💰 Gold Prices Live Update

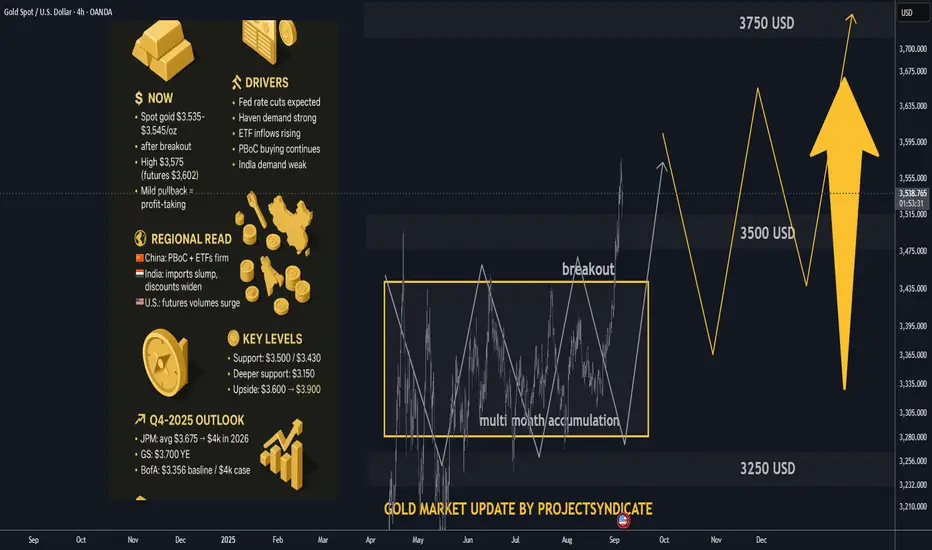

• Spot gold consolidating $3,535–$3,545/oz, after a decisive breakout above the multi-month range ($3,300–$3,450).

• Fresh all-time highs were set this week, with spot hitting $3,575 and U.S. futures spiking to $3,602 intraday.

• Current pullback appears mild and orderly, suggesting profit-taking post-breakout rather than trend reversal.

________________________________________

📰 Fresh headlines

• Gold powers to record highs on safe-haven demand.

• Breakout above $3,500 confirms bullish momentum.

• Futures hit $3,600+ as central banks, ETFs add to positions.

• Weekly close strong despite pullback, as rate-cut bets intensify.

• ETF holdings surge to highest since 2022; central banks remain active buyers.

• Analysts eye $3,600–$3,900 near-term targets.

________________________________________

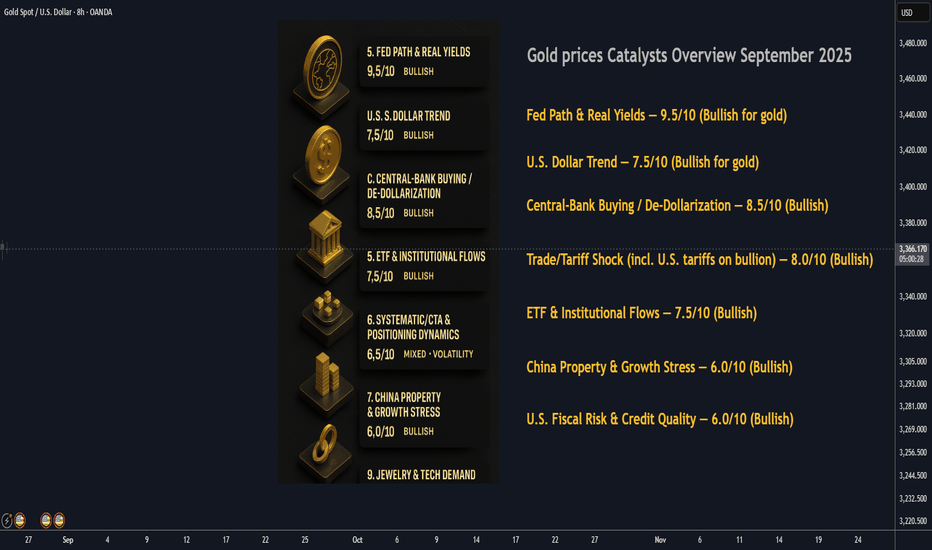

🔧 What’s driving the breakout

• Technical breakout: Months of range-bound trade ($3,300–$3,450) built a strong base; breach above $3,500 unleashed momentum buying.

