Gold Market Analysis (In-depth & Strategic Overview):

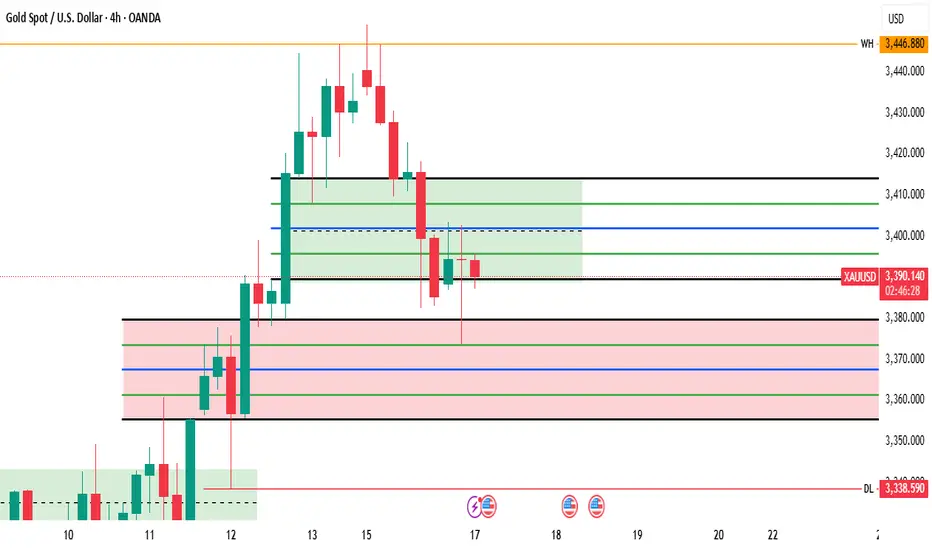

Gold has recently broken below its 4-hour bullish Fair Value Gap (FVG) and is currently trading beneath its Consequent Encroachment (CE) level — a signal that short-term bullish momentum has weakened.

In the latest 4H candle, the market swept the liquidity resting below the previous day's lows, a classic move to trap early sellers and collect stop-losses. Right after this liquidity grab, the price touched the daily bullish FVG, found support there, and then managed to close back inside the 4H FVG. This action reflects a temporary defense by buyers — but the battle is far from over.

📌 Key Levels to Watch:

$3401: This is a critical resistance level. If the market successfully closes above $3401, it could signal a bullish continuation, paving the way for an upward move.

$3389: This is a crucial support level. If price breaks below $3389, it would likely lead to further downside movement, opening the door for deeper corrections.

⏳ Current Strategy:

The best move right now is to wait and watch how the market reacts to these key levels. A breakout above $3401 would confirm strength and potential bullish continuation. Conversely, a breakdown below $3389 could trigger a fresh wave of selling pressure.

🚨 Until one of these levels is clearly broken, the market may remain in a state of indecision or range-bound movement.

🔍 Always DYOR – Do Your Own Research!

Stay informed, manage your risk wisely, and avoid emotional decisions.

Gold has recently broken below its 4-hour bullish Fair Value Gap (FVG) and is currently trading beneath its Consequent Encroachment (CE) level — a signal that short-term bullish momentum has weakened.

In the latest 4H candle, the market swept the liquidity resting below the previous day's lows, a classic move to trap early sellers and collect stop-losses. Right after this liquidity grab, the price touched the daily bullish FVG, found support there, and then managed to close back inside the 4H FVG. This action reflects a temporary defense by buyers — but the battle is far from over.

📌 Key Levels to Watch:

$3401: This is a critical resistance level. If the market successfully closes above $3401, it could signal a bullish continuation, paving the way for an upward move.

$3389: This is a crucial support level. If price breaks below $3389, it would likely lead to further downside movement, opening the door for deeper corrections.

⏳ Current Strategy:

The best move right now is to wait and watch how the market reacts to these key levels. A breakout above $3401 would confirm strength and potential bullish continuation. Conversely, a breakdown below $3389 could trigger a fresh wave of selling pressure.

🚨 Until one of these levels is clearly broken, the market may remain in a state of indecision or range-bound movement.

🔍 Always DYOR – Do Your Own Research!

Stay informed, manage your risk wisely, and avoid emotional decisions.

Join My Telegram Channel For Getting Free Signals and Analysis 👇👇

t.me/fxinsighthub7

t.me/fxinsighthub7

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join My Telegram Channel For Getting Free Signals and Analysis 👇👇

t.me/fxinsighthub7

t.me/fxinsighthub7

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.