Hey Everyone,

Please see our weekly chart update.

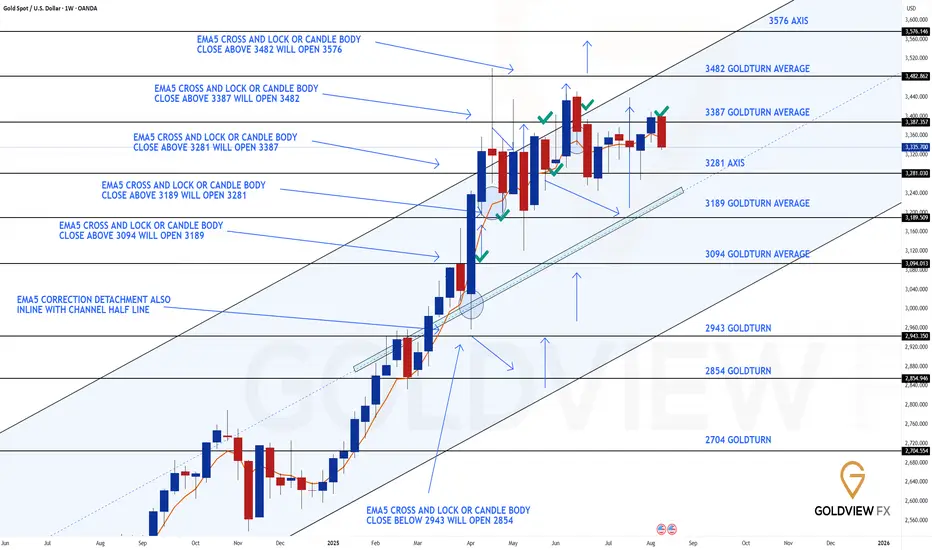

3387 Rejected, 3482 Gap Still Open

Following up on last week’s close above 3387, price has since shown rejection at that same level, leaving the 3482 gap still unfilled from the previous candle body. This pullback now highlights the 3281 gap below as support, keeping the broader structure intact but tempering the immediate upside momentum.

We’re watching for a potential re-challenge of 3387 before the path toward 3482 can resume. Until then, the market remains range-bound within these structural pivots.

Current Outlook

🔹 3387 Rejection

Despite previous week’s close above, price could not sustain higher, confirming 3387 as a tough barrier in the short term.

🔹 3281 as Key Support

The gap below sits at 3281, which remains the anchor pivot. As long as it holds, buyers have the chance to reload.

🔹 3482 Still Open

The unfilled gap to 3482 remains the long-term upside target. A re-test and hold above 3387 is needed before momentum can extend toward that objective.

Updated Levels to Watch

📉 Support – 3281

Critical base. A breakdown here would shift structure bearish.

📈 Resistance – 3387

Now the immediate barrier. Expect this to be re-challenged before further upside can develop.

📈 Upside Gap Target – 3482

Still open from previous structure. Comes into play only if 3387 can be cleared decisively.

Plan:

Price is consolidating between 3281 and 3387, with 3482 waiting above. Until 3387 is reclaimed on a closing basis, range trading remains the play. A clean break above flips bias bullish toward 3482, while failure at 3281 risks a deeper rotation.

Thanks as always for your support,

Mr Gold

GoldViewFX

Please see our weekly chart update.

3387 Rejected, 3482 Gap Still Open

Following up on last week’s close above 3387, price has since shown rejection at that same level, leaving the 3482 gap still unfilled from the previous candle body. This pullback now highlights the 3281 gap below as support, keeping the broader structure intact but tempering the immediate upside momentum.

We’re watching for a potential re-challenge of 3387 before the path toward 3482 can resume. Until then, the market remains range-bound within these structural pivots.

Current Outlook

🔹 3387 Rejection

Despite previous week’s close above, price could not sustain higher, confirming 3387 as a tough barrier in the short term.

🔹 3281 as Key Support

The gap below sits at 3281, which remains the anchor pivot. As long as it holds, buyers have the chance to reload.

🔹 3482 Still Open

The unfilled gap to 3482 remains the long-term upside target. A re-test and hold above 3387 is needed before momentum can extend toward that objective.

Updated Levels to Watch

📉 Support – 3281

Critical base. A breakdown here would shift structure bearish.

📈 Resistance – 3387

Now the immediate barrier. Expect this to be re-challenged before further upside can develop.

📈 Upside Gap Target – 3482

Still open from previous structure. Comes into play only if 3387 can be cleared decisively.

Plan:

Price is consolidating between 3281 and 3387, with 3482 waiting above. Until 3387 is reclaimed on a closing basis, range trading remains the play. A clean break above flips bias bullish toward 3482, while failure at 3281 risks a deeper rotation.

Thanks as always for your support,

Mr Gold

GoldViewFX

🪙 JOIN OUR FREE TELEGRAM GROUP 🪙 t.me/GoldView_FX

🪙 JOIN OUR DISCORD FOR BACKUP 🪙

discord.com/invite/9ZrEHGuaE2

🏆MESSAGE US FOR VIP SIGNALS🏆

t.me/GoldviewFX

or

email goldviewfx@gmail com

🪙 JOIN OUR DISCORD FOR BACKUP 🪙

discord.com/invite/9ZrEHGuaE2

🏆MESSAGE US FOR VIP SIGNALS🏆

t.me/GoldviewFX

or

email goldviewfx@gmail com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🪙 JOIN OUR FREE TELEGRAM GROUP 🪙 t.me/GoldView_FX

🪙 JOIN OUR DISCORD FOR BACKUP 🪙

discord.com/invite/9ZrEHGuaE2

🏆MESSAGE US FOR VIP SIGNALS🏆

t.me/GoldviewFX

or

email goldviewfx@gmail com

🪙 JOIN OUR DISCORD FOR BACKUP 🪙

discord.com/invite/9ZrEHGuaE2

🏆MESSAGE US FOR VIP SIGNALS🏆

t.me/GoldviewFX

or

email goldviewfx@gmail com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.