• Macro tailwinds: Fed rate-cut expectations and falling real yields are lifting gold’s appeal.

• Haven demand: Political tensions and policy uncertainty amplify defensive flows.

• Institutional support: ETF inflows accelerating, GLD holdings climbing.

• Official sector: PBoC and other central banks continue steady accumulation.

• Physical drag: India demand subdued at elevated prices; local imports hit multi-year lows.

________________________________________

🌍 Regional quick read

• 🇨🇳 China: PBoC extends buying streak; local ETFs resilient.

• 🇮🇳 India: Imports at 2-year low, physical discounts widen as prices bite.

• 🇺🇸 U.S.: Futures volumes surge on breakout; non-farm payrolls eyed for near-term volatility.

________________________________________

🧭 Key levels

• Immediate support: $3,500 (psychological + breakout retest).

• Secondary support: $3,430 (prior range top).

• Deeper pullback zone: $3,150 (major base support if correction extends).

• Upside targets: $3,600 already tested; $3,750–$3,900 in play if flows persist.

• Positioning: Open interest + volumes confirm breakout conviction; current dip orderly.

________________________________________

🔭 Q4-2025 outlook

• JPMorgan: avg $3,675, path to $4,000 in 2026.

• Goldman Sachs: $3,700 by year-end.

• BofA: $3,356 baseline, $4,000 stretch case.

• Citi: Near-term $3,500+, but warns of risks if demand fades.

• Consensus: $3,500–$3,750 base case; bullish tail $3,900, bearish tail $3,250–$3,400.

________________________________________

🧱 Risks & swing factors

• U.S. payrolls + Fed meeting: Short-term catalysts for volatility.

• ETF flows + lease rates: Critical to sustaining momentum.

• Geopolitical noise: Keeps haven demand sticky.

• Physical demand weakness: Especially in India, could cap rallies.

________________________________________

⚡ Key takeaways

• 💥 Breakout confirmed: Gold shattered the $3,300–$3,450 range, powered through $3,500, and tagged $3,575 — clearing multi-month resistance.

• 📈 Pullback healthy: Current drift lower looks like mild profit-taking, not distribution.

• 🏦 Flows remain bullish: Central banks + ETFs underpinning the rally.

• 🧭 Q4 outlook intact: $3,500–$3,750 base case; $3,900 bullish tail / $3,300 bearish tail.

• 🇮🇳 Physical demand soft: Indian weakness may keep rallies from overheating.

• Spot gold consolidating $3,535–$3,545/oz, after a decisive breakout above the multi-month range ($3,300–$3,450).

• Fresh all-time highs were set this week, with spot hitting $3,575 and U.S. futures spiking to $3,602 intraday.

• Current pullback appears mild and orderly, suggesting profit-taking post-breakout rather than trend reversal.

________________________________________

📰 Fresh headlines

• Gold powers to record highs on safe-haven demand.

• Breakout above $3,500 confirms bullish momentum.

• Futures hit $3,600+ as central banks, ETFs add to positions.

• Weekly close strong despite pullback, as rate-cut bets intensify.

• ETF holdings surge to highest since 2022; central banks remain active buyers.

• Analysts eye $3,600–$3,900 near-term targets.

________________________________________

🔧 What’s driving the breakout

• Technical breakout: Months of range-bound trade ($3,300–$3,450) built a strong base; breach above $3,500 unleashed momentum buying.

• Macro tailwinds: Fed rate-cut expectations and falling real yields are lifting gold’s appeal.

• Haven demand: Political tensions and policy uncertainty amplify defensive flows.

• Institutional support: ETF inflows accelerating, GLD holdings climbing.

• Official sector: PBoC and other central banks continue steady accumulation.

• Physical drag: India demand subdued at elevated prices; local imports hit multi-year lows.

________________________________________

🌍 Regional quick read

• 🇨🇳 China: PBoC extends buying streak; local ETFs resilient.

