Gold attracted some dip-buying interest during Tuesday’s trading session, reversing part of the previous day’s losses as rising geopolitical tensions reignited demand for safe-haven assets.

The market is increasingly pricing in the expectation that the Federal Reserve will begin a rate-cutting cycle in September — a scenario that favors non-yielding assets like gold. However, a modest recovery in the U.S. dollar could act as a headwind in the short term.

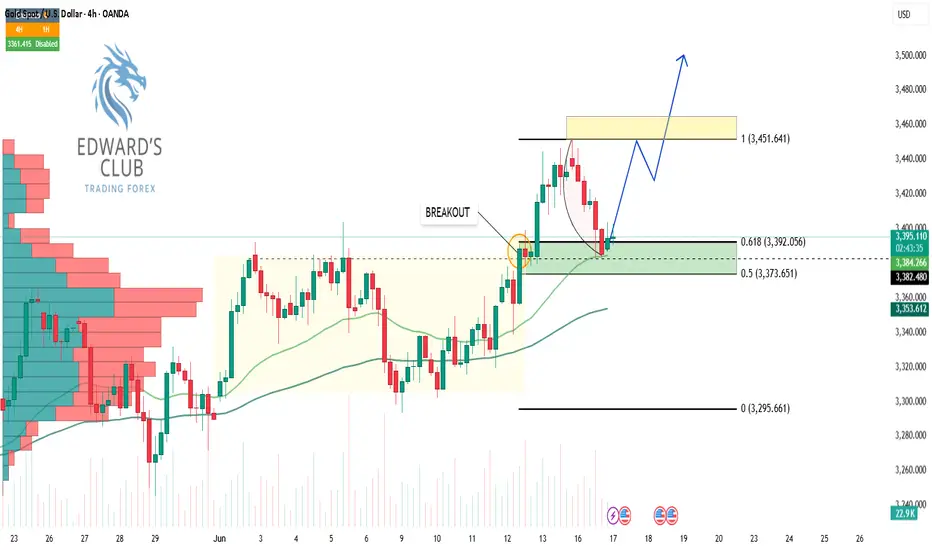

If conditions align, XAUUSD may capitalize on its recent upward momentum to resume the broader bullish trend, especially after completing a healthy pullback near the 0.618 Fibonacci retracement — in line with Dow Theory continuation.

The market is increasingly pricing in the expectation that the Federal Reserve will begin a rate-cutting cycle in September — a scenario that favors non-yielding assets like gold. However, a modest recovery in the U.S. dollar could act as a headwind in the short term.

If conditions align, XAUUSD may capitalize on its recent upward momentum to resume the broader bullish trend, especially after completing a healthy pullback near the 0.618 Fibonacci retracement — in line with Dow Theory continuation.

Trade active

✅You can get 7-10 Forex, XAUUSD, Bitcoin...signal every day

✅ Trading knowledge and answers to questions 24/7

✅Completely free.

👉Join by clicking the following link:

t.me/+6a8jSQbpr2tmYWFl

✅ Trading knowledge and answers to questions 24/7

✅Completely free.

👉Join by clicking the following link:

t.me/+6a8jSQbpr2tmYWFl

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅You can get 7-10 Forex, XAUUSD, Bitcoin...signal every day

✅ Trading knowledge and answers to questions 24/7

✅Completely free.

👉Join by clicking the following link:

t.me/+6a8jSQbpr2tmYWFl

✅ Trading knowledge and answers to questions 24/7

✅Completely free.

👉Join by clicking the following link:

t.me/+6a8jSQbpr2tmYWFl

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.