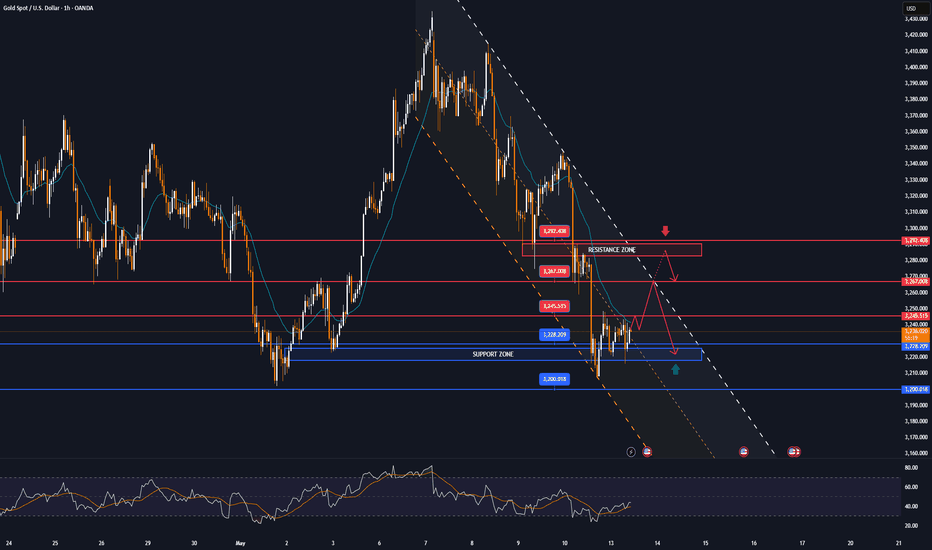

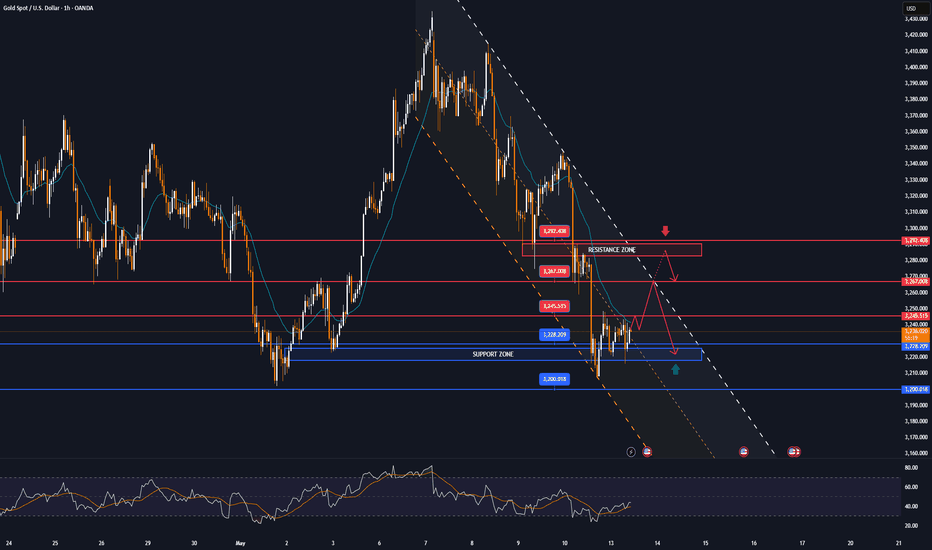

Technical Outlook Analysis

On the daily chart, gold is still trading in a narrow range with short-term conditions leaning towards the downside with the main pressure from the EMA21.

However, the downside momentum is currently limited by the 0.50% Fibonacci retracement level, which is also the nearest support. If gold is sold below $3,228, it will have the prospect of continuing to decline with the next target around $3,163 in the short term.

For gold to resume its uptrend, the necessary condition is that the price action needs to be pushed above the EMA21 and break above the raw price level of 3,300 USD.

Although the main trend from the price channel has not been broken yet, the short-term outlook for gold is bearish, and the notable positions will also be listed as follows.

Support: 3,228 – 3,200 – 3,163 USD

Resistance: 3,245 – 3,292 – 3,300 USD

SELL XAUUSD PRICE 3284 - 3282⚡️

↠↠ Stop Loss 3288

→Take Profit 1 3276

↨

→Take Profit 2 3370

BUY XAUUSD PRICE 3165 - 3167⚡️

↠↠ Stop Loss 3161

→Take Profit 1 3173

↨

→Take Profit 2 3179

Note

The US dollar continued to weaken in the European morning session, as yesterday's selling momentum showed no signs of abating. After a surge earlier in the week, the USD failed to maintain its momentum and is now under pressure again.Note

🔴SPOT gold fell below $3,220 an ounce, down 0.64% on the day.Note

🔴Gold SPOT lost $3,200 an ounce, down 1.26% on the day.Note

Immediately after Moody’s downgraded the US credit rating from AAA to AA1, the market was shocked: gold increased by more than 40 USD, reaching 3244 USD/oz in the Asian session; the USD weakened and US stock futures fell.Note

According to technical analysis, gold is on the rise with the next resistance levels being 3,350 – 3,400 – 3,438 and could head towards the historical peak of 3,500 USD/oz if it does not fall below the support level of 3,300 USD.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.