• 🇮🇳 India: Imports at 2-year low, physical discounts widen as prices bite.

• 🇺🇸 U.S.: Futures volumes surge on breakout; non-farm payrolls eyed for near-term volatility.

________________________________________

🧭 Key levels

• Immediate support: $3,500 (psychological + breakout retest).

• Secondary support: $3,430 (prior range top).

• Deeper pullback zone: $3,150 (major base support if correction extends).

• Upside targets: $3,600 already tested; $3,750–$3,900 in play if flows persist.

• Positioning: Open interest + volumes confirm breakout conviction; current dip orderly.

________________________________________

🔭 Q4-2025 outlook

• JPMorgan: avg $3,675, path to $4,000 in 2026.

• Goldman Sachs: $3,700 by year-end.

• BofA: $3,356 baseline, $4,000 stretch case.

• Citi: Near-term $3,500+, but warns of risks if demand fades.

• Consensus: $3,500–$3,750 base case; bullish tail $3,900, bearish tail $3,250–$3,400.

________________________________________

🧱 Risks & swing factors

• U.S. payrolls + Fed meeting: Short-term catalysts for volatility.

• ETF flows + lease rates: Critical to sustaining momentum.

• Geopolitical noise: Keeps haven demand sticky.

• Physical demand weakness: Especially in India, could cap rallies.

________________________________________

⚡ Key takeaways

• 💥 Breakout confirmed: Gold shattered the $3,300–$3,450 range, powered through $3,500, and tagged $3,575 — clearing multi-month resistance.

• 📈 Pullback healthy: Current drift lower looks like mild profit-taking, not distribution.

• 🏦 Flows remain bullish: Central banks + ETFs underpinning the rally.

• 🧭 Q4 outlook intact: $3,500–$3,750 base case; $3,900 bullish tail / $3,300 bearish tail.

• 🇮🇳 Physical demand soft: Indian weakness may keep rallies from overheating.

Note

📢 Market Update – September 5, 2025 (Friday close)🧰 Macro driver of the day:

🧾 U.S. jobs miss + rising Fed-cut odds

NFP rose +22k and unemployment ticked to 4.3%, reinforcing expectations for a rate cut at the Sept 17 FOMC. U.S. stocks faded to finish modestly lower on the day. FX wrap: “Gold up $41 to $3,586 — fresh record high; CHF led, CAD lagged” into the North American close.

🥇 Gold – Record run, strong weekly close

Intraday spiked to a fresh ATH (NY) after the jobs miss; spot gold printed a session high near $3,600.90. Friday 5:00pm ET close: $3,585.30/oz.

💶 EUR/USD – Pop above 1.17 on USD slip

Intraday: ripped to ~1.1750–1.1760 after NFP.

Friday close (5:05pm ET): 1.1720 (+0.59% d/d).

💴 USD/JPY – Yen bid on yields lower

Intraday low pressed into the mid-146s as U.S. yields fell.

Friday close (5:05pm ET): 147.40 (−0.73% d/d).

💷 GBP/USD – Steady grind higher

Friday close (5:05pm ET): 1.3510 (+0.56% d/d).

🇨🇭 USD/CHF – CHF strongest major

Friday close (5:05pm ET): 0.7981 (−0.92% d/d).

💵 Dollar gauges – Broad pressure

DXY slipped back below 98 during the session; WSJ Dollar Index finished the week at 95.06 (down for a fifth straight week).

📉 U.S. equities – Soft finish

S&P 500 −0.3%, Dow −0.5%, Nasdaq marginally lower on Friday as growth worries outweighed rate-cut optimism.

📊 Friday closing board (5:00–5:05pm ET)

Gold (Spot): $3,585.30/oz

EUR/USD: 1.1720 | USD/JPY: 147.40 | GBP/USD: 1.3510 | USD/CHF: 0.7981

🧠 Key Takeaway:

A soft labor print + falling yields ignited safe-haven flows into gold and broad USD selling into the Friday close. Volatility stays elevated into next week’s inflation prints and the Sept 17 Fed meeting—size positions conservatively and pre-define risk.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.