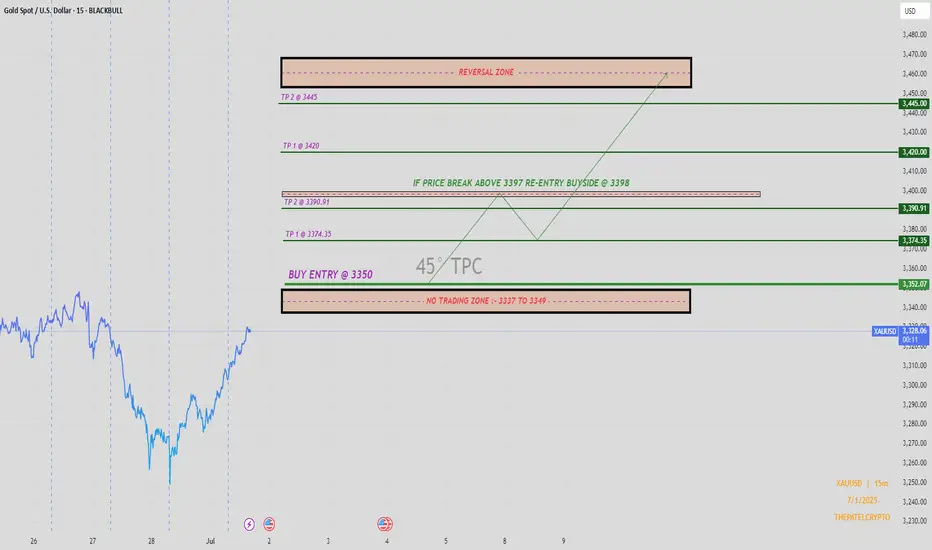

This chart presents a carefully planned intraday buy opportunity on XAUUSD (Gold vs. US Dollar), focusing on short-term bullish price action.

📍 Key Levels & Setup Logic:

Buy Entry Zone: 3350

A strong potential demand area based on recent market structure. The price is expected to bounce from this level if bullish pressure sustains.

No Trading Zone: 3337–3349

This zone marks an area of high volatility and indecision. Traders are advised to avoid initiating trades within this range to prevent premature entries and whipsaws.

TP 1 – 3374.35:

First take profit level aligning with minor resistance and past consolidation.

TP 2 – 3390.91:

Second take profit target based on resistance zone and Fibonacci confluence.

Re-Entry Point:

If the price breaks and holds above 3397, a buy-side re-entry is valid at 3398, targeting continuation toward higher resistances.

TP 3 – 3420 & TP 4 – 3445 (Reversal Zone):

Strong resistance and potential exhaustion/reversal zone. Monitor price action closely here for signs of trend weakening.

SL- Previous Swing Low.

⚠️ ZONES:

🔴 No Trading Zone: 3337–3349 (Avoid trades in this range — potential indecision zone)

🔴 Reversal Zone: Near 3445 — monitor price action for potential exhaustion.

📌 Technical Commentary:

Structure favours upside as long as price sustains above the No Trading Zone.

Clean higher-low formation suggests momentum shift.

If price confirms break above 3397 resistance, bullish continuation toward 3445 is highly probable.

🔍 Trade Summary:

Strategy: Buy on Breakout & Pullback

Confirmation: Bullish bounce from 3350 or breakout above 3397

Risk Management: Avoid trades within 3337–3349; reassess if price falls below this zone

Profit Targets: Laddered exits at 3374.35, 3390.91, 3420, 3445

⚠️ Disclaimer & Important Note:

This analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any financial instrument. All trading involves risk. We are not responsible for any kind of loss incurred, whether financial, emotional, or otherwise. Always do your own research and consult with a licensed financial advisor before making any trading decisions.

Trading involves significant risk, and you should never invest more than you can afford to lose. Past performance is not indicative of future results.

The trade idea shared above reflects personal market interpretation and is subject to change based on new market conditions.

📍Posted by: THEPATELCRYPTO

📈 Stay safe. Trade smart.

🔔 Follow for more ideas!

📍 Key Levels & Setup Logic:

Buy Entry Zone: 3350

A strong potential demand area based on recent market structure. The price is expected to bounce from this level if bullish pressure sustains.

No Trading Zone: 3337–3349

This zone marks an area of high volatility and indecision. Traders are advised to avoid initiating trades within this range to prevent premature entries and whipsaws.

TP 1 – 3374.35:

First take profit level aligning with minor resistance and past consolidation.

TP 2 – 3390.91:

Second take profit target based on resistance zone and Fibonacci confluence.

Re-Entry Point:

If the price breaks and holds above 3397, a buy-side re-entry is valid at 3398, targeting continuation toward higher resistances.

TP 3 – 3420 & TP 4 – 3445 (Reversal Zone):

Strong resistance and potential exhaustion/reversal zone. Monitor price action closely here for signs of trend weakening.

SL- Previous Swing Low.

⚠️ ZONES:

🔴 No Trading Zone: 3337–3349 (Avoid trades in this range — potential indecision zone)

🔴 Reversal Zone: Near 3445 — monitor price action for potential exhaustion.

📌 Technical Commentary:

Structure favours upside as long as price sustains above the No Trading Zone.

Clean higher-low formation suggests momentum shift.

If price confirms break above 3397 resistance, bullish continuation toward 3445 is highly probable.

🔍 Trade Summary:

Strategy: Buy on Breakout & Pullback

Confirmation: Bullish bounce from 3350 or breakout above 3397

Risk Management: Avoid trades within 3337–3349; reassess if price falls below this zone

Profit Targets: Laddered exits at 3374.35, 3390.91, 3420, 3445

⚠️ Disclaimer & Important Note:

This analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any financial instrument. All trading involves risk. We are not responsible for any kind of loss incurred, whether financial, emotional, or otherwise. Always do your own research and consult with a licensed financial advisor before making any trading decisions.

Trading involves significant risk, and you should never invest more than you can afford to lose. Past performance is not indicative of future results.

The trade idea shared above reflects personal market interpretation and is subject to change based on new market conditions.

📍Posted by: THEPATELCRYPTO

📈 Stay safe. Trade smart.

🔔 Follow for more ideas!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.